ESG investing, or investing with social responsibility, focuses on environmental, social, and governance factors. As a strategy, it aligns investment decisions with personal values while aiming to support companies committed to improving their performance in these areas.

ESG investing has gained prominence as it emphasizes ethical and sustainable practices and can potentially deliver positive financial returns. With growing concern for environmental and social issues, ESG investing offers a way for individuals to contribute to positive changes while pursuing financial goals.

As the significance of ESG investing continues to rise, it presents an opportunity to create a positive impact in the world while diversifying and securing investment portfolios. Organizations and individuals alike are increasingly recognizing the importance of aligning their investments with social responsibility, reflecting a broader societal shift towards sustainable and ethical practices.

Credit: www.mycnote.com

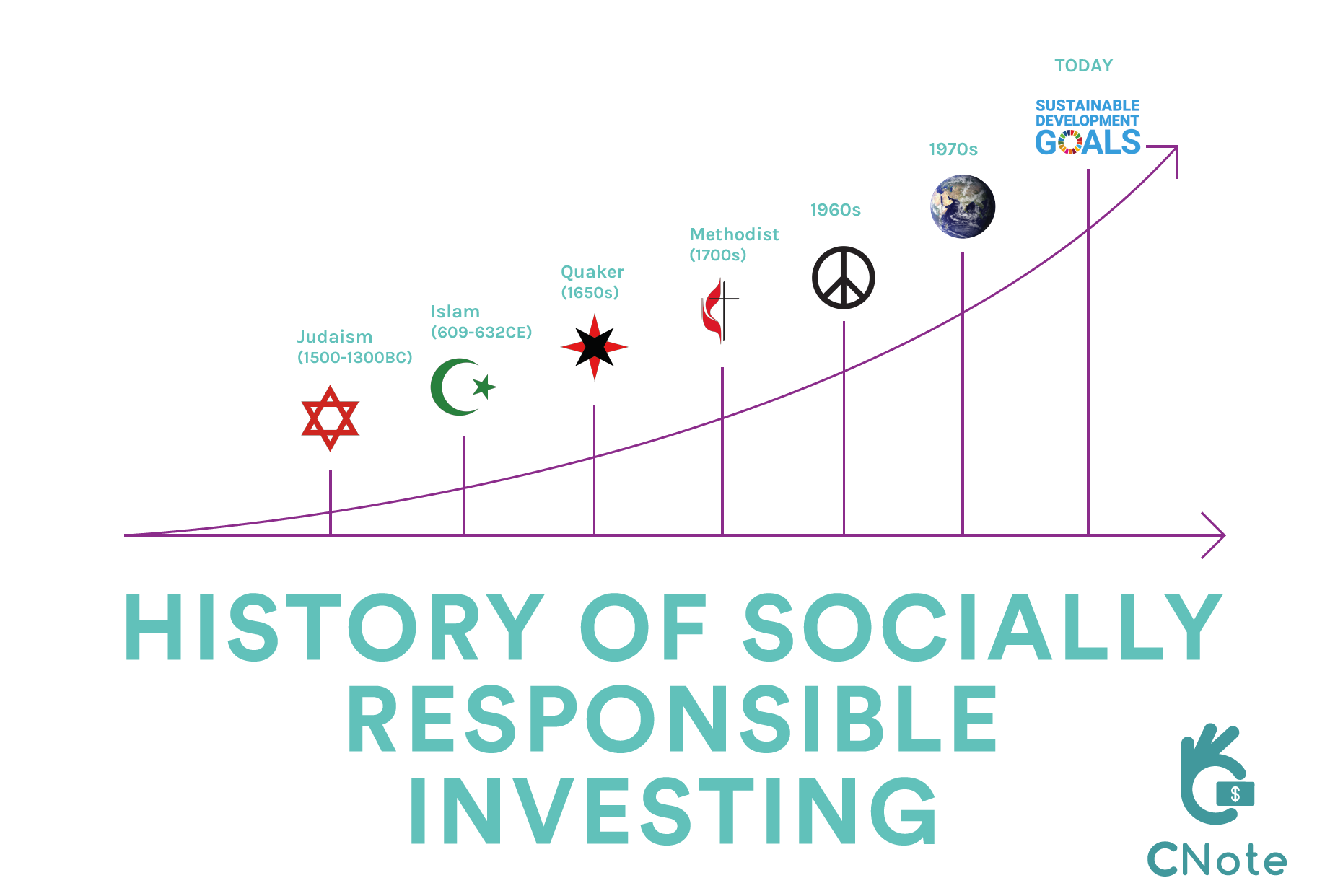

The Evolution Of Esg Investing

The concept of ESG (Environmental, Social, and Governance) investing has been gaining prominence over the years due to the increasing focus on sustainability and ethical practices.

Trends Leading to the Rise of ESG Investing

- Increasing awareness of climate change and social issues

- Demand for transparency and accountability in corporate practices

- Rise of socially responsible consumer behavior

Credit: www.bankrate.com

Understanding Esg Criteria

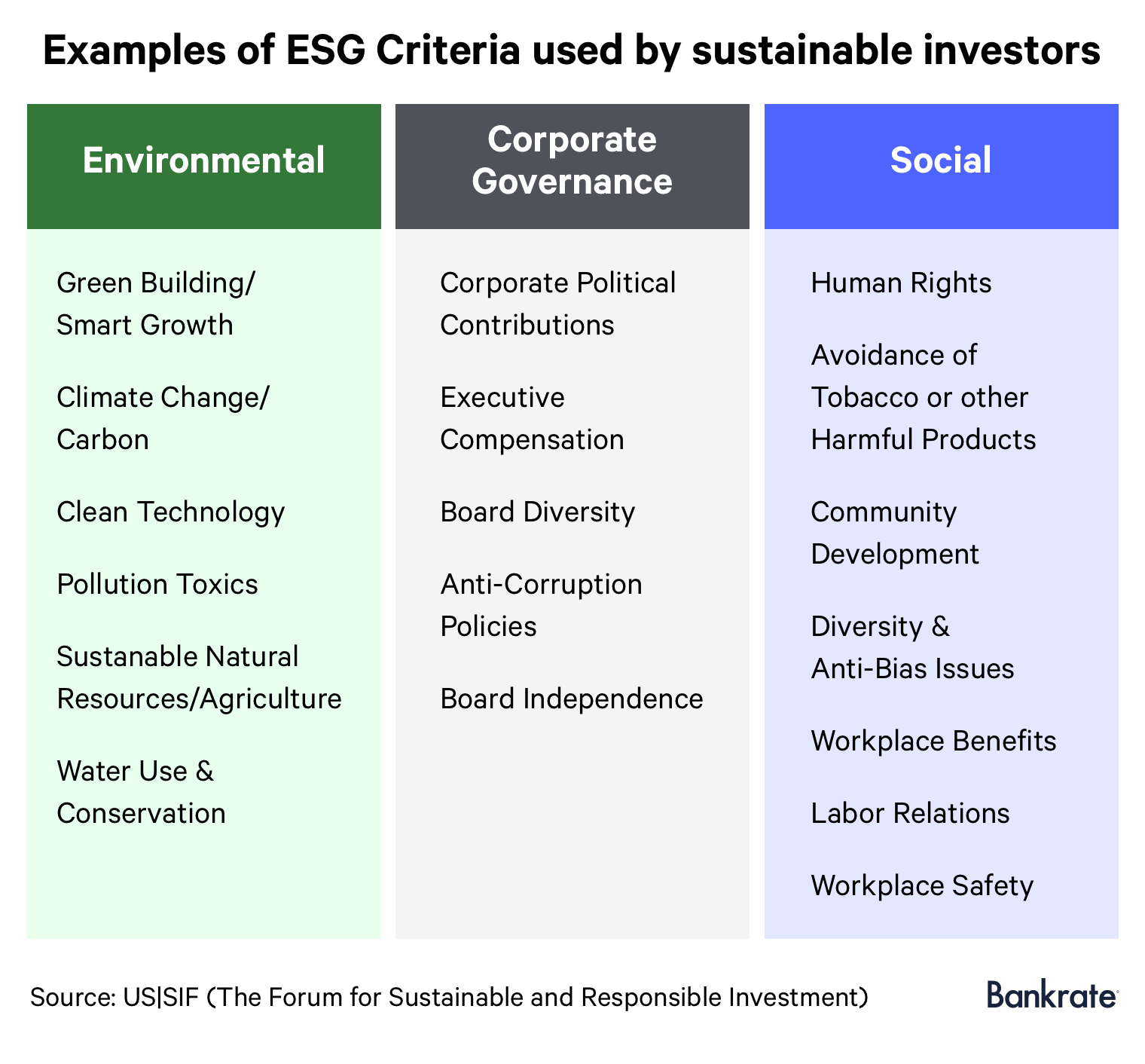

Understanding ESG (Environmental, Social, Governance) criteria is essential for investors who are looking to incorporate social responsibility into their investment decisions. ESG criteria provides a framework to evaluate a company’s performance and impact on issues beyond financial returns.

Environmental Factors

When considering ESG investing, the evaluation of environmental factors is crucial. Environmental criteria assesses a company’s impact on the planet, including its carbon emissions, energy efficiency, waste management, and resource conservation. These factors play a significant role in determining a company’s sustainability and its ability to adapt to the challenges of climate change.

Social Factors

Social factors incorporate a company’s impact on society, employees, and the community. This includes areas such as labor practices, diversity and inclusion, human rights, community relations, and customer satisfaction. Evaluating a company’s social performance can provide valuable insights into its relationships with its stakeholders and its contributions to social development.

Governance Factors

Proper governance is a fundamental aspect of ESG investing. Governance criteria examine a company’s leadership, executive compensation, shareholder rights, and overall ethical standards. Good corporate governance ensures transparency, accountability, and fairness, which are essential for maintaining trust and confidence among investors and other stakeholders.

By understanding and incorporating these ESG criteria into investment decisions, investors can align their financial goals with their values and contribute to a more sustainable and responsible global economy.

Benefits Of Esg Investing

One of the primary benefits of ESG (Environmental, Social, and Governance) investing is risk mitigation. Companies that prioritize ESG practices tend to have stronger risk management frameworks in place. By considering environmental factors such as climate change or social factors such as labor practices, investors can identify potential risks and make more informed investment decisions.

ESG investing is focused on the long-term value creation of companies. By considering ESG factors, investors can assess a company’s ability to generate sustainable profits and growth over time. This approach recognizes that sustainable businesses, which effectively manage environmental and social risks, are more likely to deliver consistent financial performance and create value for shareholders.

ESG investing allows individuals to align their investment strategies with their personal values. By investing in companies that prioritize ESG principles, individuals can support businesses that are committed to making a positive social and environmental impact. This alignment provides a sense of fulfillment and peace of mind, knowing that investments are actively contributing to a better world.

:max_bytes(150000):strip_icc()/dotdash-history-impact-investing-Final-5ce8444275794c3c99868ddbc11b1011.jpg)

Credit: www.investopedia.com

Esg Vs. Csr

When it comes to responsible investing, ESG and CSR are two significant concepts that often intertwine but hold distinct attributes. The acronym ESG stands for Environmental, Social, and Governance, while CSR represents Corporate Social Responsibility.

Distinguishing Corporate Social Responsibility From Esg

Corporate Social Responsibility (CSR) primarily emphasizes a company’s responsibility to act in a socially responsible manner, often going beyond regulatory requirements to contribute to sustainable development. It typically involves philanthropic efforts or donations to charitable causes, focusing on the company’s impact on society and the environment.

Measuring Sustainability Through Esg Criteria

On the other hand, ESG incorporates a broader set of criteria that encompasses environmental practices, social impact, and corporate governance, with a specific focus on sustainable and ethical business practices. ESG investing evaluates a company’s commitment to sustainability, diversity and inclusion, ethical behavior, and transparent governance structures, offering a more comprehensive analysis of a company’s long-term impact on both financial and non-financial stakeholders.

The Future Of Esg Investing

ESG investing, also known as socially responsible investing, is on the rise as more individuals prioritize investing in companies that align with environmental, social, and governance principles. This approach allows investors to make a positive impact while still achieving financial goals.

Global Trends In Esg Integration

ESG (Environmental, Social, and Governance) investing has witnessed a significant rise in recent years, driven by global trends in ESG integration. As more investors recognize the importance of investing with social responsibility, the future of ESG investing looks promising. In order to understand the future trajectory of ESG investing, it’s crucial to consider the global trends in ESG integration. Across the globe, there has been a growing emphasis on sustainable and responsible investment practices. Companies are now expected to demonstrate their commitment to ESG factors in order to attract investors and maintain a positive reputation. Investors are increasingly incorporating ESG considerations into their investment strategies. They are recognizing the potential risks posed by environmental and social issues, as well as the importance of good corporate governance. This shift in mindset has led to a surge in demand for investments that align with ethical and sustainable principles.Implications For Company Performance And Investor Strategies

The rise of ESG investing is not only driven by ethical considerations but also by the potential implications for company performance and investor strategies. Companies that prioritize ESG factors are more likely to demonstrate resilience in the face of challenges and generate long-term value for their investors. Investing in companies with strong ESG practices can reduce the risk of exposure to environmental and social disasters, such as climate change events or labor controversies. By considering these factors, investors can make more informed decisions and avoid investments that may harm their portfolios. Furthermore, integrating ESG factors into investment strategies can also unlock new opportunities for investors. As sustainable solutions and technologies continue to advance, companies that align themselves with ESG principles are well-positioned to benefit from these trends. This can result in higher returns and better performance compared to companies that neglect ESG considerations. In conclusion, the future of ESG investing looks promising as global trends in ESG integration continue to shape the investment landscape. The implications for company performance and investor strategies highlight the importance of incorporating ESG factors into investment decision-making. By investing with social responsibility, we can contribute to a more sustainable and inclusive future while potentially generating attractive returns.Practical Applications Of Esg Investing

Embracing Environmental, Social, and Governance (ESG) principles is not just a trend but a strategic move towards socially responsible investing. Understanding the practical applications of ESG investing can pave the way for sustainable growth and positive impact in the financial world.

Case Studies: Companies Embracing Esg Principles

Company A: Implemented renewable energy sources, reduced carbon footprint, and improved workplace diversity. Increased investor trust and long-term value.

Company B: Enhanced supply chain transparency, supported community initiatives, and focused on ethical leadership. Attracted conscious investors and strengthened brand reputation.

Implementing Esg Strategies In Investment Portfolios

- Screening: Exclude high-risk industries like tobacco or weapons.

- Integration: Incorporate ESG factors to analyze investment risks and opportunities.

- Engagement: Encourage companies to improve ESG practices through active dialogue.

- Impact Investing: Direct investments towards initiatives with measurable social and environmental benefits.

Challenges And Criticisms

As ESG investing gains traction, it faces several challenges and criticisms, prompting a closer look at data quality and standardization as well as concerns about greenwashing and ethical implications.

Data Quality And Standardization

One major concern in ESG investing is the reliability and consistency of ESG data across companies. Standardizing metrics and reporting frameworks is essential for meaningful comparison and analysis.

Greenwashing And Ethical Concerns

Greenwashing poses a significant issue, where companies may misrepresent their environmental efforts to appear more sustainable than they are. Ensuring transparency and accountability is crucial in addressing these ethical concerns.

Frequently Asked Questions

What Is Esg Socially Responsible Investing?

ESG socially responsible investing aligns investments with personal values. It focuses on environment, social, and governance factors. Investors support companies improving in these areas.

What Is Social Responsibility In Esg?

Social responsibility in ESG refers to aligning investment choices with personal values based on environment, social, and governance factors.

Why Is Esg Investing Increasing?

ESG investing is increasing due to a growing desire to align investments with personal values. Investors prioritize companies showing commitment to environmental, social, and governance improvements. This ethical approach fosters positive societal and environmental impacts while generating financial returns.

When Did Esg Investing Become Popular?

ESG investing became popular as investors started to align their investments with personal values. ESG stands for environment, social, and governance, and investors seek companies that prioritize these areas.

Conclusion

As we navigate the evolving landscape of investing, it becomes increasingly evident that ESG considerations are no longer just a trend, but a fundamental aspect of responsible investing. Embracing ESG principles gives investors the opportunity to contribute to positive societal and environmental change, while also seeking financial returns.

By integrating ESG factors into our investment decisions, we can pave the way for a more sustainable and ethical future.

Oscar Giles is a multifaceted expert with a distinctive proficiency in product launches, mutual funds, and startup investments. With a comprehensive background in finance and strategic marketing, Oscar Giles has become a trusted advisor in the dynamic intersection of introducing new products and navigating diverse investment landscapes. Her career is marked by successful product launches, where she seamlessly integrates financial acumen with market trends to drive successful market entries. Simultaneously, Oscar Giles’s expertise extends into the world of mutual funds and startup investments, where she excels in identifying and nurturing high-potential ventures. Her unique skill set allows her to bridge the gap between innovative product offerings and strategic investment decisions. As a thought leader in these interconnected domains, Oscar Giles continues to shape the conversation around effective product launches and smart investment strategies, offering valuable insights to entrepreneurs, investors, and businesses alike.