The S&P 500 Index is composed of 500 of the largest publicly traded companies in the US. These companies represent various sectors and are chosen based on market capitalization.

The S&P 500 Index composition represents a diverse range of industries and provides a broad snapshot of the US stock market. Companies included in this index are considered to be industry leaders and have a significant impact on the overall performance of the index.

Investors often use the S&P 500 as a benchmark to gauge the performance of their own portfolios. Understanding the composition of this index can provide valuable insights into the trends and dynamics of the US economy.

Understanding S&p 500 Index Composition

Understanding the composition of the S&P 500 Index involves analyzing the various companies that make up this leading stock market index, including their financial performance and market value. By assessing factors such as sales growth, earnings change, and price momentum, investors can gain insights into the overall health of the index.

Definition Of S&p 500 Index

The S&P 500, or the Standard & Poor’s 500, is a market-capitalization-weighted index comprising 500 of the largest publicly traded companies in the US. The index serves as a benchmark for the overall performance of the US stock market.

Significance Of Analyzing S&p 500 Companies

Analyzing the S&P 500 companies provides valuable insights into the health and trends of the market. Investors can gain an understanding of the strength of various sectors and make informed investment decisions based on the performance of these leading companies.

Analyzing S&p 500 Companies

When analyzing S&P 500 companies, it is crucial to evaluate different metrics to understand their performance and potential. This involves looking at key indicators for both growth and value stocks.

Key Metrics For Assessing Growth Stocks

- Sales growth

- Earnings change to price ratio

- Momentum

Growth stocks are evaluated based on their sales growth, the relationship between earnings change and price, and momentum.

Key Metrics For Assessing Value Stocks

- Book value ratio

- Earnings ratio to price

- Sales ratio to price

Value stocks are analyzed using three main factors: book value ratio, earnings ratio to price, and sales ratio to price.

Market Trends In S&p 500

The S&P 500 is a widely followed index that encompasses the largest 500 publicly traded companies in the United States. As one of the most reputable benchmarks for the U.S. stock market, it provides valuable insights into the overall health and performance of the economy. Understanding the market trends in the S&P 500 is crucial for investors and market participants alike.

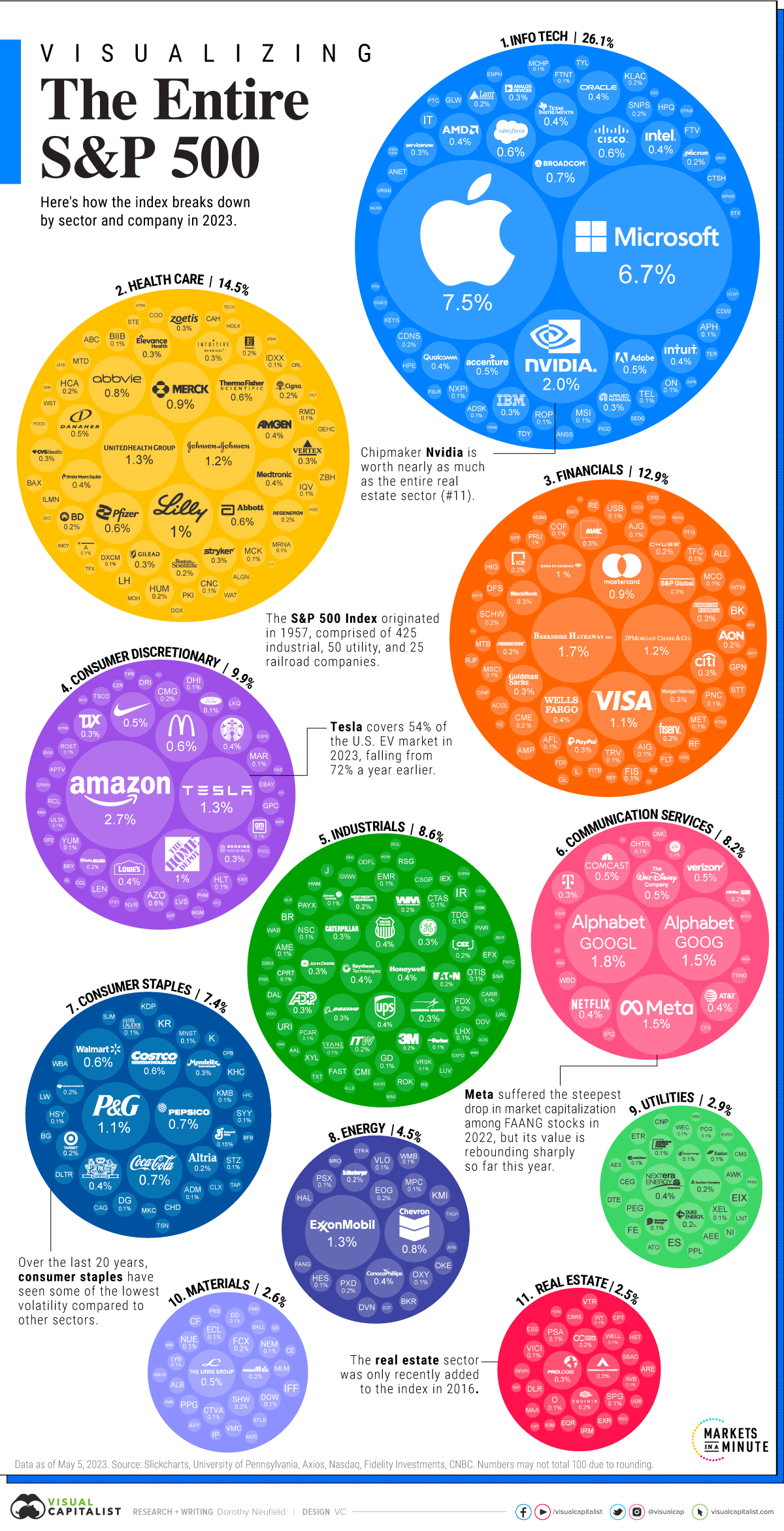

Overview Of Sector Composition

The S&P 500 index is made up of companies from various sectors, each representing a specific component of the economy. By analyzing the sector composition, we can gain a deeper understanding of the industries shaping the index’s performance.

Here is an overview of the sector composition of the S&P 500:

| Sector | Percentage of Index |

|---|---|

| Information Technology | 24% |

| Healthcare | 14% |

| Financials | 12% |

| Consumer Discretionary | 11% |

| Communication Services | 11% |

| Industrials | 10% |

| Consumer Staples | 7% |

| Utilities | 3% |

| Real Estate | 3% |

| Materials | 3% |

| Energy | 3% |

These sectors represent the key drivers of the U.S. economy and their performance can greatly impact the overall market trends in the S&P 500.

Analysis Of Market Performance

The market performance of the S&P 500 is influenced by a wide range of factors, including economic indicators, geopolitical events, and company-specific news. By analyzing historical data and market trends, we can gain insights into the overall performance and direction of the index.

Key metrics used to assess the market performance of the S&P 500 include:

- Daily price movements and trends

- Volatility levels and patterns

- Trading volume and liquidity

- Forward and trailing price-to-earnings ratios

- Dividend yields

These metrics help investors and market participants gauge the current market sentiment and make informed investment decisions.

In conclusion, keeping a close eye on the sector composition and market performance of the S&P 500 is essential for anyone interested in understanding and navigating the dynamics of the U.S. stock market. By monitoring the market trends, investors can identify potential opportunities and risks, and make well-informed investment decisions.

Credit: www.visualcapitalist.com

Comparative Analysis

When it comes to analyzing the composition of the S&P 500 Index, a comparative analysis provides valuable insights for investors. By comparing the S&P 500 with other market indices, we can better understand its significance and performance in the broader financial landscape. Additionally, examining the impact of the S&P 500 composition on investment strategies allows investors to make informed decisions based on their unique goals and risk tolerance.

Comparison With Other Market Indices

The S&P 500 Index stands out as one of the most widely recognized and followed market indices globally. However, it is essential to compare its performance with other leading indices to gain a comprehensive understanding of its strengths and weaknesses.

One key comparison is with the Dow Jones Industrial Average (DJIA), which tracks the performance of 30 large publicly traded companies. While the DJIA represents a smaller sample size compared to the S&P 500’s 500 constituents, it is often seen as a barometer of the overall market strength due to its long history.

Another notable comparison is with the Nasdaq Composite Index, which primarily includes technology-related stocks. Given the S&P 500’s diverse composition across various sectors, comparing its performance with the tech-heavy Nasdaq provides insights into sector-specific trends and market dynamics.

Impact Of S&p 500 Composition On Investment Strategies

The composition of the S&P 500 Index has a significant impact on investment strategies. As the index includes a wide range of sectors and industries, investors can align their portfolios with specific sectors they believe will outperform the broader market.

For example, if an investor expects the healthcare sector to experience substantial growth, they may choose to allocate a higher percentage of their portfolio to healthcare-related stocks within the S&P 500. Conversely, if they anticipate a downturn in the energy sector, they may reduce their exposure to energy stocks within the index.

Additionally, the weighting of each constituent within the S&P 500 can influence investment decisions. Stocks with higher weightings in the index may receive more attention from investors and impact market trends accordingly. Monitoring these weightings allows investors to adjust their investment strategies accordingly.

In conclusion, conducting a comparative analysis of the S&P 500 Index composition and understanding its impact on investment strategies are crucial for investors looking to navigate the complex world of financial markets. By staying informed and adapting their portfolios based on market trends, investors can make better-informed decisions and potentially maximize their returns.

Role Of S&p 500 In Investment Decisions

As one of the most widely tracked equity indices globally, the S&P 500 plays a crucial role in shaping investment decisions for institutional and retail investors alike. Understanding how this index composition influences investment strategies is paramount for navigating the dynamic financial markets.

Influence On Institutional Investors

- Portfolio Allocation: Institutional investors heavily rely on S&P 500’s composition for strategic asset allocation.

- Benchmarking: Many funds use S&P 500 as a benchmark to evaluate their performance in comparison to the market.

- Risk Management: The index’s diverse range of sectors assists institutions in managing risk exposure effectively.

Influence On Retail Investors

- Accessibility: Retail investors often use S&P 500-based ETFs to gain exposure to a diversified portfolio.

- Market Sentiment: Fluctuations in the index can impact retail investor sentiment and trading decisions.

- Performance Tracking: Many individual investors track the S&P 500 to gauge the overall market performance.

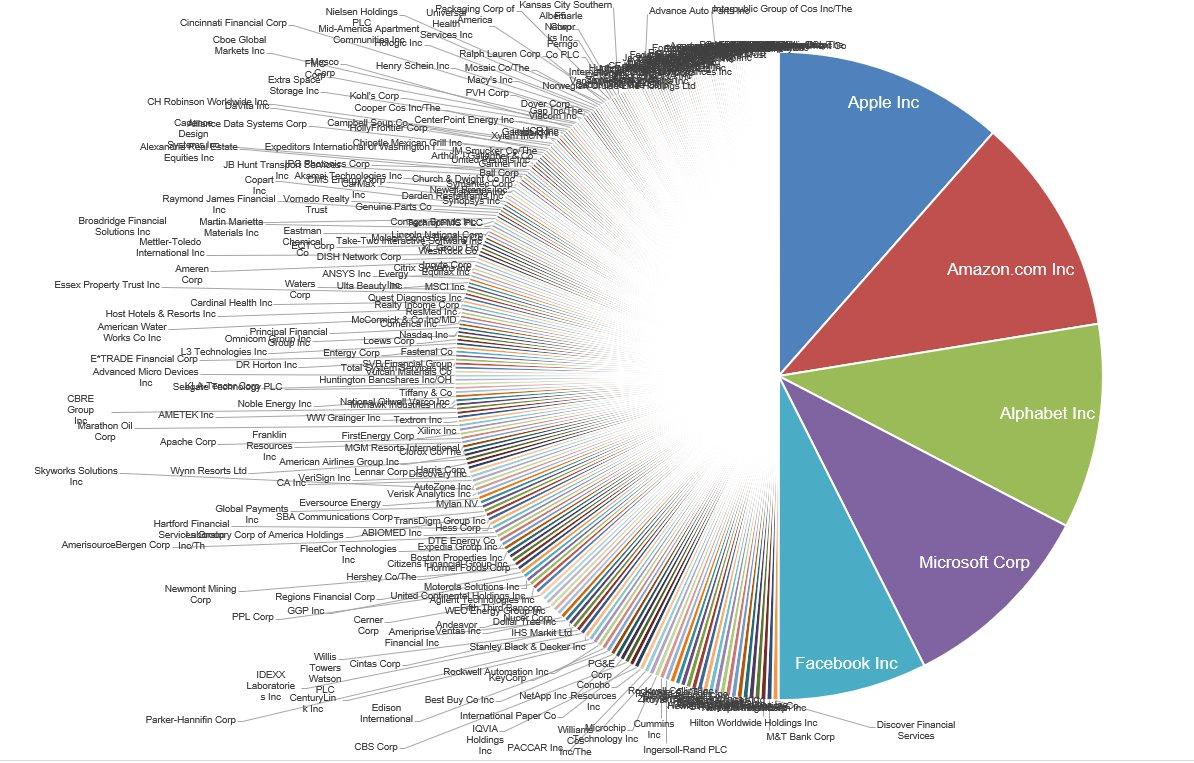

Credit: www.wallstreetprep.com

Challenges And Controversies

The S&P 500 Index Composition plays a crucial role in the global financial market, but it is not without its challenges and controversies. Understanding these aspects is essential for investors and analysts to make informed decisions. Let’s delve into the controversies surrounding inclusion criteria and the challenges in interpreting market trends.

Controversies Surrounding Inclusion Criteria

In determining the inclusion of companies in the S&P 500 Index, controversies can arise due to the subjective nature of the criteria. Companies vying for inclusion often engage in questionable practices to meet the eligibility standards, creating ethical dilemmas. Moreover, the criteria may not always reflect the market’s true composition, leading to skepticism among investors and analysts.

Challenges In Interpreting Market Trends

Interpreting market trends based on the S&P 500 Index can be challenging due to its diverse composition and the impact of external factors. The sheer number of components and their varying influences on the index make it difficult to discern clear patterns. Additionally, external events and market sentiments can skew the interpretation of trends, posing a significant challenge for market analysis and decision-making.

Forecasting Future Composition

The composition of the S&P 500 Index plays a crucial role in guiding investment decisions and understanding the dynamics of the stock market. Predicting the future composition empowers investors and analysts to anticipate market shifts and adjust their strategies accordingly.

Predicting Changes In S&p 500 Companies

Anticipating changes in the S&P 500 companies is essential for investors to stay ahead of market trends. Historically, companies that demonstrate consistent growth and financial stability are more likely to be included in the index. Tracking the performance of potential candidates can provide valuable insights into potential future additions to the S&P 500.

Anticipated Market Shifts

- Market shifts are often reflected in changes to the S&P 500 composition, as the index aims to represent the overall market dynamics.

- Monitoring the industry sectors that show substantial growth and innovation can help forecast potential changes to the index’s composition.

- Analyzing historical data and market trends can aid in predicting future adjustments and identifying companies primed for inclusion in the S&P 500 Index.

Credit: seekingalpha.com

Frequently Asked Questions

What Is The Composition Of The S&p 500?

The S&P 500 consists of 500 large-cap stocks measuring the performance of the U. S. stock market.

What Comprises The S&p 500 Stock Composite Index?

The S&P 500 stock composite index comprises 500 large companies listed on US stock exchanges.

What Is The Breakdown Of The S&p 500 Industry?

The breakdown of the S&P 500 industry includes sectors like technology, healthcare, financials, consumer discretionary, and industrials.

What Are The Components Of The S&p 500 Growth Index?

The components of the S&P 500 growth index include companies that have high sales growth, a favorable ratio of earnings change to price, and positive momentum. These stocks are identified based on three factors: sales growth, earnings change to price ratio, and momentum.

Conclusion

Understanding the S&P 500 index composition is essential for investors to navigate the market effectively. With a focus on growth and value stocks, analyzing components based on sales, earnings, and momentum can lead to informed investment decisions. Stay informed and stay ahead in the dynamic world of stock market investing.

Oscar Giles is a multifaceted expert with a distinctive proficiency in product launches, mutual funds, and startup investments. With a comprehensive background in finance and strategic marketing, Oscar Giles has become a trusted advisor in the dynamic intersection of introducing new products and navigating diverse investment landscapes. Her career is marked by successful product launches, where she seamlessly integrates financial acumen with market trends to drive successful market entries. Simultaneously, Oscar Giles’s expertise extends into the world of mutual funds and startup investments, where she excels in identifying and nurturing high-potential ventures. Her unique skill set allows her to bridge the gap between innovative product offerings and strategic investment decisions. As a thought leader in these interconnected domains, Oscar Giles continues to shape the conversation around effective product launches and smart investment strategies, offering valuable insights to entrepreneurs, investors, and businesses alike.