S&P 500 Dividend Aristocrats consist of companies with a long history of consistent dividend payments. These companies are known for their reliable dividend yields and are tracked by the SPDR Dividend Aristocrats ETFs to provide investors with quality yield opportunities.

The S&P 500 Dividend Aristocrats index is composed of reputable companies that have a strong track record of rewarding their shareholders through dividends. Investing in these Dividend Aristocrats can be a strategic move for those seeking stable and dependable returns.

With a focus on companies that prioritize consistent dividend payments, the S&P 500 Dividend Aristocrats offer investors a way to potentially benefit from strong dividend growth over time. It is important to carefully consider the individual companies within this index to make informed investment decisions that align with financial goals.

Credit: www.etftrends.com

Defining Dividend Aristocrats

In the world of investments, Dividend Aristocrats stand out as a coveted group of stocks for income-seeking investors. These are companies that have displayed a remarkable track record of consistently increasing dividends for at least 25 consecutive years, making them a symbol of stability and reliability in the stock market.

Criteria For Inclusion In The S&p 500 Dividend Aristocrats List

For a company to qualify as a S&P 500 Dividend Aristocrat, it needs to meet specific criteria set by S&P Dow Jones Indices. Firstly, the company must be a member of the S&P 500, which consists of 500 of the largest publicly traded companies in the U.S. Secondly, the company should have a history of increasing dividends for at least 25 consecutive years. Furthermore, it needs to exhibit sufficient liquidity and certain market capitalization requirements. Therefore, inclusion in this elite group is a clear sign of financial strength and long-term stability.

How They Differ From Other Stocks

Unlike many other stocks, Dividend Aristocrats have a proven track record of not only paying dividends consistently but also increasing them year after year. This sets them apart as reliable income-generating assets, providing investors with a sense of confidence and security in uncertain market conditions. Their ability to weather economic downturns and sustain dividend growth makes them a preferred choice for income investors seeking long-term stability and reliable returns.

Credit: seekingalpha.com

Benefits Of Investing In Dividend Aristocrats

Investing in S&P 500 Dividend Aristocrats offers numerous benefits, including a consistent track record of dividend payments and the potential for long-term growth. These companies have shown their ability to weather economic downturns and provide reliable income to investors.

Stability And Consistency Of Dividend Payments

Dividend Aristocrats offer reliable income streams to investors.

These companies have a proven track record of consistent dividend payments.

Investing in Dividend Aristocrats can provide stability in a volatile market.

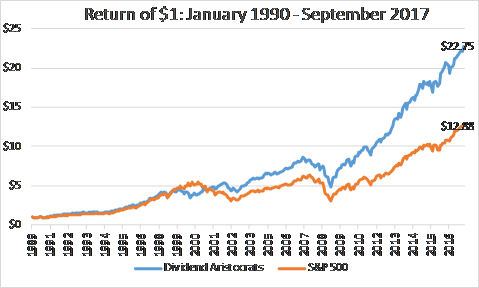

Long-term Growth Potential

Dividend Aristocrats have a strong foundation for long-term growth.

These companies often show resilience and growth even during economic downturns.

Investing in Dividend Aristocrats can lead to sustained wealth accumulation over time.

Top S&p 500 Dividend Aristocrats

The Top S&P 500 Dividend Aristocrats consist of companies with a strong history of consistently paying dividends. These companies, such as Target Corp. , Caterpillar Inc. , and Lowe’s Cos Inc. , are known for their reliable dividend payments.

Target Corp.

Target Corp., symbol TGT, operates in the consumer staples sector. It is one of the top S&P 500 Dividend Aristocrats, known for its consistent history of paying dividends. With a focus on quality yield, Target Corp. is a popular choice for investors looking for long-term dividend growth and stability.Caterpillar Inc.

Caterpillar Inc., symbol CAT, operates in the industrials sector. As a member of the S&P 500 Dividend Aristocrats, Caterpillar Inc. has a strong track record of dividend payment consistency. It is a preferred choice for investors who value both income generation and potential capital appreciation.Lowe’s Cos Inc.

Lowe’s Cos Inc., symbol LOW, operates in the consumer staples sector. As one of the top S&P 500 Dividend Aristocrats, Lowe’s Cos Inc. is renowned for its reliable dividend payments. Investors appreciate the company’s commitment to providing consistent income and its potential for long-term growth.Pentair Plc

Pentair PLC, symbol PNR, is a member of the S&P 500 Dividend Aristocrats and operates in various sectors. With a focus on quality yield, Pentair PLC is recognized for its dependable dividend payments. Investors find the company appealing for its stability and income generation potential.Emerson Electric Co.

Emerson Electric Co., symbol EMR, operates in multiple sectors and is a prominent member of the S&P 500 Dividend Aristocrats. Known for its consistent dividend payments, Emerson Electric Co. appeals to investors who value reliable income and long-term growth prospects.Dover Corp.

Dover Corp., symbol DOV, operates in the industrials sector and is among the top S&P 500 Dividend Aristocrats. Investors appreciate Dover Corp.’s commitment to consistent dividend payments, making it a favored choice for income-focused portfolios.Archer-daniels-midland Co.

Archer-Daniels-Midland Co., symbol ADM, operates in the consumer staples sector and is recognized as one of the S&P 500 Dividend Aristocrats. With its long history of paying dividends, Archer-Daniels-Midland Co. offers investors stability and potential for future growth.Ecolab Inc.

Ecolab Inc., symbol ECL, is a member of the S&P 500 Dividend Aristocrats and operates in various sectors. Known for its consistent dividend payouts, Ecolab Inc. appeals to investors seeking both income and potential capital appreciation.Etfs Tracking Dividend Aristocrats

ETFs tracking Dividend Aristocrats are highly sought after by investors seeking exposure to a portfolio of companies with a strong track record of consistently growing dividends. These ETFs offer a convenient way for investors to gain exposure to these companies while benefiting from the diversification and potential for dividend income.

Spdr Dividend Aristocrats Etfs

The SPDR S&P Dividend ETF (SDY) and the SPDR S&P 500 Aristocrats ETF (NOBL) are two prominent ETFs tracking Dividend Aristocrats. Both ETFs aim to provide investors with exposure to companies that have a history of consistently increasing dividends over time.

Performance And Yield Comparison

When comparing the performance and yield of these ETFs, it’s important to consider factors such as the historical dividend growth rates, sector allocation, and expense ratios. These metrics can give investors valuable insights into how these ETFs have performed in the past and the potential income they can generate.

For investors seeking a balance between dividend yield and stability, analyzing the historical performance and yield of SPDR Dividend Aristocrats ETFs can be a crucial step in making informed investment decisions.

S&p 500 Dividend Aristocrats Index

The S&P 500 Dividend Aristocrats Index tracks top-performing S&P 500 companies with a solid dividend history, making it a reliable investment choice for consistent returns. Investors seek this index for long-term growth and stability in their portfolios.

Overview Of The S&p 500 Dividend Aristocrats Index

The S&P 500 Dividend Aristocrats Index comprises companies within the S&P 500 that have a track record of consistently increasing dividends over time. These elite companies are recognized for their stability and reliability in providing steady dividend payouts to investors.

High Yield Dividend Aristocrats

High Yield Dividend Aristocrats are companies in the S&P 500 Dividend Aristocrats Index that offer above-average dividend yields. These companies are sought after by investors looking to generate higher income through dividend payments while still benefiting from the reliability and consistency associated with the Aristocrats.

Credit: www.facebook.com

Notable Financial Publications’ Coverage

Covering the latest S&P 500 Dividend Aristocrats updates, notable financial publications delve into the stock market movement and strategies of companies with a consistent dividend-paying history. Investors rely on these insights to make informed decisions and identify potential opportunities within the market.

Investopedia

Investopedia, a leading financial education website, provides extensive coverage of S&P 500 Dividend Aristocrats, offering in-depth analysis and insights for investors seeking information on these elite dividend-paying stocks.

Nerdwallet

NerdWallet, a trusted personal finance company, offers valuable resources for investors interested in S&P 500 Dividend Aristocrats, highlighting the best dividend stocks for dependable dividend growth and providing expert advice on how to navigate the market.

Kiplinger

Kiplinger, known for its expert insights on personal finance and investing, showcases the S&P 500 Dividend Aristocrats as a top choice for investors seeking dependable dividend stocks, providing actionable recommendations and analysis.

Proshares

ProShares, a prominent provider of exchange-traded funds (ETFs), offers strategic insights into the S&P 500 Dividend Aristocrats through their ETF products, catering to investors looking for exposure to high-quality dividend-paying companies.

Yahoo Finance

Yahoo Finance, a leading financial news and data platform, extensively covers S&P 500 Dividend Aristocrats, offering comprehensive information on these blue-chip stocks and their performance, serving as a go-to resource for investors.

Investor’s Business Daily

Investor’s Business Daily, a widely respected financial publication, features insightful coverage of S&P 500 Dividend Aristocrats, providing valuable analysis and market trends to help investors make informed decisions.

Marketwatch

MarketWatch, a trusted source for financial news and market insights, offers detailed coverage of S&P 500 Dividend Aristocrats, providing readers with up-to-date information and analysis on these prestigious dividend-paying stocks.

Cnbc

CNBC, a leading financial news network, delves into the world of S&P 500 Dividend Aristocrats, offering expert commentary and analysis on these elite dividend stocks, allowing investors to stay informed about market developments.

Wsj

The Wall Street Journal, a renowned financial publication, provides in-depth coverage of S&P 500 Dividend Aristocrats, offering valuable insights and expert opinions on these companies, giving investors a comprehensive view of the market.

Frequently Asked Questions

How Do I Buy S&p 500 Dividend Aristocrats?

To buy S&P 500 Dividend Aristocrats, invest in the SPDR Dividend Aristocrats ETF or individual stock through a brokerage.

What Stocks Make Up The S&p 500 Dividend Aristocrats?

The S&P 500 Dividend Aristocrats include Target Corp, Caterpillar Inc, Lowe’s Cos Inc, Pentair PLC, Emerson Electric Co, Dover Corp, Archer-Daniels-Midland Co, and Ecolab Inc.

Is There An Etf That Tracks The Dividend Aristocrats?

Yes, the SPDR Dividend Aristocrats ETFs track companies with a long history of paying dividends.

Which Dividend Aristocrats Have The Highest Yield?

The Dividend Aristocrats with the highest yield are Target Corp. (TGT), Caterpillar Inc. (CAT), Lowe’s Cos Inc. (LOW), Pentair PLC (PNR), Emerson Electric Co. (EMR), Dover Corp. (DOV), Archer-Daniels-Midland Co. (ADM), and Ecolab Inc. (ECL). These companies have a long history of consistent dividend payments.

Conclusion

Investing in S&P 500 Dividend Aristocrats can provide stable dividend growth. These companies have a proven track record of consistent payouts, making them attractive options for investors seeking long-term returns. Consider adding these reputable stocks to your portfolio for reliable income.

Oscar Giles is a multifaceted expert with a distinctive proficiency in product launches, mutual funds, and startup investments. With a comprehensive background in finance and strategic marketing, Oscar Giles has become a trusted advisor in the dynamic intersection of introducing new products and navigating diverse investment landscapes. Her career is marked by successful product launches, where she seamlessly integrates financial acumen with market trends to drive successful market entries. Simultaneously, Oscar Giles’s expertise extends into the world of mutual funds and startup investments, where she excels in identifying and nurturing high-potential ventures. Her unique skill set allows her to bridge the gap between innovative product offerings and strategic investment decisions. As a thought leader in these interconnected domains, Oscar Giles continues to shape the conversation around effective product launches and smart investment strategies, offering valuable insights to entrepreneurs, investors, and businesses alike.