When considering real estate investments, weigh the pros and cons to make informed decisions. Residential, commercial, crowdfunding, technology, and vacation properties offer income and appreciation potential, but require substantial initial costs, management responsibilities, and market risks.

Real estate investments offer diverse opportunities; however, careful analysis is essential to navigate potential challenges and maximize returns. Real estate investments present various opportunities and challenges. From residential and commercial properties to crowdfunding and technology-driven approaches, each option offers distinct advantages and drawbacks.

Understanding these aspects is vital for making informed investment decisions. While potential for steady income, capital appreciation, and tax benefits make real estate an attractive investment option, high initial costs, property management responsibilities, and market risks must be carefully considered. The following exploration details the positives and negatives of real estate investments, shedding light on navigating the complexities of this investment avenue.

Credit: www.dwellscape.ca

Types Of Real Estate Investments

Real estate investments offer various options like residential development, commercial properties, crowdfunding, real estate technology, and short-term rentals. Pros include steady income, capital appreciation, and tax benefits, while cons include high costs, management responsibilities, and market risks. It’s crucial to weigh these factors before making an investment decision.

Residential Real Estate Development

Residential real estate development involves constructing or renovating properties for residential purposes.

Commercial Real Estate Investment

Commercial real estate investment focuses on properties intended for business use, such as office buildings or retail spaces.

Real Estate Crowdfunding

Real estate crowdfunding enables investors to pool funds online to invest in various real estate projects.

Real Estate Technology (proptech)

Real Estate Technology, also known as PropTech, leverages technology to enhance real estate processes and services.

Short-term Rentals And Vacation Properties

Short-term rentals and vacation properties involve renting out properties on a short-term basis for leisure or temporary stays.

Advantages Of Real Estate Investing

Real estate investing offers several advantages that make it an attractive option for investors seeking long-term returns and diversified portfolios.

Steady Income

Investing in real estate provides stable and consistent income through rental payments. Unlike other investment types, such as stocks and bonds, real estate properties offer the opportunity for regular cash flow, contributing to a reliable and predictable source of revenue.

Capital Appreciation

Real estate properties have the potential for appreciation in value over time. Property values may increase due to factors such as demand in the local market, improvements in infrastructure, and overall economic growth, allowing investors to build equity and generate substantial profits upon resale.

Tax Benefits

Investing in real estate offers various tax advantages that can lead to significant savings for investors. Tax deductions on mortgage interest, property depreciation, repairs, and operating expenses can reduce taxable income, while long-term capital gains tax rates for property sales may be lower than those for other investments.

Challenges In Real Estate Investing

While investing in real estate can be a lucrative venture, it is not without its fair share of challenges. Before diving into this type of investment, it is crucial to understand and consider the obstacles you may face along the way. These challenges include:

High Initial Costs

One of the major challenges in real estate investing is the high initial costs involved. Acquiring properties requires a significant amount of capital, which can be a barrier for many potential investors. The upfront expenses include the down payment, closing costs, inspection fees, and potentially renovation or repair costs. This financial commitment can be daunting for individuals or businesses starting on their real estate investment journey.

Property Management Responsibilities

Another challenge in real estate investing is the responsibilities that come with property management. Owning a property means taking on various tasks, such as finding and screening tenants, ensuring property maintenance, handling rent collection, and addressing tenant concerns and complaints. Managing properties requires time, effort, and sometimes additional expenses if professional property management services are hired. It’s essential to have the necessary skills or resources to navigate these responsibilities successfully.

Market Risks

Market risks are inherent in real estate investing. The real estate market can experience fluctuations, and investing at the wrong time or in the wrong location can result in financial losses. Factors such as economic conditions, interest rates, demographic trends, and competition affect property values and rental demand. Additionally, unexpected events like natural disasters or changes in government regulations can significantly impact the market. Investors need to stay informed and adapt their strategies to mitigate these risks.

Safest Real Estate Investment Types

Discover the safest real estate investment types like long-term rentals, short-term rentals, buy-and-hold properties, and multi-family homes. Each option presents unique benefits such as steady income and capital appreciation while requiring careful consideration to navigate challenges like market fluctuations and property management responsibilities.

Long-term Rental Properties

Investing in long-term rental properties is considered one of the safest types of real estate investments. With a long-term rental property, you can enjoy a steady stream of rental income. This type of investment provides stability as tenants sign lease contracts for extended periods, typically a year or more. Pros:- Regular Income: Long-term rental properties can generate consistent monthly rental income, providing you with a reliable source of cash flow.

- Appreciation: Over time, the value of your rental property may increase, allowing you to benefit from capital appreciation.

- Tax Benefits: Rental properties offer various tax advantages, allowing you to deduct expenses such as mortgage interest, property taxes, and maintenance costs.

- Property Management: Managing long-term rental properties requires time and effort, including finding tenants, handling maintenance requests, and dealing with potential vacancies.

- Market Risks: The value of your property can fluctuate depending on market conditions, which may impact your investment returns.

- Tenant Challenges: Dealing with problem tenants or experiencing rental defaults can be a potential downside of long-term rental properties.

Short-term Rental Properties

Short-term rental properties, such as vacation rentals and Airbnb properties, can also be a safe real estate investment option. This type of investment involves renting out properties on a short-term basis, typically for a few nights or weeks. Pros:- Higher Rental Income: Short-term rentals often have higher rental rates compared to long-term rentals, allowing you to earn more income in a shorter period.

- Flexibility: With short-term rental properties, you have the flexibility to use the property for personal use or rent it out, giving you more control over your investment.

- Diversification: Investing in short-term rental properties can diversify your real estate portfolio, reducing the risk of relying solely on long-term rentals.

- Higher Management Requirements: Managing short-term rental properties involves more frequent turnover, guest communication, and marketing efforts, requiring additional time and resources.

- Market Volatility: The demand for short-term rentals can be subject to market fluctuations, impacting the occupancy rate and rental income potential.

- Regulatory Challenges: Some areas have strict regulations and restrictions on short-term rentals, limiting the investment opportunities and potentially causing legal complications.

Buy-and-hold Real Estate

Buy-and-hold real estate investments involve purchasing properties with the intention of holding onto them for an extended period. This strategy is often utilized for long-term appreciation and rental income generation. Pros:- Long-Term Wealth Building: Investing in buy-and-hold real estate allows you to build long-term wealth through rental income and potential property value appreciation.

- Tax Advantages: Similar to other rental properties, buy-and-hold investments offer tax benefits, including deductions for expenses and depreciation.

- Passive Income: Once you acquire the properties, rental income becomes a passive source of cash flow, allowing you to build wealth while minimizing active involvement.

- Market Risks: The real estate market can experience fluctuations, impacting the value of your investment property.

- Property Maintenance: Maintaining the property over the long term can require regular repairs, renovations, and property management, adding to the overall costs of ownership.

- Market Liquidity: Unlike stocks or bonds, real estate is not as liquid, and selling properties to access funds may take time and incur additional expenses.

Multi-family Homes

Investing in multi-family homes, such as duplexes and apartment buildings, can be a safe and profitable real estate investment strategy. These properties have multiple units, allowing you to generate rental income from multiple tenants. Pros:- Multiple Income Streams: Multi-family homes offer the potential for multiple rental income streams, reducing the risk associated with relying on a single tenant.

- Economies of Scale: By owning several rental units within one property, you can benefit from economies of scale in terms of property management and maintenance.

- Lower Vacancy Risk: With multiple units, the risk of total vacancy is reduced as vacancies in one unit can be offset by income from other occupied units.

- Higher Purchase Price: Acquiring multi-family homes typically requires a higher upfront investment compared to single-family properties.

- Increased Management Responsibilities: Managing multiple units and dealing with multiple tenants can be more challenging and time-consuming than managing a single property.

- Complex Financing: Financing multi-family properties may involve more complex loan structures and qualification requirements.

Inadvisable Times For Real Estate Investment

Investing in real estate can be a lucrative endeavor, but there are certain times when it may not be advisable to enter the market. It’s important to consider the potential risks and drawbacks before making a decision. Below are two key factors that indicate inadvisable times for real estate investment:

Unstable Market Conditions

Market conditions play a vital role in the success of real estate investments. If the local real estate market is experiencing instability, such as declining property values, high foreclosure rates, or oversupply, it may not be an ideal time to invest. Unstable market conditions can lead to financial losses and decreased property value, which can negatively impact your investment portfolio.

Availability Of Affordable Financing

The availability of affordable financing is another crucial factor to consider before investing in real estate. When financing options are limited or interest rates are high, it becomes more challenging to secure favorable terms for your investment property. High borrowing costs can eat into your potential profits and make it difficult to generate a positive cash flow.

Ultimately, timing is key when it comes to real estate investments. It’s important to thoroughly research the market, analyze the trends, and consult with professionals to determine the best time to make your move. Keep in mind that there will always be risks associated with any investment, and being cautious during inadvisable times can help protect your financial wellbeing.

Credit: www.cincinkyrealestate.com

Control In Real Estate Investment

When it comes to real estate investment, control is a key factor that sets it apart from other investment options.

Hands-on Approach

- You have direct control over your investment decisions in real estate.

- Manage properties, make strategic improvements, and set rental prices based on your judgment.

- Being hands-on allows for greater customization and flexibility in your investment strategy.

Code

Unlike stock investments where you are subject to market volatility, in real estate, you can actively influence the performance of your assets.

Unordered List

- __Pros__: Control over property management and decision-making.

- __Cons__: Requires more time and effort compared to passive investments.

Comparison Of Real Estate Investment With Other Types

- Stocks represent ownership in a company.

- Real estate is physical property.

- Stocks offer liquidity.

- Bonds are debt instruments.

- Real estate offers tangible assets.

- Bonds have fixed interest rates.

- Mutual funds pool investors’ money.

- Real estate allows direct ownership.

- Mutual funds are managed by professionals.

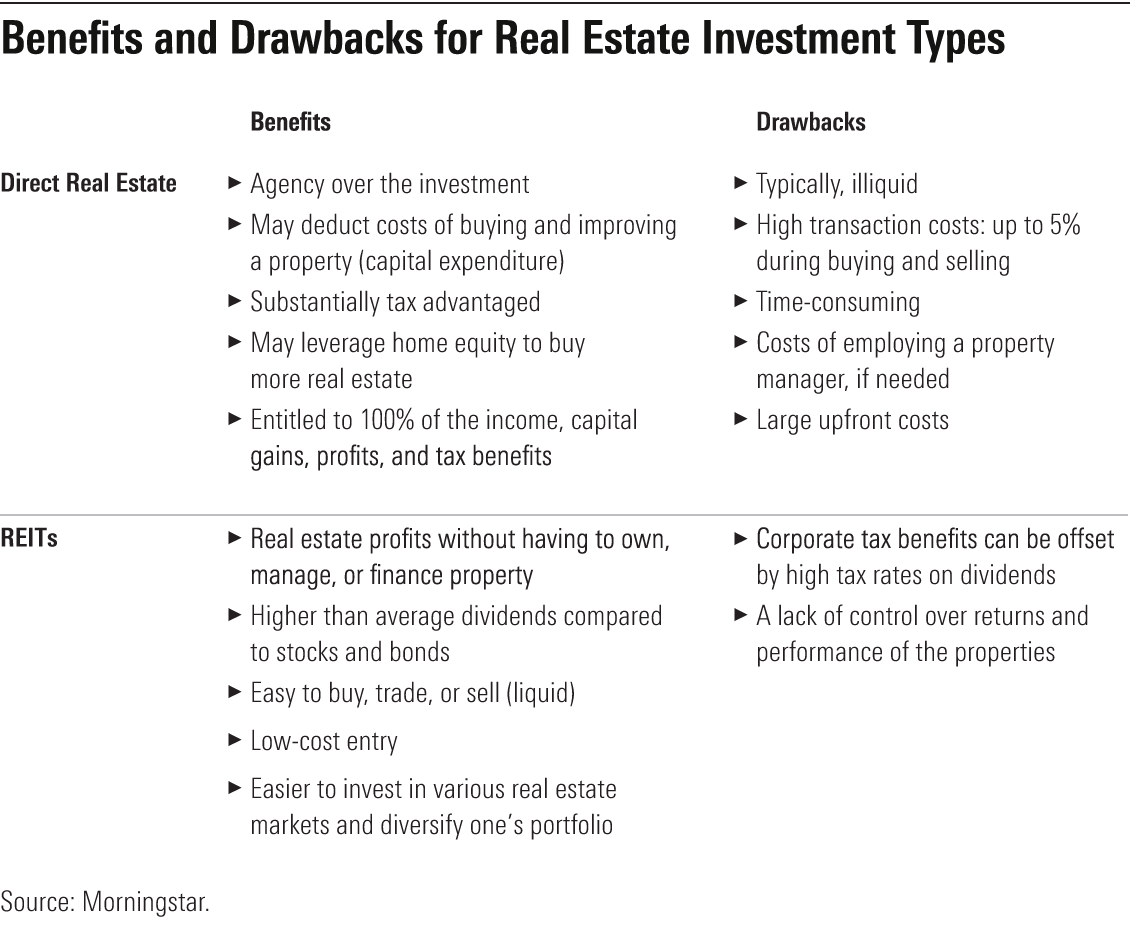

Credit: www.morningstar.com

Exploring Different Types Of Real Estate Funds

Real estate funds offer investors the opportunity to diversify their portfolios and access the real estate market without the hassles of property management. There are various types of real estate funds, each with its own advantages and disadvantages. Let’s dive into the different types of real estate funds, their pros, and cons.

Reits

Real Estate Investment Trusts (REITs) are publicly traded companies that own, operate, or finance income-generating properties across various real estate sectors. REITs offer liquidity, regular income through dividends, and portfolio diversification. However, they are susceptible to market volatility and may be sensitive to interest rate changes.

Open-end Funds

Open-end real estate funds allow investors to buy and sell shares at any time. They provide diversification and are actively managed, potentially resulting in higher returns. On the downside, they may have higher fees and are subject to market risks.

Closed-end Funds

Closed-end real estate funds have a fixed number of shares and are traded on stock exchanges. They often have a finite life, making them suitable for investors with a long-term investment horizon. However, they can be illiquid and may have higher initial fees.

Frequently Asked Questions

What Is The Most Profitable Type Of Real Estate Investment?

Residential real estate development, Commercial real estate, Real estate crowdfunding, PropTech, Short-term rentals are profitable investments with key trends and factors for success.

What Are The Positives And Negatives Of Real Estate Investing?

Real estate investing has the potential for steady income, capital appreciation, and tax benefits. However, it comes with high initial costs, property management responsibilities, and market risks.

What Is The Safest Type Of Real Estate Investment?

The safest real estate investments are Long-Term Rental Properties, Short-Term Rental Properties, Buy-and-Hold Real Estate, and Multi-Family Homes. These options offer lower risk.

When Not To Invest In Real Estate?

You should avoid investing in real estate when the market conditions are unstable, such as declining property values, high foreclosure rates, or oversupply. It’s important to be aware of the local real estate market before making an investment.

Conclusion

Real estate investing offers the potential for steady income, capital appreciation, and tax benefits. However, challenges such as high initial costs, property management responsibilities, and market risks should be carefully considered. With various types of real estate ventures available, it’s essential to weigh the pros and cons to make informed investment decisions.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.