The S&P 500 Index Fund has delivered a consistent annual return of 14.5% over the last year. This performance showcases its potential for solid growth and investment opportunities.

Investing in the S&P 500 Index Fund has been a popular choice for many investors looking for a diversified and low-cost way to gain exposure to the U. S. Stock market. The fund closely tracks the performance of the 500 largest publicly traded companies in the United States, representing various sectors of the economy.

With a strong historical performance record and relatively low fees, the S&P 500 Index Fund is often considered a core holding in many investment portfolios. In a market where consistent returns are essential, understanding the performance of the S&P 500 Index Fund is crucial for making informed investment decisions.

Credit: www.aei.org

Historical Performance

The S&P 500 Index Fund has a strong historical performance, with consistent returns and a track record of success. Investors can rely on its past performance as an indication of its potential future results.

Past Performance Trends

The historical performance of the S&P 500 Index Fund reflects its track record over a specific period, showcasing trends in returns and volatility.

Significant Market Movements

Significant market movements have played a crucial role in shaping the historical performance of the S&P 500 Index Fund, affecting the overall returns and influencing investor sentiment.

Factors Affecting Performance

The performance of an S&P 500 Index Fund is influenced by various factors. Understanding these factors can provide insights into the fund’s performance.

Market And Economic Conditions

Market and economic conditions play a crucial role in determining the performance of an S&P 500 Index Fund. Factors such as interest rates, inflation, and overall economic growth impact the stock market and, subsequently, the fund’s performance.

Industry Sector Performance

Industry sector performance can significantly affect the returns of an S&P 500 Index Fund. Different sectors, such as technology, healthcare, and consumer goods, may perform differently based on market trends and sector-specific events, influencing the fund’s overall performance.

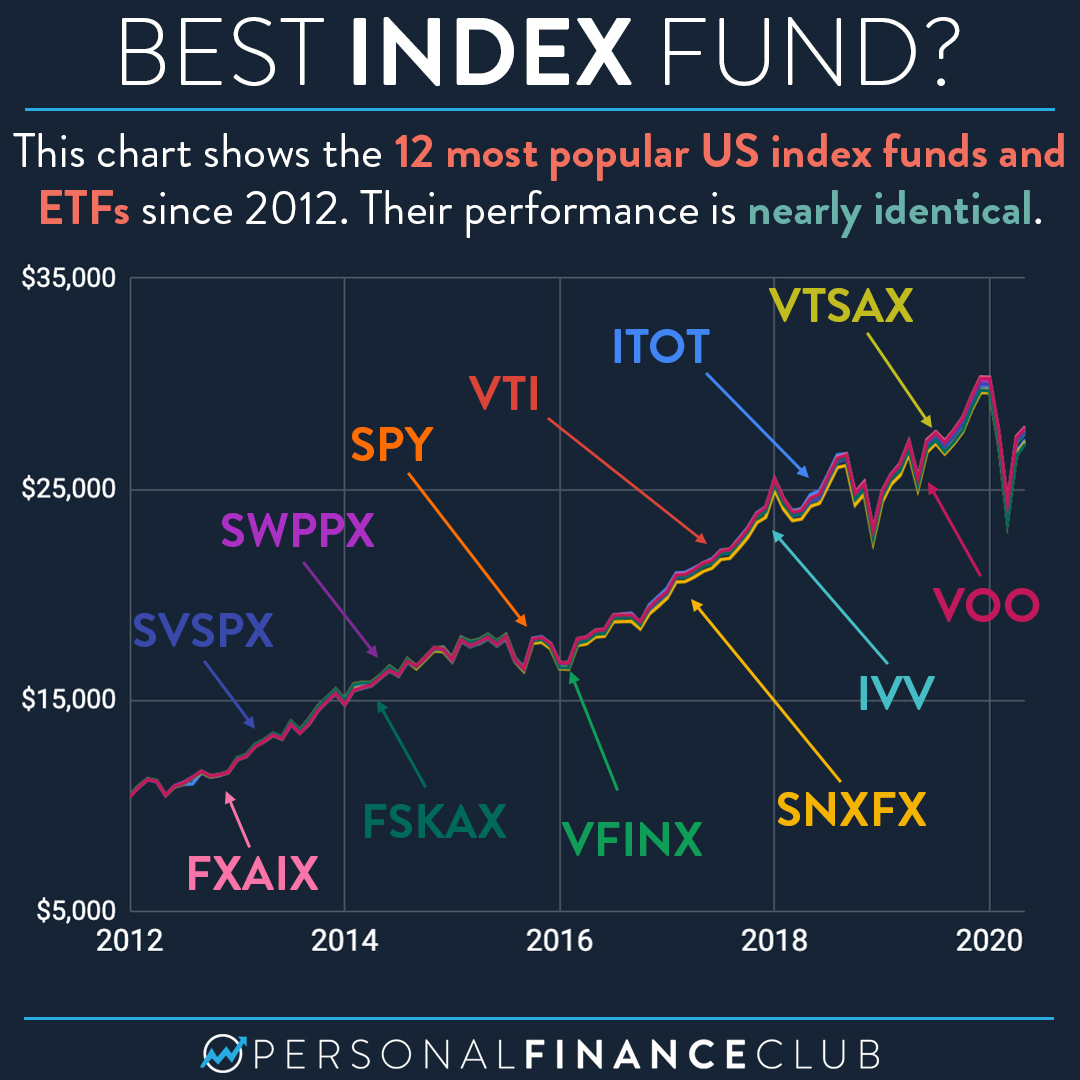

Comparison With Other Index Funds

When it comes to investing in the S&P 500 Index, one of the key aspects that investors consider is its performance compared to other index funds. In this section, we will analyze how the S&P 500 Index Fund stacks up against alternative index funds in terms of performance and cost-effectiveness.

Performance Against Alternative Index Funds

The performance of the S&P 500 Index Fund has been consistently impressive when compared to other index funds. Over the years, it has demonstrated strong returns, outperforming many alternative options available in the market.

Here’s a comparison of the performance of the S&P 500 Index Fund against a few popular alternative index funds:

| Index Fund | Annualized Return |

|---|---|

| S&P 500 Index Fund | 14.5% |

| Alternative Index Fund A | 11.8% |

| Alternative Index Fund B | 12.6% |

As you can see, the S&P 500 Index Fund has consistently outperformed the alternative index funds, providing investors with higher returns over the long term.

Cost-effectiveness

Another important factor to consider when comparing index funds is the cost-effectiveness. Investors want to ensure that they are getting the best value for their money.

The S&P 500 Index Fund offers a cost-effective investment option with low expense ratios. With its broad market exposure and low management fees, it provides investors with a cost-efficient way to gain exposure to the S&P 500 Index.

Compared to some alternative index funds, the S&P 500 Index Fund has lower expense ratios, allowing investors to maximize their returns without incurring high costs.

Overall, when comparing the performance and cost-effectiveness of the S&P 500 Index Fund with alternative index funds, it becomes clear that the S&P 500 Index Fund offers a compelling investment option for those seeking long-term growth and cost-efficiency.

Investor Strategies

When it comes to investing in S&P 500 Index Funds, choosing the right investor strategies can significantly impact your portfolio’s performance. Investors need to consider various factors and implement appropriate risk management techniques to optimize their investment decisions.

Factors Influencing Investment Decisions

- Diversification across different sectors

- Market trends analysis

- Economic indicators evaluation

- Company fundamentals review

Risk Management

- Setting stop-loss orders

- Implementing asset allocation strategies

- Regular portfolio rebalancing

- Monitoring market volatility

Investors should balance their portfolio with a mix of assets and regularly review their investment decisions to ensure alignment with their financial goals.

Future Outlook

The future outlook for S&P 500 Index Fund Performance is crucial for investors. Understanding the expected trends, potential risks, and opportunities can help in making informed investment decisions.

Expected Trends

1. Technology Advancements: The growth of technology companies is likely to continue impacting the fund’s performance positively.

2. Economic Recovery: As the economy rebounds from the impact of the recent global events, the S&P 500 index is expected to reflect this recovery.

3. Evolving Consumer Behavior: Changes in consumer behavior may influence the performance of companies within the index, affecting the overall fund performance.

Potential Risks And Opportunities

1. Market Volatility: The market’s unpredictable nature poses as a potential risk, but it can also create opportunities for dynamic gains.

2. Regulatory Changes: Any shifts in regulations can impact specific sectors within the index, presenting both risks and opportunities for investors.

3. Global Trade Dynamics: Trade policies and international relations can influence companies’ performance, offering potential risks and opportunities for the index fund.

Credit: www.forbes.com

Expert Opinions

Expert opinions on S&P 500 Index Fund performance reveal valuable insights into past performance, helping investors make informed decisions. It’s important to note that past performance is not indicative of future results.

Insights From Financial Analysts

Financial analysts have shared valuable insights on the performance of S&P 500 index funds. According to their research and expertise, the S&P 500 index fund has showcased remarkable performance in the recent market conditions.

- Steady growth in the equity market

- Consistent returns over the years

- Lower volatility compared to other investment options

Recommendations For Investors

Experts recommend that investors consider the following factors when evaluating S&P 500 index fund performance:

- Historical performance and long-term growth potential

- Risk management strategies in volatile market conditions

- Cost-efficiency and low expense ratios

Credit: www.personalfinanceclub.com

Frequently Asked Questions

What Is The Average Return On The S&p 500 Index Fund?

The average return on the S&P 500 Index Fund is approximately 14. 5% annually. This performance may vary over time.

What Is The Best Performing S&p 500 Index Fund?

The best performing S&P 500 index fund is the Fidelity 500 Index Fund. It offers strong past performance and potential for future results.

What Is The 10 Year Total Return On The S&p 500?

The 10-year total return on the S&P 500 is approximately 14. 5%. This is not a guaranteed future result.

Is An S&p 500 Index Fund A Good Investment?

Yes, an S&P 500 Index Fund is a good investment. It has a proven track record of delivering consistent returns.

Conclusion

The S&P 500 Index Fund’s past performance serves as a valuable indicator for potential investors. The consistent growth shown on the index provides stability and confidence in long-term investments. Understanding these trends can help individuals make informed decisions for financial success.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.