Mutual funds offer professional management but usually come with higher fees. ETFs provide lower costs and trade flexibility but lack active management.

Mutual funds and ETFs are popular investment vehicles. Both have unique advantages and drawbacks. Mutual funds are managed by professionals, potentially offering better growth. Yet, they often come with higher fees and less trading flexibility. ETFs, or Exchange-Traded Funds, usually have lower costs and can be traded like stocks.

This provides more control over buying and selling. However, ETFs may not offer the same level of active management as mutual funds. Understanding these differences helps investors make informed decisions. Each option suits different financial goals and investment strategies.

Investment Strategies

Investing can be tricky. Mutual funds and ETFs are popular choices. They offer different strategies. Understanding these can help you choose better.

Active Vs. Passive Management

Mutual funds often have active management. A professional picks stocks or bonds. The goal is to beat the market. This can lead to higher costs.

ETFs usually follow passive management. They track a market index. This keeps costs lower. You get steady market returns.

| Type | Management Style | Cost |

|---|---|---|

| Mutual Funds | Active | Higher |

| ETFs | Passive | Lower |

Diversification Benefits

Diversification spreads risk across many investments. Mutual funds and ETFs both offer this. They hold many stocks or bonds.

Mutual funds can focus on specific sectors. This can increase risk but also rewards.

ETFs usually cover broader indices. This gives them wide market exposure. They are less risky.

- Mutual funds: sector-focused or broad

- ETFs: typically broad indices

Choose based on your risk tolerance. Both can help diversify your portfolio.

Credit: www.profinancialsolutions.com

Cost Comparison

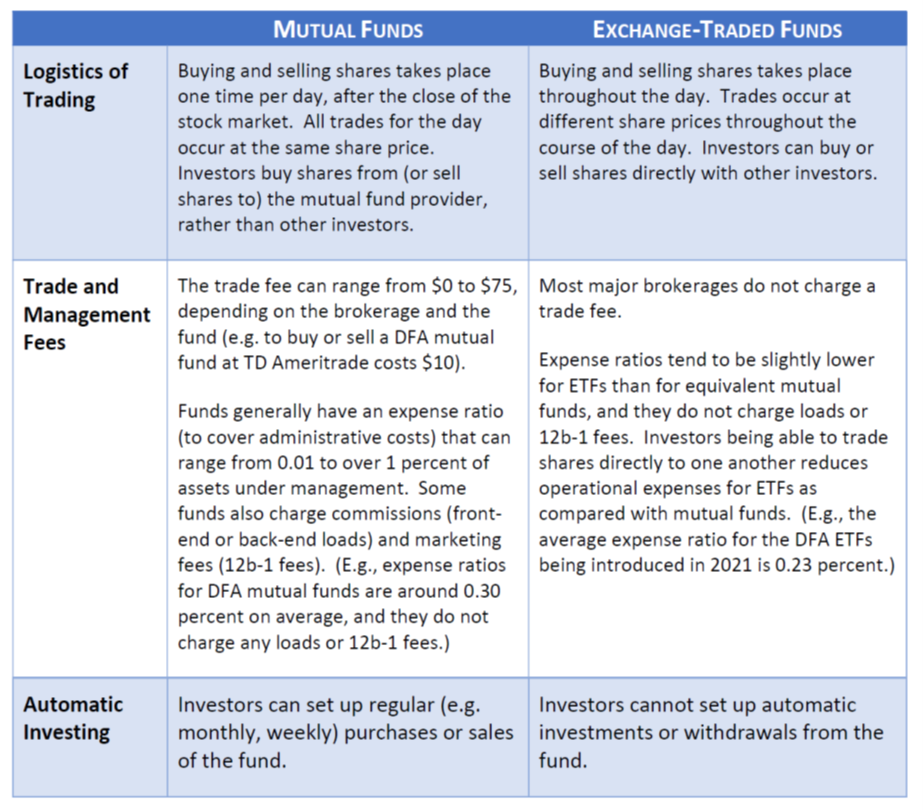

Both mutual funds and ETFs have costs associated with them. Comparing these costs can help you decide which one is better for you. Let’s break down the cost comparison into two main parts: Expense Ratios and Transaction Fees.

Expense Ratios

The expense ratio is the annual fee that all funds charge their shareholders. It covers the fund’s operating expenses. Mutual funds generally have higher expense ratios. This is due to active management and other overhead costs. On the other hand, ETFs often have lower expense ratios. They are usually passively managed.

| Type | Average Expense Ratio |

|---|---|

| Mutual Funds | 0.50% – 1.50% |

| ETFs | 0.10% – 0.50% |

Choosing a fund with a low expense ratio can save you money over time. This is important for long-term investments.

Transaction Fees

Transaction fees are the costs incurred when buying or selling a fund. Mutual funds may charge a front-end load or back-end load. These are fees paid when you buy or sell the fund. Some mutual funds also have no-load options, but they might have higher expense ratios.

- Front-End Load: Fee paid when buying the fund.

- Back-End Load: Fee paid when selling the fund.

ETFs, in contrast, are traded on stock exchanges. You pay a commission to your broker when you buy or sell ETFs. Some brokers offer commission-free ETFs. This can make ETFs more cost-effective for frequent traders.

Here’s a quick comparison:

| Type | Transaction Fees |

|---|---|

| Mutual Funds | Front-End/Back-End Loads, No-Load Options |

| ETFs | Broker Commissions, Some Commission-Free Options |

Understanding these costs can help you make an informed decision. Always check the fees before investing in any fund.

Tax Implications

Understanding the tax implications of mutual funds and ETFs is crucial. Taxes can affect your investment returns significantly. Let’s dive into the details of capital gains taxes and tax efficiency.

Capital Gains Taxes

Mutual funds and ETFs have different rules for capital gains taxes. Mutual funds often distribute capital gains to investors each year. This means you may owe taxes on these gains, even if you didn’t sell any shares.

ETFs, on the other hand, are generally more tax-efficient. Most ETFs use a process called in-kind redemptions. This helps to minimize capital gains distributions.

| Investment Type | Capital Gains Distribution |

|---|---|

| Mutual Funds | Often yearly |

| ETFs | Less frequent |

Tax Efficiency

Tax efficiency measures how well an investment minimizes taxes. ETFs are usually more tax-efficient than mutual funds. This is because of their unique structure and trading process.

Mutual funds buy and sell securities frequently. This can lead to higher capital gains distributions. ETFs trade like stocks, and their transactions are more tax-friendly.

Consider these factors:

- ETFs often have lower turnover rates.

- Mutual funds may trigger more taxable events.

Investors seeking to minimize taxes might prefer ETFs. Their structure offers a significant advantage in tax efficiency.

Liquidity And Trading

Understanding the liquidity and trading aspects of mutual funds and ETFs is crucial for any investor. This section will delve into how these investment vehicles perform in terms of market hours and intraday trading.

Market Hours

Mutual funds and ETFs differ significantly in market hours. Mutual funds trade only once per day after the market closes. The price you get is the Net Asset Value (NAV) calculated at the end of the trading day.

ETFs, on the other hand, trade on an exchange like stocks. This means you can buy or sell ETFs throughout the trading day. Their prices fluctuate based on supply and demand, providing more flexibility.

Intraday Trading

Intraday trading is another key difference between mutual funds and ETFs. ETFs allow for intraday trading. This means you can enter or exit positions within the same day.

Mutual funds do not offer this option. You can only trade mutual funds at the end of the day when the NAV is calculated. This lack of flexibility can be a drawback for active traders.

| Aspect | Mutual Funds | ETFs |

|---|---|---|

| Market Hours | End of Day | Throughout Trading Day |

| Intraday Trading | Not Available | Available |

In summary, mutual funds and ETFs each offer unique benefits and drawbacks in terms of liquidity and trading. ETFs provide more flexibility due to intraday trading and all-day market access. Mutual funds, while less flexible, might suit those who prefer less frequent trading.

Performance And Returns

Understanding the performance and returns of mutual funds and ETFs is crucial. These factors help investors decide which option suits their needs. Let’s dive into the historical performance and risk aspects of both.

Historical Performance

Historical performance showcases how investments have performed in the past. Both mutual funds and ETFs offer varied results based on their management styles.

Mutual funds are often actively managed. This means fund managers make frequent changes to the portfolio. The goal is to outperform the market. This can lead to higher returns but also higher costs.

ETFs are typically passively managed. They track a specific index. This results in returns that closely mirror the index. ETFs usually have lower fees due to less frequent trading.

| Investment Type | Management Style | Typical Returns | Cost |

|---|---|---|---|

| Mutual Funds | Active | Varies, potential for higher returns | Higher |

| ETFs | Passive | Tracks index, consistent returns | Lower |

Risk And Volatility

Risk and volatility measure how much the value of an investment can change. Both mutual funds and ETFs come with their own risks.

Mutual funds may have higher volatility due to active management. Fund managers may take risks to achieve higher returns.

ETFs usually have lower volatility. They follow an index which provides stability. This makes ETFs more predictable for investors.

- Mutual Funds: Higher risk, potential for higher returns

- ETFs: Lower risk, consistent returns

Credit: www.facebook.com

Accessibility And Minimum Investments

Understanding Accessibility and Minimum Investments is crucial when choosing between mutual funds and ETFs. Both options offer unique benefits and drawbacks. Making an informed decision requires knowing their initial investment requirements and ease of access.

Initial Investment Requirements

Mutual funds often have higher initial investment requirements. Many mutual funds require a minimum investment of $1,000 or more. This can be a barrier for new investors.

ETFs, on the other hand, typically do not have minimum investment amounts. You can buy just one share of an ETF. This makes ETFs more accessible for those with limited funds.

Ease Of Access

Mutual funds are generally purchased through investment companies or brokers. This process can sometimes be slow and involve paperwork. They are often bought at the end of the trading day.

ETFs are traded on stock exchanges like individual stocks. This means you can buy and sell ETFs throughout the trading day. The ease of access to ETFs is a significant advantage for active traders.

| Aspect | Mutual Funds | ETFs |

|---|---|---|

| Initial Investment | $1,000 or more | One share |

| Purchase Process | Through brokers or investment companies | On stock exchanges |

| Trading Times | End of trading day | Throughout the trading day |

Both mutual funds and ETFs have their own accessibility features. Your choice will depend on your financial situation and trading preferences.

Suitability For Different Investors

Understanding the suitability of Mutual Funds and ETFs is crucial. Different investors have different needs. Let’s explore which investment works best for you.

Long-term Investors

Mutual Funds are often ideal for long-term investors. They offer professional management and diversification. Over time, these can lead to substantial growth.

- Mutual Funds usually have higher fees.

- They often require a minimum investment.

- Best for those who prefer a hands-off approach.

ETFs, on the other hand, can also be good for long-term goals. They usually have lower fees than mutual funds. They are also traded like stocks.

- ETFs offer flexibility.

- They can be easily bought and sold.

- Good for those who want more control over their investments.

Short-term Traders

ETFs are generally better for short-term traders. They trade on exchanges like stocks. This allows for quick buy and sell actions.

- ETFs have lower transaction costs.

- They offer real-time pricing.

- They are suitable for day trading.

Mutual Funds are not ideal for short-term trades. They are designed for long-term investment. They do not offer real-time pricing. Transactions are processed at the end of the trading day.

- Mutual Funds have higher fees.

- Not suitable for frequent trading.

Credit: scrab.com

Frequently Asked Questions

Is It Better To Buy Etfs Or Mutual Funds?

ETFs offer lower fees and intraday trading, ideal for active traders. Mutual funds provide professional management and better for long-term investors. Choose based on your investment strategy and goals.

Should I Switch My Mutual Funds To Etfs?

Switching from mutual funds to ETFs depends on your investment goals. ETFs offer lower fees and more trading flexibility. Evaluate your needs.

Why Are Etfs So Much Cheaper Than Mutual Funds?

ETFs are cheaper because they have lower management fees and trade like stocks, reducing operational costs. They also have lower expense ratios compared to mutual funds.

Why Are The Pros And Cons Of A Mutual Fund?

Pros include diversification, professional management, and liquidity. Cons include management fees, potential for lower-than-expected returns, and lack of control over individual investments.

Conclusion

Choosing between mutual funds and ETFs depends on your investment goals. Mutual funds offer professional management, while ETFs provide flexibility. Both have unique benefits and drawbacks. Assess your needs, risk tolerance, and investment strategy to make an informed decision. Investing wisely can help you achieve financial success and grow your portfolio effectively.

Elaine C. Durham is a distinguished figure in the domain of new business investments, recognized for her expertise and strategic acumen in navigating the dynamic landscape of emerging ventures. With a robust educational background and a wealth of experience, Elaine has become a trusted authority in the field, contributing valuable insights to the realm of investment strategies for nascent businesses. Her professional journey is marked by a keen ability to identify promising opportunities, coupled with a shrewd understanding of market dynamics and risk management. Known for her innovative approach and successful endeavors, Elaine C. Durham stands as a beacon for entrepreneurs and investors alike, offering a wealth of knowledge on fostering growth and sustainability in the ever-evolving world of new business investments.