US Stock Market Volatility can impact investor confidence and asset prices significantly. Managing market volatility is crucial for long-term investment success.

As U. S. Stocks are known to be more volatile compared to stocks of foreign firms, understanding market volatility is essential for investors. Volatility measures the degree of price changes and affects various investment vehicles differently. While bonds are typically less volatile than stocks, understanding market dynamics is key to navigating through volatile periods.

By staying informed and having a well-thought-out investment strategy, investors can better prepare for market volatility and potentially capitalize on opportunities that arise during market fluctuations. Building a resilient investment portfolio that can weather market volatility is essential for long-term financial success.

Credit: www.researchgate.net

Understanding Volatility In The Us Stock Market

The US Stock Market demonstrates significant volatility, reflecting rapid price changes in investments. Understanding this volatility is crucial for navigating the market effectively. By monitoring and analyzing market fluctuations, investors can make informed decisions to manage risks and optimize their portfolios.

What Is Stock Market Volatility?

Stock market volatility refers to the rapid and significant changes in the prices of stocks and other financial instruments. It is a measure of the degree of variation of trading prices over time, indicating the level of risk or uncertainty in the market. Volatility can impact investment decisions and overall market stability.

Causes Of Volatility In The Us Stock Market

Various factors contribute to the volatility in the US stock market. Market sentiment, economic indicators, geopolitical events, corporate earnings, and regulatory changes can all influence stock prices. Additionally, supply and demand dynamics, investor behavior, and external shocks such as natural disasters or global crises play a vital role in driving market volatility.

Measuring Market Volatility

Market volatility on the US Stock Market measures the degree to which stock prices change, reflecting the risk and uncertainty in the market. Understanding and tracking market volatility is crucial for investors to make informed decisions and manage their portfolio effectively.

The CBOE Volatility Index (VIX) is a popular tool used to gauge market volatility and predict potential market movements.

Cboe Volatility Index (vix)

The CBOE Volatility Index, or VIX, is a popular measure used to gauge market volatility. It indicates the market’s expectation of future volatility based on options trading on the S&P 500 Index. A higher VIX value typically signifies increased market uncertainty and potential price fluctuations.

Historical Data And Trends

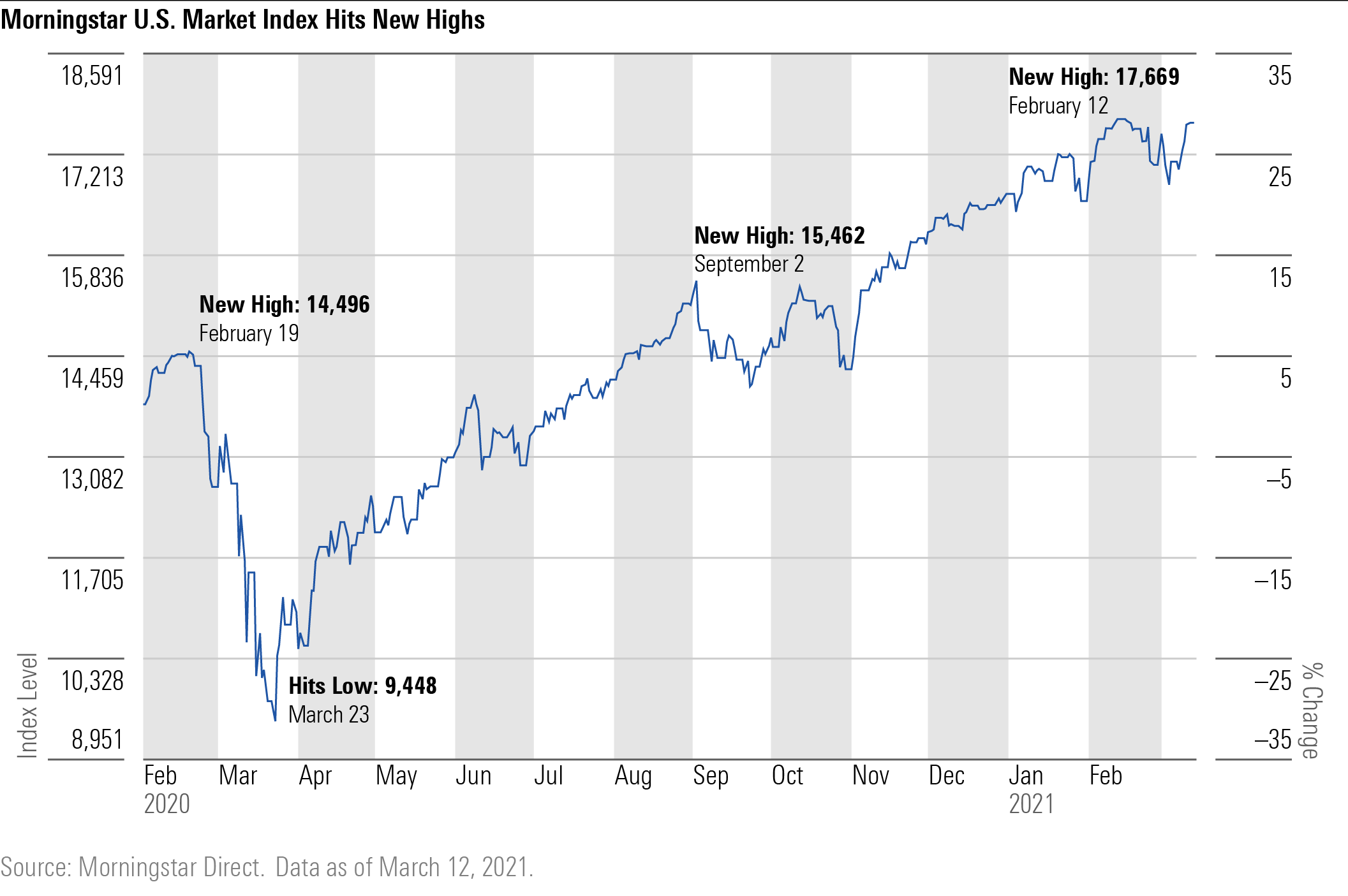

Studying historical data and trends can provide valuable insights into market volatility patterns. By analyzing past market behavior, investors can better prepare for potential fluctuations and make informed decisions. Historical data gives a glimpse into how the market has reacted to various events and economic conditions over time.

Effects Of Market Volatility

Market volatility refers to the rapid and significant changes in stock prices and market conditions. It can have profound effects on investment strategies and stock prices. Understanding the effects of market volatility is crucial for investors and traders looking to navigate the unpredictable nature of the stock market. In this section, we will explore two major effects of market volatility: its impact on investment strategies and its influence on stock prices.

Impact On Investment Strategies

Market volatility can greatly impact investment strategies, forcing investors to rethink their approach and adapt to the changing market conditions. Here are some key points to consider:

- Increased Risk: During periods of high volatility, the level of risk in the market generally increases. This can make investors more cautious, leading to a shift towards lower-risk investments.

- Rebalancing Portfolios: Volatility often prompts investors to rebalance their portfolios in order to mitigate risk. This may involve adjusting asset allocations or diversifying holdings.

- Long-Term Investment Horizon: Volatility can test the patience of investors, but it is important to remember the long-term nature of investing. Staying focused on long-term goals can help mitigate the impact of short-term market fluctuations.

- Opportunities for Active Management: Some investors may take advantage of market volatility by actively managing their investments. This may involve buying undervalued stocks or selling overvalued ones.

- Importance of Research and Due Diligence: Market volatility highlights the significance of conducting thorough research and due diligence before making any investment decisions. Being well-informed can help identify potential risks and opportunities.

Influence On Stock Prices

Market volatility can significantly influence stock prices, causing them to fluctuate rapidly. Here are some key factors to consider:

- Increased Trading Activity: Volatility often leads to an increase in trading activity as investors react to changing market conditions. This can result in large fluctuations in stock prices as supply and demand dynamics shift.

- Emotional Investing: Volatility can trigger emotional responses from investors, leading to irrational buying or selling decisions. This can further contribute to price volatility in the market.

- Market Sentiment: Volatility can impact market sentiment, causing investors to become more cautious or fearful. Negative market sentiment can lead to a decline in stock prices, while positive sentiment can drive prices higher.

- Impact on Earnings: Companies’ earnings can be affected by market volatility, especially if it hinders economic growth or undermines consumer confidence. This can lead to changes in stock prices as investors reevaluate the company’s profitability.

- Systemic Risk: High market volatility can sometimes be an indication of broader systemic risks in the financial system. This can trigger a decline in stock prices across various sectors and industries.

In conclusion, market volatility can have significant effects on investment strategies and stock prices. It is important for investors to stay informed, maintain a long-term perspective, and consider the potential opportunities and risks associated with volatility when making investment decisions.

Navigating Turbulent Waters

In the face of US stock market volatility, navigating through turbulent waters becomes crucial. With dramatic fluctuations impacting investment values, understanding market shifts and long-term strategies are essential for investors to weather uncertainties. Keep a close eye on fluctuations and consider seeking professional advice to steer through this challenging period effectively.

Strategies For Managing Market Volatility

Managing market volatility can be challenging, but it is not impossible. By following practical strategies, investors can navigate through turbulent waters and make informed decisions. Here are some effective strategies to help you manage market volatility:

- Diversify Your Portfolio: Diversification is key to minimize risk and protect your investments. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of market volatility on your portfolio.

- Maintain a Long-Term Perspective: It’s important to remember that market volatility is temporary. Instead of reacting emotionally to short-term market movements, focus on your long-term investment goals. Stay committed to your investment strategy and avoid making impulsive decisions.

- Stay Informed: Keep yourself updated with the latest market news and economic indicators. Being well-informed can help you understand market trends and make better investment decisions. However, it’s essential to rely on credible sources and avoid reacting to every headline.

- Consider Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money on a regular basis, regardless of market conditions. This strategy allows you to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the impact of market volatility.

Tools For Assessing Risk

Assessing risk is crucial for successfully managing market volatility. Here are some valuable tools that can help you analyze and measure risk:

- Volatility Index (VIX): The Volatility Index, also known as VIX, is a widely-used measure of market volatility. It reflects investor sentiment and provides an indication of the expected volatility in the market. Monitoring the VIX can help you gauge the level of uncertainty and adjust your investment strategy accordingly.

- Historical Data Analysis: Analyzing historical market data can provide insights into past patterns and trends. By studying historical market behavior during volatile periods, you can gain a better understanding of how the market may react in the future. This information can help you make informed decisions based on historical precedent.

- Technical Analysis Tools: Various technical analysis tools, such as moving averages, trendlines, and oscillators, can help you identify potential market trends and reversals. These tools can assist you in making more informed investment decisions by analyzing price movements and market indicators.

By implementing these strategies and utilizing the right tools, you can navigate the turbulent waters of the US stock market volatility with confidence and make informed investment decisions.

Investor Reactions To Volatile Markets

Investor reactions to volatile markets in the US stock market can vary greatly. Some investors may take advantage of the fluctuations and see it as an opportunity for increased profits, while others may become more cautious and risk-averse, leading to potential sell-offs and market declines.

It is important for investors to closely monitor and adapt their strategies based on market volatility.

Behavioral Finance And Market Volatility

Behavioral finance plays a significant role in shaping investor reactions to volatile markets. This field of study explores how various psychological biases and emotions can influence investment decision-making.

During periods of market volatility, investors can experience behavioral biases such as loss aversion, where they have a stronger emotional response to losses compared to gains. This bias often leads investors to make irrational decisions based on short-term market fluctuations rather than long-term investment strategies.

Another common bias is herding behavior, where investors tend to follow the crowd and make investment decisions based on the actions of others. This behavior can exacerbate market volatility as investors flock to buy or sell based on the actions of their peers.

Understanding these biases and their impact on investor behavior is crucial for navigating volatile markets. By recognizing and managing these behavioral tendencies, investors can make more informed and rational decisions to mitigate the negative effects of market volatility.

Role Of Sentiment In Trading

Sentiment analysis is a valuable tool in understanding investor reactions to volatile markets. This approach involves analyzing various indicators, such as news sentiment, social media sentiment, and investor sentiment surveys, to gauge the overall mood and outlook of market participants.

During times of high market volatility, investor sentiment can swing between extreme optimism and extreme pessimism, leading to exaggerated market movements. When sentiment is positive, investors may exhibit a greater willingness to take on risk and buy into the market. Conversely, during negative sentiment, investors may be more likely to sell and take a defensive position.

It’s important to note that sentiment is not always rational and can be influenced by emotional biases. However, tracking sentiment can provide valuable insights into potential market trends and shifts in investor behavior.

Credit: www.researchgate.net

Economic Implications Of Market Volatility

Market volatility, characterized by rapid and unpredictable price fluctuations, holds significant economic implications. The impact on GDP and Economic Indicators, as well as the policy responses to volatility, is crucial in understanding the broader consequences of market instability.

Impact On Gdp And Economic Indicators

Market volatility can exert considerable influence on a country’s GDP and economic indicators. When stock prices fluctuate drastically, it impacts consumer and investor confidence, which in turn affects spending and investment levels. This can ultimately lead to a slowdown in economic growth and a decline in GDP. Additionally, volatile markets can result in fluctuations in inflation rates, exchange rates, and interest rates, influencing consumer purchasing power, business investment decisions, and international trade dynamics.

Policy Responses To Volatility

In response to market volatility, governments and central banks often implement various policies to mitigate its adverse effects. Monetary and fiscal policies may be employed to stabilize the economy and restore market confidence. Central banks can adjust interest rates to encourage borrowing and spending or enact quantitative easing measures to inject liquidity into the financial system. Governments may also implement fiscal stimulus packages to bolster economic activity through increased public spending and tax incentives. Moreover, regulatory changes and interventions in financial markets may be introduced to enhance market stability and reduce speculative activities contributing to volatility.

Historical Cases Of Market Volatility

The US stock market has witnessed several historical instances of volatility. These occurrences offer valuable insights into the impact of market turbulence and the subsequent reactions. Understanding the historical context of market volatility can provide valuable lessons for investors and analysts alike, helping them navigate through uncertain times.

Lessons From Past Market Turbulence

When examining historical cases of market volatility, it becomes evident that market disruptions are often followed by periods of recovery and growth. Investors who remain level-headed and make strategic decisions during turbulent times tend to emerge stronger. Embracing diversification, stable investing strategies, and a long-term outlook based on historical data can help mitigate the impact of market volatility.

Market Reactions To Global Events

Global events have historically influenced market volatility, triggering fluctuations in stock prices and investor sentiment. Events such as geopolitical tensions, economic crises, and natural disasters have often led to short-term market disruptions. Understanding how different markets have reacted to these global events in the past can provide valuable insights for predicting and managing future market volatility.

The Future Of Market Volatility

Market volatility has become a defining feature of the US Stock Market landscape, impacting investment strategies and market performance. Understanding and navigating this volatility is crucial for investors seeking to capitalize on market fluctuations and economic growth opportunities.

Technological Advancements In Risk Management

Technology is revolutionizing risk management in the stock market. With the introduction of advanced algorithms and AI-powered tools, firms can now analyze data at unprecedented speeds.

Predictions And Speculations

Forecasting market trends has become more accurate due to sophisticated predictive models. Analysts are leveraging big data and machine learning to make informed speculations.

Credit: www.morningstar.com

Frequently Asked Questions

Is Us Market More Volatile?

Yes, U. S. stocks are more volatile than those of similar foreign firms due to factors impacting shareholder wealth and economic growth. Volatility measures the degree of price change, with bonds generally considered less volatile than stocks. Market volatility can be managed through strategic investment approaches.

What Is The Volatility Of The Market?

Stock market volatility measures the degree of price changes in investments. Generally, stocks are more volatile compared to bonds. Volatility can impact shareholder wealth and economic growth positively or negatively.

What Is The Average Volatility Of The Stock Market?

The average volatility of the stock market fluctuates based on market conditions and historical data.

Are We Experiencing Market Volatility?

Yes, market volatility is currently being experienced. Stocks in the US are more volatile than those of foreign firms. Volatility measures the price change of an investment, with stocks generally being more volatile than bonds. It is important to have strategies in place to handle market volatility.

Conclusion

As we’ve seen, US stock market volatility is a complex and dynamic phenomenon with significant impact. Understanding its underlying factors and potential effects on investments can provide valuable insights for investors. By keeping a close eye on market trends and making informed decisions, investors can navigate volatility more effectively.

Stay informed and proactive to make the most of market fluctuations.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.