Understanding risk management in stock market investing is crucial for protecting your investment portfolio. By implementing effective risk management strategies, investors can minimize potential losses and optimize their returns.

This involves assessing and mitigating various risks, such as market volatility, economic factors, and individual stock performance. Diversification, hedging, and active portfolio management are common risk management techniques used to navigate fluctuating market conditions. Additionally, setting clear risk appetite, determining risk-reward ratios, and implementing stop loss orders are essential for managing risk in trading.

Overall, a comprehensive understanding of risk management is essential for successful stock market investing and safeguarding your financial welfare.

The Essence Of Risk In Stock Investing

Understanding risk management in stock market investing is essential for navigating the volatile nature of the market. It involves assessing potential risks and implementing strategies to minimize losses. Proper risk management is crucial for maintaining financial stability and achieving long-term investment success.

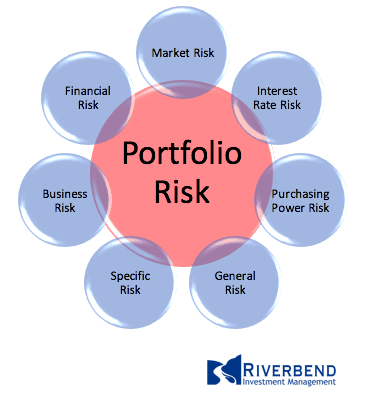

Different Types Of Market Risks

Risk is an inherent part of stock market investing. It is important to understand the different types of market risks that can impact your investments.

- Market Risk: This type of risk is associated with the overall market conditions and can result in losses due to factors such as interest rates, inflation, and currency exchange rates.

- Systematic Risk: Also known as non-diversifiable risk, it refers to risks that affect the entire market and cannot be eliminated through diversification. Examples include economic recessions, political instability, and natural disasters.

- Specific Risk: Also known as unsystematic risk, it refers to risks that are specific to individual stocks or sectors. These risks can be minimized through diversification.

Impact Of Volatility On Portfolio

Volatility is a measure of how much a stock price fluctuates over a given period of time. It is essential to understand the impact of volatility on your investment portfolio.

- Higher Volatility: Stocks with higher volatility tend to experience larger price swings, which can result in higher potential returns but also higher potential losses.

- Lower Volatility: Stocks with lower volatility are generally more stable and may provide a more steady return, but with potentially lower gains.

It is crucial to manage the risk associated with stock market investing to protect your investment capital and achieve your financial goals. By diversifying your portfolio, you can minimize the impact of specific risks and ensure a more balanced investment approach. Additionally, regularly reviewing and adjusting your portfolio based on market conditions and your risk tolerance can help mitigate potential losses.

Credit: www.riverbendinvestments.com

Setting Your Risk Appetite

Understanding risk management in stock market investing involves setting your risk appetite. This means determining how much risk you are willing to take on in your investment portfolio. By carefully assessing your risk tolerance and establishing clear risk management strategies, you can mitigate potential losses and make more informed investment decisions.

Assessing Individual Risk Tolerance

When it comes to setting your risk appetite in stock market investing, it’s essential to begin by assessing your individual risk tolerance. This involves understanding your comfort level with potential financial losses and the impact of market volatility on your investment portfolio.

By evaluating your risk tolerance, you can determine the amount of risk you are willing to take on in pursuit of potential returns. This assessment is crucial in creating a well-informed investment strategy that aligns with your financial goals and psychological disposition.

Creating A Personalized Investment Strategy

Once you have assessed your individual risk tolerance, the next step is to create a personalized investment strategy that reflects your risk appetite and investment objectives. This involves developing a plan that outlines the allocation of your investment capital across various asset classes and financial instruments.

Your personalized investment strategy should consider factors such as your time horizon, income requirements, and liquidity needs. Additionally, it should incorporate diversification principles to mitigate specific risks associated with individual securities or market segments.

Risk-reward Ratio Unveiled

Understanding the risk-reward ratio is essential for successful stock market investing. It is a fundamental concept that helps investors assess the potential gains and losses of a trade. By understanding and implementing this ratio in trade decisions, investors can make informed choices and manage their risk effectively.

Calculating Potential Gains And Losses

Before making any investment decision, it’s crucial to calculate the potential gains and losses. This involves analyzing the price at which you enter a trade and the anticipated price at which you will exit. By determining the potential profit and potential loss, you can evaluate the risk-reward ratio of the trade.

Implementing Ratio In Trade Decisions

Implementing the risk-reward ratio in trade decisions allows investors to assess the potential return against the risk of loss. It helps in setting realistic profit targets and stop-loss levels based on the calculated ratio. By incorporating this ratio into their trading strategy, investors can make disciplined and rational decisions.

Diversification As A Risk Mitigation Tool

Diversification is a vital risk mitigation tool in stock market investing. By spreading investments across various asset classes and sectors, investors can minimize the impact of market fluctuations and potential losses, enhancing their overall risk management strategy.

Building A Balanced Portfolio

Diversification is one of the most effective risk mitigation tools in stock market investing. It involves building a balanced portfolio by investing in a variety of assets across different industries and sectors. This helps to spread out the risk and reduce the impact of any single stock or sector performing poorly. A balanced portfolio should include a mix of stocks, bonds, and other asset classes.

Strategies For Diversifying Investments

There are several strategies for diversifying investments, including:

- Industry diversification: Investing in companies across different industries such as healthcare, technology, and finance. This helps to reduce the impact of any single industry downturn.

- Sector diversification: Investing in companies within a particular sector, such as energy or consumer goods. This helps to spread out the risk within that sector.

- Geographic diversification: Investing in companies across different geographic regions such as North America, Europe, and Asia. This helps to reduce the impact of any single country or region experiencing economic or political turmoil.

- Asset class diversification: Investing in a variety of asset classes such as stocks, bonds, real estate, and commodities. This helps to spread out the risk across different types of investments.

It’s important to note that diversification does not guarantee a profit or completely eliminate risk. However, it can help to reduce the impact of any single investment performing poorly. It’s also important to regularly review and rebalance your portfolio to ensure it remains diversified and aligned with your investment goals and risk tolerance.

The Role Of Stop Loss And Take Profit Orders

In stock market investing, understanding risk management is crucial. One important aspect of risk management is the use of stop loss and take profit orders. These orders help investors limit their losses and secure profits by automatically closing positions at predetermined levels.

By implementing these orders, investors can protect their capital and make more informed decisions.

Setting Effective Stop Loss Points

Stop loss is an order that helps traders to limit their losses on a trade. It is a predetermined point where traders exit their trade to prevent further losses. Setting effective stop loss points is crucial in risk management as it helps traders to protect their capital. To set an effective stop loss, traders should consider their risk tolerance, market volatility, and the position size of their trade. Traders should also avoid setting their stop loss too tight, which could cause them to exit the trade prematurely.

Benefits Of Take Profit Orders

Take profit is an order that helps traders to lock in their profits on a trade. It is a predetermined point where traders exit their trade to secure their gains. Take profit orders are beneficial in risk management as they help traders to avoid giving back their gains due to market volatility. Traders should set their take profit based on their risk-reward ratio and market conditions. Take profit orders also help traders to avoid the emotional bias of holding onto a trade for too long in the hope of making more profits.

In conclusion, stop loss and take profit orders are crucial in risk management for stock market investing. Setting effective stop loss points and using take profit orders can help traders to protect their capital and lock in their gains. Traders should also consider other risk management strategies such as diversification, hedging, and active portfolio management to mitigate the impact of market fluctuations. By applying effective risk management strategies, traders can improve their chances of success in the stock market.

Position Sizing And Portfolio Management

Position sizing and portfolio management are crucial aspects of understanding risk management in stock market investing. By carefully determining the appropriate position size for each trade and effectively managing the overall portfolio, investors can mitigate potential losses and maximize their returns.

Implementing risk management strategies such as diversification and setting stop-loss orders can help protect against market fluctuations and ensure long-term success in the stock market.

Position sizing and portfolio management are crucial aspects of risk management in stock market investing. By determining the optimal position size and adjusting positions based on market conditions, investors can minimize their risk and maximize their returns.

Determining Optimal Position Size

Determining the optimal position size is a critical step in managing risk in the stock market. Investors should never risk more than they can afford to lose, and determining the optimal position size is an essential part of this process. There are several methods for determining the optimal position size, including the fixed dollar amount method, the percentage risk method, and the volatility-adjusted position size method.

Adjusting Positions Based On Market Conditions

Market conditions can change rapidly, and investors must be prepared to adjust their positions accordingly. For example, if the market is experiencing high volatility, investors may want to reduce their position sizes to minimize their risk. Conversely, if the market is experiencing low volatility, investors may want to increase their position sizes to take advantage of potential gains. Additionally, investors should regularly review their portfolios and make adjustments as necessary to ensure they are adequately diversified and aligned with their investment objectives.

Summary

In summary, position sizing and portfolio management are essential components of risk management in stock market investing. By determining the optimal position size and adjusting positions based on market conditions, investors can minimize their risk and maximize their returns. It is essential to regularly review and adjust portfolios to ensure they remain aligned with investment objectives and are adequately diversified.

Hedging Strategies For Stock Market Investors

Discover effective hedging strategies for stock market investors to understand and manage risks. Mitigate potential losses and protect investments through diversification, options, and other risk management techniques. By employing these strategies, investors can navigate market fluctuations and safeguard their financial portfolios.

Introduction to Hedging Instruments

As a stock market investor, you’re always looking for ways to minimize your risk and protect your portfolio. One of the most effective ways to do this is through hedging strategies. Hedging involves taking an opposing position in the market to offset potential losses in your current positions. Hedging instruments such as futures contracts, options contracts, and exchange-traded funds (ETFs) can help you manage risk in your investments.

Practical Hedging Techniques

To effectively hedge your investments, you need to know which hedging instrument to use and when to use it. Here are some practical hedging techniques you can use to protect your portfolio:

1. Futures Contracts: Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. They’re often used to hedge against price fluctuations in commodities, currencies, and stock market indices.

2. Options Contracts: Options contracts give you the right, but not the obligation, to buy or sell an asset at a predetermined price and date in the future. They’re often used to hedge against potential losses in individual stocks.

3. ETFs: ETFs are investment funds that trade on stock exchanges like individual stocks. They’re designed to track the performance of a specific index or sector, making them a useful tool for hedging against market volatility.

When it comes to hedging, it’s important to remember that no strategy is foolproof. Hedging can help you manage risk, but it can also limit your potential gains. As a stock market investor, it’s up to you to decide which hedging techniques are best suited to your investment goals and risk tolerance.

Credit: fastercapital.com

Coping With Black Swan Events

Coping with Black Swan Events is crucial in understanding risk management in stock market investing. Traders must implement a proper risk-management strategy to protect themselves from catastrophic losses, such as determining their risk appetite, calculating risk-reward ratios, and safeguarding against long-tail risks or unexpected market events.

Understanding Tail Risk

When it comes to stock market investing, understanding tail risk is crucial. Tail risk refers to the possibility of extreme events that deviate significantly from the norm, impacting investment portfolios in unexpected ways. These events, often referred to as “black swan events,” can lead to substantial losses if not managed effectively.

Preparation And Response Strategies

Investors must prepare for and implement response strategies to cope with black swan events and mitigate their potential impact on their investment portfolios. This involves proactive risk management measures and strategic planning to minimize the adverse effects of such unforeseen occurrences.

Maintaining A Risk Management Trading Log

When it comes to stock market investing, understanding and managing risk is crucial for long-term success. One effective way to manage risk is by maintaining a risk management trading log. This log serves as a valuable tool for traders to track and analyze their trading activities, helping them make informed decisions and improve their overall performance.

Benefits Of Documenting Trading Activity

Documenting trading activity offers several key benefits for investors. By maintaining a detailed log of trades, traders can gain valuable insights into their performance and identify patterns and trends that can inform future decisions. Additionally, documenting trading activity provides a historical record that can be used for performance analysis and evaluation.

Key Elements To Track In A Trading Log

Tracking important elements in a trading log is essential for comprehensive risk management. These key elements include:

- Entry and exit points for each trade

- Trade duration and holding period

- Reasons for entering and exiting a trade

- Profit and loss for each trade

- Trading strategy employed

- Market conditions at the time of trade

- Emotional state during the trade

Continuous Learning And Adaptation

When it comes to stock market investing, understanding risk management is crucial for long-term success. One of the key aspects of effective risk management is continuous learning and adaptation. The stock market is dynamic and constantly evolving, so it is essential for investors to stay informed and adapt their strategies accordingly.

Staying Informed On Market Trends

To effectively manage risk in the stock market, it is important to stay informed about the latest market trends. This involves regularly monitoring market news, analyzing economic indicators, and keeping an eye on industry-specific developments. By staying informed, investors can identify potential risks and make informed decisions to mitigate them.

Another important aspect of continuous learning and adaptation in risk management is incorporating feedback. By analyzing past investment decisions and their outcomes, investors can gain valuable insights into their risk management strategies. This feedback loop allows them to identify areas for improvement and make necessary adjustments to their approach.

Here are some key practices to incorporate feedback into risk management:

- Regularly review and analyze your investment portfolio performance.

- Identify patterns and trends in your investment decisions.

- Assess the effectiveness of your risk management strategies based on past outcomes.

- Seek feedback from experienced investors or financial advisors.

- Continuously update your risk management plan based on the feedback received.

By continuously learning and adapting, investors can enhance their risk management strategies and increase their chances of success in the stock market. Remember, risk management is not a one-time task, but an ongoing process that requires constant vigilance and adjustment.

So, keep learning, stay informed, and be ready to adapt!

:max_bytes(150000):strip_icc()/market-risk.asp-Final-267d57db9f87429cb80051c8a5132847.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

How Do You Understand Risk Management In Trading?

Understanding risk management in trading involves controlling potential losses by setting stop-loss orders and determining risk-reward ratios. It also includes diversifying investments and using risk-appropriate position sizes to mitigate market fluctuations and protect against catastrophic losses.

What Is The Risk Management Process In The Stock Market?

Risk management in the stock market involves strategies to minimize losses from market fluctuations. Techniques like diversification and hedging are used to mitigate market risk. It’s crucial for protecting investment portfolios and ensuring financial stability.

What Is The 1% Rule In Trading?

The 1% rule in trading refers to the practice of risking no more than 1% of your trading account balance on a single trade. This is a risk management strategy aimed at limiting potential losses and preserving capital. By adhering to this rule, traders can avoid large drawdowns and maintain a sustainable trading approach.

How Do You Understand Risk In Investing?

Understanding risk in investing means recognizing the possibility of losing money in pursuit of potential gains. It involves assessing the likelihood of negative outcomes and taking steps to mitigate them, such as diversifying your portfolio and setting stop-loss orders. Proper risk management is crucial for protecting your financial welfare and achieving sustainable returns.

Conclusion

Understanding risk management is crucial for successful stock market investing. By following proper risk management strategies, such as determining risk appetite, calculating risk-reward ratios, and protecting against black swan events, traders can safeguard their investments and minimize potential losses. It is important to stick to a trading plan, consider costs, limit margin use, and use take profit and stop loss orders.

By employing these techniques, investors can navigate the volatile stock market with confidence and increase their chances of long-term profitability.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.