Stock investing is crucial for retirement to ensure a steady income and preserve savings. As you near retirement, consider adjusting your portfolio allocation to balance income generation with wealth preservation.

It’s important to choose stocks and investments wisely to optimize your retirement savings. Portfolio diversification with stocks like Johnson & Johnson, Pfizer, and Realty Income Corporation can provide stability in retirement. Furthermore, incorporating bonds, dividend stocks, and balanced portfolios can help secure your financial future post-retirement.

Make well-informed investment decisions based on your financial goals and risk tolerance to build a secure retirement portfolio.

Credit: www.fool.com

Understanding The Importance Of Stock Investing For Retirement

When planning for retirement, it’s crucial to understand the importance of stock investing. Many people assume that stocks are too risky and volatile for retirement savings. However, a well-balanced and diversified stock portfolio can actually be a powerful asset in securing a financially stable retirement.

Significance Of Stock Investing

Stock investing plays a crucial role in building a retirement portfolio that can withstand the test of time. By incorporating stocks into your retirement strategy, you can benefit from the potential for long-term growth, outpacing inflation and ultimately preserving the purchasing power of your savings.

Benefits Of Stock Investing For Retirement

Stock investing offers various benefits for retirement planning. Firstly, stocks have historically provided higher returns compared to other investment options such as bonds or savings accounts. This can lead to a larger retirement nest egg and provide a buffer against increasing living costs in the future.

Creating A Retirement Investment Portfolio

Investing in the stock market is a strategic way to secure your financial future during retirement. One crucial aspect of preparing for retirement is building a diversified investment portfolio that can help you achieve your long-term financial goals. By carefully selecting a mix of assets, you can mitigate risk and maximize returns over time.

Diversification In Retirement Portfolio

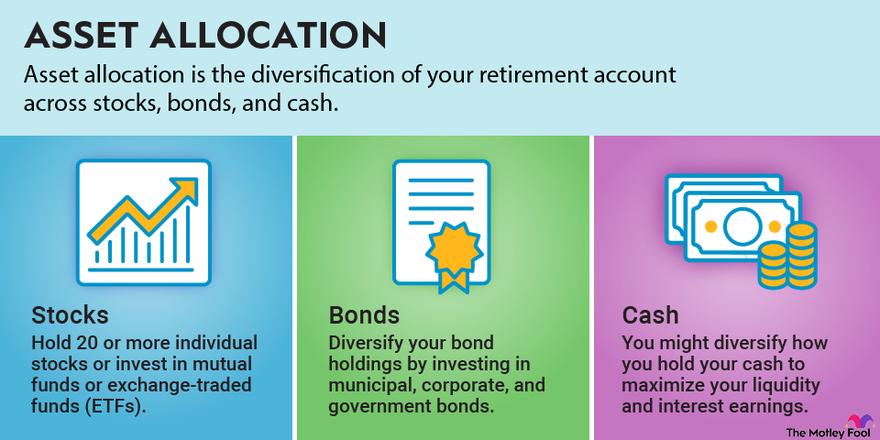

Diversification is key to reducing risk in your retirement portfolio. It involves spreading your investments across various asset classes, such as stocks, bonds, and real estate, to minimize the impact of market fluctuations on your overall portfolio value. By diversifying, you can potentially safeguard your retirement savings against unexpected market downturns.

Best Retirement Stocks To Include

When considering retirement stocks, it’s essential to look for companies that offer stable dividend yields and sustainable growth potential. Some of the best retirement stocks to include in your portfolio are industry leaders like Johnson & Johnson (NYSE: JNJ), Pfizer Inc. (NYSE: PFE), The Proctor and Gamble Company (NYSE: PG), and Realty Income Corporation (NYSE: O). Investing in these established companies can provide a reliable income stream and long-term value for retirees.

Strategies For Maximizing Retirement Wealth

When it comes to preparing for retirement, one of the key goals is to maximize your wealth. Investing in stocks is a popular strategy for achieving this, as it offers the potential for higher returns compared to other investment options. However, it’s important to adopt the right strategies to ensure you generate income and adapt your investment strategy over time. In this article, we will explore two essential strategies for maximizing your retirement wealth: Investment Options for Generating Income and Adapting Investment Strategy Over Time.

Investment Options For Generating Income

Choosing the right investment options can be crucial to generating income during retirement. Here are some options worth considering:

- Bonds: Bonds offer a fixed income stream and are considered less risky compared to stocks. They can provide stability in your investment portfolio and help generate a consistent income.

- Dividend stocks: Investing in dividend-paying stocks can be an excellent way to generate income. These stocks distribute a portion of the company’s profits to shareholders in the form of dividends.

- Real estate investment trusts (REITs): REITs are companies that own and manage real estate properties. Investing in REITs can provide regular income through rental payments from properties they own.

Adapting Investment Strategy Over Time

As you move closer to retirement, it’s essential to adapt your investment strategy to focus more on preserving your money while still generating income. Here are a few considerations:

- Diversify your portfolio: Diversification can help reduce risk by spreading your investments across different asset classes. Consider investing in a mix of stocks, bonds, and other assets to protect your retirement wealth.

- Gradually reduce stock allocation: With retirement approaching, it may be wise to reduce your allocation to stocks and increase your exposure to more stable assets. This strategy aims to safeguard your savings from potential market volatility.

- Consider annuities: Annuities can provide a guaranteed income stream during retirement. These financial products pay out a fixed amount at regular intervals, offering peace of mind and financial stability.

In conclusion, maximizing your retirement wealth requires careful consideration of investment options for generating income and adapting your investment strategy over time. By choosing the right mix of investments and adjusting your portfolio as you approach retirement, you can build a robust financial foundation for your golden years. Remember, consulting with a financial advisor can provide personalized guidance based on your specific needs and goals.

Financial Planning For Retirement

Considering stock investing for retirement? Allocate more to stocks early on for growth potential. Later, shift to income generation and preservation. Ensure a diversified portfolio for a secure retirement plan. Invest wisely for a financially stable future.

Investment Allocation By Age

Structuring A Retirement Portfolio

Financial planning for retirement is a crucial aspect of ensuring a comfortable and secure future. Whether you are just starting your career or are already nearing retirement age, it’s never too early or too late to start thinking about how you can make your money work for you. One key aspect of financial planning for retirement is investment allocation by age. This involves determining how much of your portfolio should be allocated to different types of investments based on your age and risk tolerance.

As a general rule, when you are younger and have a longer time horizon until retirement, you can afford to take on more risk and have a higher allocation to stocks. Stocks have historically provided higher returns than other asset classes over the long term but come with higher volatility. By allocating a larger portion of your portfolio to stocks, you have the potential to earn higher returns and grow your savings over time.

However, as you approach retirement, it becomes important to gradually shift your investment allocation to more conservative options to protect your savings. This is because you have less time to recover from market downturns and cannot afford to take on as much risk. Bonds, fixed annuities, and dividend-paying stocks are some examples of investments that provide more stability and regular income.

Investment Allocation By Age

When it comes to investment allocation by age, there isn’t a one-size-fits-all approach. The ideal allocation will depend on various factors, including your risk tolerance, financial goals, and time horizon until retirement. However, here’s a general guideline for investment allocation by age:

| Age Range | Stocks | Bonds | Cash and Cash Equivalents |

|---|---|---|---|

| 20s – 30s | 70% – 80% | 10% – 20% | 5% – 10% |

| 40s – 50s | 60% – 70% | 20% – 30% | 10% – 15% |

| 60s and beyond | 40% – 50% | 40% – 50% | 10% – 20% |

Keep in mind that these are just general guidelines and your personal circumstances may vary. It’s always a good idea to consult with a financial advisor to determine the best allocation for your individual situation.

Structuring A Retirement Portfolio

Structuring a retirement portfolio involves selecting the right mix of investments to meet your financial goals and risk tolerance. Here are some key steps to help you structure your retirement portfolio:

- Evaluate your risk tolerance: Determine how much risk you are comfortable taking and what level of volatility you can withstand.

- Set your financial goals: Define your short-term and long-term financial goals, such as the amount of income you need in retirement and any legacy you want to leave behind.

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of any single investment’s performance.

- Consider tax-efficient strategies: Look for investment options that provide tax advantages, such as tax-deferred retirement accounts or municipal bonds.

- Monitor and adjust your portfolio: Regularly review your portfolio’s performance and make adjustments as needed to stay on track with your goals.

By following these steps and regularly reassessing your portfolio, you can structure a retirement portfolio that aligns with your financial objectives and provides the potential for long-term growth and income.

Understanding Stock Selection For Retirement

When it comes to investing for retirement, stock selection plays a crucial role in determining the success of your portfolio. Stocks offer the potential for long-term growth and income, making them a popular choice for retirement investors. However, not all stocks are created equal, and it’s important to choose wisely. In this article, we will discuss two important strategies for stock selection in retirement: choosing stocks for dividend income and investing in growth stocks.

Choosing Stocks For Dividend Income

If you’re looking for steady income during your retirement years, choosing stocks that offer dividends can be a smart strategy. Dividends are payments made by companies to their shareholders as a portion of their profits. These payments can provide a regular stream of income, making them an attractive option for retirees.

When selecting stocks for dividend income, there are a few key factors to consider:

- Dividend Yield: This represents the annual dividend payment as a percentage of the stock’s current price. A higher dividend yield indicates a higher income potential.

- Dividend History: Look for companies that have a consistent track record of paying dividends and increasing them over time. This demonstrates their commitment to shareholders.

- Financial Health: Make sure the company has the financial stability to continue paying dividends. Look for low debt levels and strong cash flow.

By selecting stocks with a focus on dividend income, you can create a reliable income stream to support your retirement lifestyle.

Investing In Growth Stocks

Growth stocks are companies that have the potential for significant increases in their stock price over time. While growth stocks may not provide immediate income through dividends, they offer the opportunity for substantial capital appreciation. This can be especially beneficial for retirees with a longer time horizon and a higher risk tolerance.

When choosing growth stocks for your retirement portfolio, consider the following:

- Company Growth Potential: Look for companies with strong fundamentals, innovative products or services, and a competitive edge in their industry. These factors can drive future earnings growth and stock price appreciation.

- Management Team: Evaluate the leadership team’s track record and their ability to execute on their growth strategy. A competent management team is essential for long-term success.

- Valuation: While growth stocks may trade at higher price-to-earnings ratios, it’s important to assess the stock’s valuation relative to its growth potential. Consider factors like earnings growth rate and industry comparisons.

By including growth stocks in your retirement portfolio, you can potentially achieve higher returns and grow your wealth over time.

Credit: myucretirement.com

Best Practices For Retirement Investment

Investing for retirement involves careful planning and strategy. It is important to consider various factors such as risk tolerance, time horizon, and financial goals. Here are some best practices to consider for retirement investment.

Managing Retirement Portfolio After Retirement

After retirement, managing your portfolio becomes crucial. It’s essential to strike a balance between growth and stability to ensure a steady stream of income. Consider allocating a portion of your portfolio to income-generating assets such as dividend stocks, bonds, and annuities while also maintaining a suitable exposure to equities for long-term growth.

Examples Of Retirement Investment Portfolios

When building a retirement investment portfolio, diversification is key. A well-balanced portfolio may include a mix of stocks, bonds, mutual funds, and other assets. Here are some examples of retirement investment portfolios:

| Asset Class | Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Mutual Funds | 15% |

| Real Estate Investment Trusts (REITs) | 5% |

These allocations are just a sample, and the actual percentages should be tailored to individual risk tolerance and financial objectives. It’s advisable to seek guidance from a financial advisor to create a personalized retirement investment portfolio.

By following these best practices and examples of retirement investment portfolios, individuals can work towards building a robust investment strategy that supports a secure and fulfilling retirement.

Common Queries About Stock Investing For Retirement

Living Off Dividends In Retirement

Living off dividends in retirement is a popular approach for many retirees to generate a steady income. Dividend stocks are beneficial as they provide regular payments, and some investors reinvest these dividends to grow their portfolio further. Additionally, dividends can act as a buffer against market volatility and inflation, offering a stable income stream. However, it’s crucial to carefully select dividend-paying stocks with a history of consistent performance to ensure reliable cash flow during retirement.

Clarifications About Investing For Retirement

When investing for retirement, understanding the key elements is essential. First, a diversified portfolio is crucial to spread risk and potentially enhance returns. Diversification often includes a mix of stocks, bonds, and other investment vehicles to manage market fluctuations. Secondly, it’s essential to consider the time horizon for retirement and adjust your investment strategy accordingly. For example, in the early retirement years, focusing on growth-oriented stocks and mutual funds could be beneficial. However, as retirement approaches, shifting the allocation towards more conservative options can help safeguard accumulated wealth for the long term.

Credit: www.simonandschuster.com

Conclusion And Expert Advice

Stock investing for retirement can be a lucrative strategy if approached wisely. Let’s delve into some guidance and expert insights for making informed decisions.

Guidance For Stock Investing In Retirement

When investing in stocks for retirement, consider a diversified portfolio to mitigate risks. Regularly review and adjust your asset allocation based on your financial goals and risk tolerance.

Expert Insights On Retirement Investments

Consult with financial advisors to tailor your investment plan to meet your retirement needs. Allocate investments in a mix of stocks, bonds, and other assets to ensure a balanced and stable portfolio.

For retirees, investing in dividend stocks or retirement-focused companies like Johnson & Johnson and Pfizer may provide steady income streams. Always prioritize long-term value and sustainability in your stock selections.

Frequently Asked Questions

Are Stocks A Good Investment For Retirement?

Stocks can be a good investment for retirement as they offer potential for growth. It’s important to adjust your portfolio to focus on income and preserving money as you near retirement. Diversifying with bonds, dividend stocks, and balanced portfolios can help secure a stable retirement income.

What Is The Best Stock For Retirees?

For retirees, good stocks include Johnson & Johnson, Pfizer Inc. , Proctor and Gamble, and Realty Income Corporation. Additionally, consider dividend stocks, utility stocks, and bonds for income generation. It’s crucial to adapt stock allocation over time to balance growth and income.

Which Investment Is Best For Retirement?

For retirement, consider investing in bonds, dividend stocks, utility stocks, fixed annuities, bank CDs, and save in high-yield accounts. Adjust investments over time for income and preservation.

How Much Money Do You Need To Retire With $100,000 A Year Income?

To retire with a $100,000 a year income, you would need to have a retirement portfolio that generates enough returns to cover this amount. Depending on your investment strategy and risk tolerance, a diversified portfolio including stocks, bonds, and other income-generating assets may be necessary.

Consider consulting with a financial advisor to determine the best approach for your specific needs.

Conclusion

Stock investing for retirement offers security against outliving savings. Adjust allocations for income generation. Consider stocks like Johnson & Johnson, Pfizer, Realty Income Corp, and Procter & Gamble. Bonds, dividend stocks, and balanced portfolios are ideal for retirement savings to ensure financial stability in later years.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.