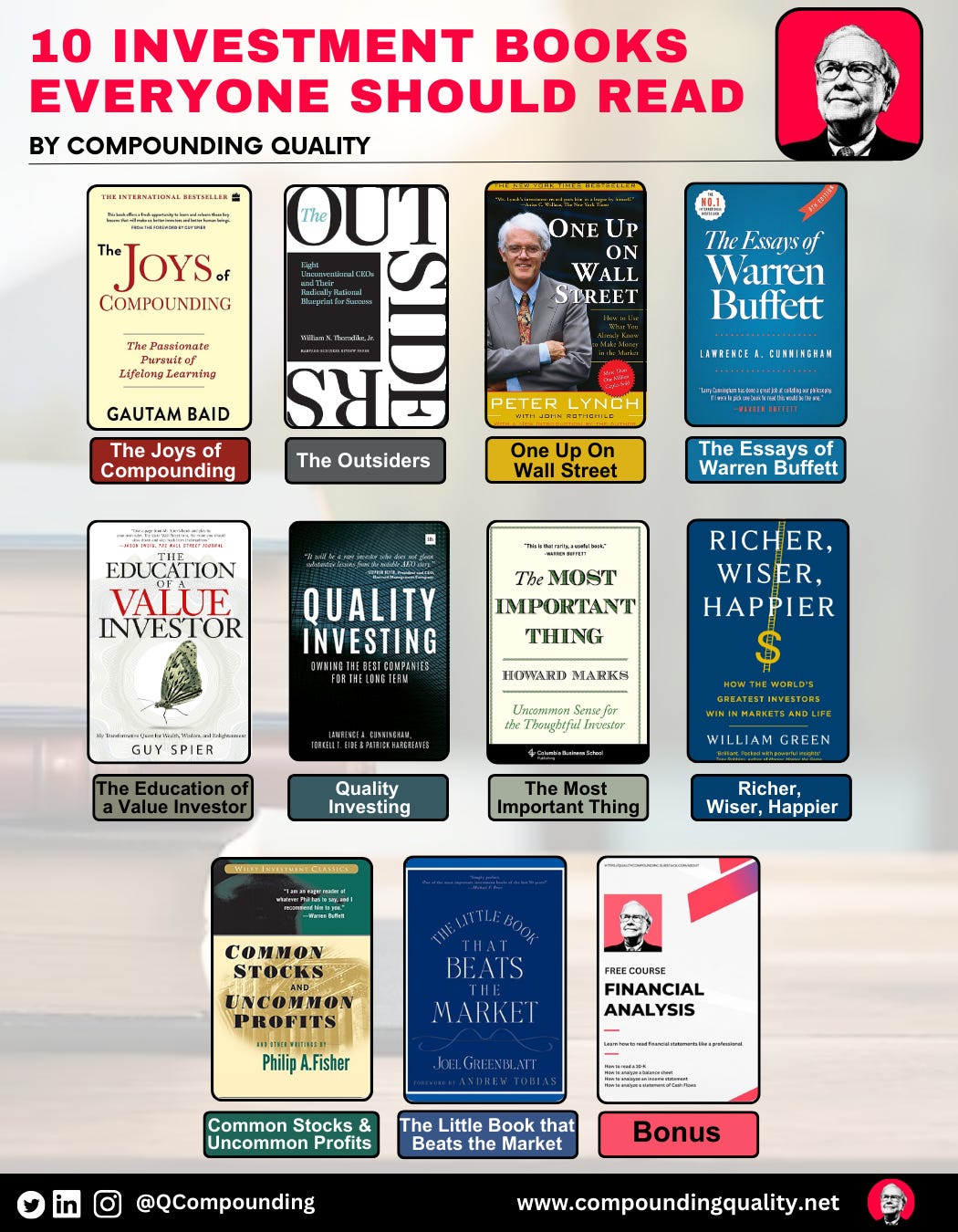

**Top 10 Books Every Investor Should Read** “The Intelligent Investor” by Benjamin Graham and “Common Stocks and Uncommon Profits” by Philip Fisher are essential reads for any investor. Investing can be a complex and daunting task, especially for beginners.

Reading the right books can provide invaluable insights and strategies. These books offer foundational knowledge and advanced techniques that can help investors make informed decisions. They cover various aspects of investing, including market analysis, risk management, and behavioral finance. Learning from the experiences and wisdom of successful investors can significantly improve one’s investment skills.

This list of top 10 books is curated to guide both novice and seasoned investors toward making smarter financial decisions. Dive into these must-read books to enhance your investment journey.

The Intelligent Investor

Among the top 10 books every investor should read, The Intelligent Investor stands out. Written by Benjamin Graham, it has been a cornerstone for many successful investors. This book offers timeless wisdom on how to make smart investment decisions.

Key Concepts

The Intelligent Investor is known for its foundational principles.

- Value Investing: Focus on undervalued stocks with strong fundamentals.

- Margin of Safety: Buy stocks at a price lower than their intrinsic value.

- Mr. Market: Treat the market as a business partner with erratic behavior.

| Concept | Description |

|---|---|

| Value Investing | Invest in undervalued stocks. |

| Margin of Safety | Purchase below intrinsic value. |

| Mr. Market | View the market’s mood swings as opportunities. |

Why It’s A Must-read

This book is a must-read for several reasons.

- Timeless Wisdom: The principles are still relevant today.

- Endorsed by Experts: Warren Buffett calls it the best book on investing.

- Practical Advice: Offers actionable tips for both beginners and pros.

The book is rich with practical advice and real-world examples. It helps investors avoid common pitfalls. Reading it can transform your investment strategy.

For those serious about investing, The Intelligent Investor is an essential read. It provides a solid foundation for making informed decisions.

Common Stocks And Uncommon Profits

“Common Stocks and Uncommon Profits” by Philip Fisher offers timeless investment strategies. Essential reading for investors seeking long-term growth.

“Common Stocks and Uncommon Profits” by Philip Fisher is a timeless classic. This book offers deep insights into the stock market. Investors praise its timeless wisdom. Fisher’s principles guide many successful investors today.

Investment Philosophy

Fisher emphasizes investing in quality companies. He advises focusing on long-term growth. This means holding stocks for years. Fisher’s approach is about understanding a company’s business.

Fisher suggests evaluating management quality. He believes in investing in companies with strong leadership. This is essential for long-term success.

| Key Points | Description |

|---|---|

| Long-term Growth | Hold stocks for years to gain profits. |

| Management Quality | Invest in companies with good leadership. |

| Business Understanding | Know the business you invest in. |

Impact On Modern Investing

Fisher’s book has influenced many modern investors. Warren Buffett is a notable follower. He incorporates Fisher’s ideas into his investment strategy.

The book stresses the importance of research. It encourages investors to dig deep before investing. This philosophy is still relevant in today’s market.

- Warren Buffett follows Fisher’s principles.

- Importance of thorough research.

- Relevance in today’s market.

“Common Stocks and Uncommon Profits” remains a must-read. It offers timeless lessons for every investor. Fisher’s wisdom continues to guide modern investing.

A Random Walk Down Wall Street

Among the top books every investor should read, A Random Walk Down Wall Street by Burton Malkiel stands out. This classic book introduces the concept of market efficiency and offers timeless investment advice. Let’s dive deeper into why this book is essential for any investor.

Principles Of Market Efficiency

Market efficiency is a core idea in this book. Malkiel explains that stock prices reflect all available information. This means it’s tough to consistently outperform the market.

The book debunks the myth of “hot tips” and “sure bets”. It shows why random stock picking often equals expert predictions. Malkiel uses easy examples to make these points clear.

The book also covers the Efficient Market Hypothesis (EMH). It suggests that it’s nearly impossible to beat the market through expert stock selection or market timing. This principle is key for new investors to understand.

Relevance In Today’s Market

A Random Walk Down Wall Street remains highly relevant today. The principles of market efficiency still hold true. Even with advanced technology, predicting stock movements is still very difficult.

Modern investors face a flood of information daily. This book helps them understand that not all information is useful. It teaches readers to focus on long-term investing strategies.

Below is a table summarizing key concepts from the book:

| Concept | Description |

|---|---|

| Efficient Market Hypothesis (EMH) | Stock prices reflect all known information. |

| Random Walk Theory | Stock price changes are random and unpredictable. |

| Long-term Investment | Focus on long-term gains rather than short-term profits. |

The book also advises on portfolio diversification. It suggests spreading investments across various assets to reduce risk. This strategy remains relevant in today’s volatile market.

In summary, A Random Walk Down Wall Street offers timeless wisdom. It teaches market principles and investment strategies that remain crucial. Every investor, novice or seasoned, can benefit from its insights.

Credit: www.fastinvest.com

One Up On Wall Street

Investing can be complex, but Peter Lynch simplifies it in his book One Up On Wall Street. This classic investment book provides valuable insights and practical strategies. Whether you’re a beginner or an experienced investor, Lynch’s advice can help you make smarter investment decisions.

Peter Lynch’s Strategies

Peter Lynch was a successful fund manager at Fidelity. He managed the Magellan Fund from 1977 to 1990. During his tenure, the fund achieved an average annual return of 29.2%. Lynch’s strategies are simple yet effective.

- Invest in what you know: Lynch advises investors to buy stocks of companies they understand.

- Do your homework: Always research a company’s fundamentals before investing.

- Avoid hot tips: Relying on tips can lead to poor investment choices.

These principles help investors identify great opportunities in the market. By following Lynch’s advice, you can build a strong investment portfolio.

Success Stories

Peter Lynch’s investment strategies have led to numerous success stories. Here are a few examples:

| Company | Return |

|---|---|

| Dunkin’ Donuts | 10x |

| Ford | 5x |

| Philip Morris | 15x |

These companies provided substantial returns for investors who followed Lynch’s advice. His approach emphasizes long-term growth and understanding market trends.

Reading One Up On Wall Street can transform your investment strategy. Peter Lynch’s insights are timeless and practical for any market condition.

The Little Book That Still Beats The Market

The Little Book That Still Beats the Market by Joel Greenblatt is a must-read for investors. It simplifies complex investment strategies into easy-to-understand concepts. Greenblatt introduces a powerful formula to outperform the market.

Magic Formula Investing

Greenblatt’s Magic Formula Investing is simple yet effective. It focuses on two key metrics: earnings yield and return on capital. These metrics help identify undervalued stocks with strong potential.

Earnings yield measures how much a company earns relative to its stock price. Return on capital evaluates how well a company generates profit from its capital. Combining these metrics helps investors find high-quality stocks at bargain prices.

Practical Applications

The book provides practical applications for implementing the Magic Formula. It suggests creating a diversified portfolio of 20-30 stocks. Investors should hold these stocks for one year before re-evaluating.

Greenblatt recommends rebalancing the portfolio annually. This ensures that only the best-performing stocks remain. The strategy is straightforward and requires minimal effort.

| Step | Action |

|---|---|

| 1 | Calculate earnings yield and return on capital for each stock. |

| 2 | Rank stocks based on these metrics. |

| 3 | Select top 20-30 stocks for your portfolio. |

| 4 | Hold stocks for one year. |

| 5 | Rebalance portfolio annually. |

- Calculate metrics

- Rank stocks

- Select top stocks

- Hold for a year

- Rebalance annually

This method reduces emotional decision-making. It also provides a disciplined approach to investing.

Investors using this strategy can expect to outperform the market consistently. The simplicity of the approach makes it accessible to both beginners and experienced investors.

Security Analysis

Security Analysis is a classic book on investing. Written by Benjamin Graham and David Dodd, this book has guided investors for decades. It teaches how to evaluate stocks and bonds.

Foundational Analysis Techniques

Security Analysis introduces fundamental analysis. This method helps investors understand a company’s value. It focuses on financial statements. Investors look at balance sheets, income statements, and cash flow statements.

- Balance Sheets: Show a company’s assets, liabilities, and equity.

- Income Statements: Detail revenue, expenses, and profit.

- Cash Flow Statements: Track cash in and out of the company.

These tools help investors decide if a stock is undervalued or overvalued. The book also explains the importance of the margin of safety. This concept means buying stocks at a price lower than their true value.

Enduring Lessons

The lessons from Security Analysis remain relevant today. The book teaches patience and discipline. Investors learn to avoid hype and focus on real value.

Graham and Dodd emphasize the importance of long-term thinking. They advise against short-term speculation. Instead, they encourage holding investments for years.

Another key lesson is the importance of diversification. This means spreading investments across different assets. This reduces risk and increases potential returns.

Security Analysis remains a cornerstone in investing literature. Its teachings continue to guide both new and seasoned investors.

The Essays Of Warren Buffett

Warren Buffett, often called the “Oracle of Omaha,” shares his wisdom through his essays. These essays provide deep insights into Buffett’s investment philosophy. They cover a range of topics crucial for any investor. Let’s dive into some key takeaways from his essays.

Investment Wisdom

Buffett’s essays are a treasure trove of investment wisdom. He emphasizes the importance of understanding the business you invest in. According to Buffett, an investor should focus on companies with a durable competitive advantage. This ensures long-term profitability and growth.

Buffett advises investors to look at the intrinsic value of a company. He believes in buying quality stocks at a fair price. This approach minimizes risk and maximizes potential returns.

Here are some key principles from Buffett’s essays:

- Buy and Hold: Invest in businesses you understand and hold them long-term.

- Focus on Quality: Choose companies with a strong competitive edge.

- Intrinsic Value: Assess the real worth of a company before investing.

Long-term Strategies

Buffett’s long-term strategies are about patience and discipline. He stresses the importance of not following the crowd. Instead, he advises making independent decisions based on thorough analysis.

Buffett believes in the power of compound interest. He suggests reinvesting earnings to build wealth over time. This strategy can lead to significant financial gains in the long run.

Consider these long-term strategies from Buffett’s essays:

- Reinvest Earnings: Use profits to buy more shares and grow your investment.

- Avoid Short-Term Noise: Ignore market fluctuations and stay focused on your goals.

- Be Patient: Allow your investments to grow over many years.

Buffett’s essays provide a roadmap for successful investing. They offer timeless advice that can benefit any investor.

Credit: www.compoundingquality.net

Market Wizards

If you’re an investor, you’ve likely heard of Market Wizards. This book, written by Jack D. Schwager, is a treasure trove of insights. It features interviews with some of the most successful traders. These traders share their strategies and secrets. Market Wizards is a must-read for anyone serious about investing.

Interviews With Top Traders

In Market Wizards, Schwager conducts detailed interviews. These interviews are with top traders in the industry. Each trader has a unique approach to the market. They share their experiences, strategies, and challenges.

The book includes interviews with legends like:

- Paul Tudor Jones

- Bruce Kovner

- Richard Dennis

- Ed Seykota

These traders offer a wealth of knowledge. They discuss their trading philosophies and techniques. Their stories are both inspiring and educational.

Lessons From The Best

Market Wizards is not just about success stories. It also shares valuable lessons. Each trader’s journey is filled with ups and downs. They talk about their mistakes and what they learned.

Some key lessons include:

- Discipline is crucial for trading success.

- Risk management can make or break a trader.

- Patience often leads to better opportunities.

These lessons are applicable to all investors. Whether you’re a beginner or experienced, there’s something to learn. The insights in Market Wizards can help improve your trading skills.

Principles: Life And Work

Principles: Life and Work by Ray Dalio offers invaluable insights into decision-making and investment strategies. This essential read features practical advice for investors seeking long-term success.

Ray Dalio’s book Principles: Life and Work offers timeless wisdom. The book shares valuable insights from Dalio’s life and career. It is an essential read for anyone looking to improve their investing skills. The principles in the book can guide investors in making better decisions.

Ray Dalio’s Principles

Ray Dalio, the founder of Bridgewater Associates, shares his life lessons. He emphasizes the importance of radical transparency and truth. Dalio believes in learning from mistakes to make better decisions. His principles focus on embracing reality and dealing with it effectively.

Application To Investing

Applying Dalio’s principles to investing can be transformative. Here are a few key principles:

- Embrace Reality: Accept the market’s ups and downs.

- Be Radically Open-Minded: Seek out differing opinions.

- Use Systems: Implement a structured investment strategy.

- Learn from Mistakes: Analyze failures to avoid future pitfalls.

These principles help investors stay grounded and make informed decisions. By following Dalio’s advice, you can improve your investment outcomes.

Credit: sbnri.com

Frequently Asked Questions

What Is The Most Famous Book About Investing?

The most famous book about investing is “The Intelligent Investor” by Benjamin Graham. It offers timeless advice and strategies.

What Is The Best Book To Learn To Invest In Stocks?

“The Intelligent Investor” by Benjamin Graham is widely regarded as the best book for learning to invest in stocks.

What Is The First Book I Should Read On Investing?

Start with “The Intelligent Investor” by Benjamin Graham. It offers timeless advice and fundamental investment principles.

Should I Read The Intelligent Investor As A Beginner?

Yes, beginners should read “The Intelligent Investor. ” It offers timeless investment advice, easy to understand principles, and foundational knowledge.

Conclusion

These top 10 books offer invaluable insights for investors at any stage. Reading them can enhance your financial acumen. Embrace the knowledge within these pages to make informed decisions. Equip yourself with strategies and concepts that stand the test of time.

Start your journey towards smarter investing today with these essential reads.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.