Real estate crowdfunding is a way to raise money online for property acquisitions from a large group of investors. It allows individuals and businesses to access capital from potential investors on internet platforms and social media sites.

Real estate crowdfunding has gained popularity as a way for individuals and businesses to invest in properties online. This form of investment allows people to pool their resources to invest in property ventures that were previously only available to high-net-worth investors and institutions.

By leveraging the power of technology and the reach of the internet, real estate crowdfunding has transformed traditional property investing. This article will explore the process of real estate crowdfunding, its benefits and limitations, and how individuals can get involved in this innovative investment opportunity. Whether you’re a seasoned real estate investor or a novice looking to diversify your portfolio, real estate crowdfunding may offer a compelling way to participate in the lucrative real estate market.

Credit: brikkapp.com

Getting Started

Creating An Llc For Real Estate

Forming an LLC for real estate provides legal protection and tax benefits.

Choosing The Right Platform

Research platforms offering diverse investment opportunities before making a choice.

Starting your real estate crowdfunding journey involves setting up an LLC and selecting a suitable platform. Creating an LLC is essential for protecting your investments and gaining tax advantages. Choosing the Right Platform requires careful consideration of the available options to ensure optimal returns.

Understanding The Process

Real estate crowdfunding is a way to raise money online for real estate acquisitions from a large group of investors. Individuals and businesses can use crowdfunding to access capital from a large group of potential investors on internet platforms and social media sites.

How Real Estate Crowdfunding Works

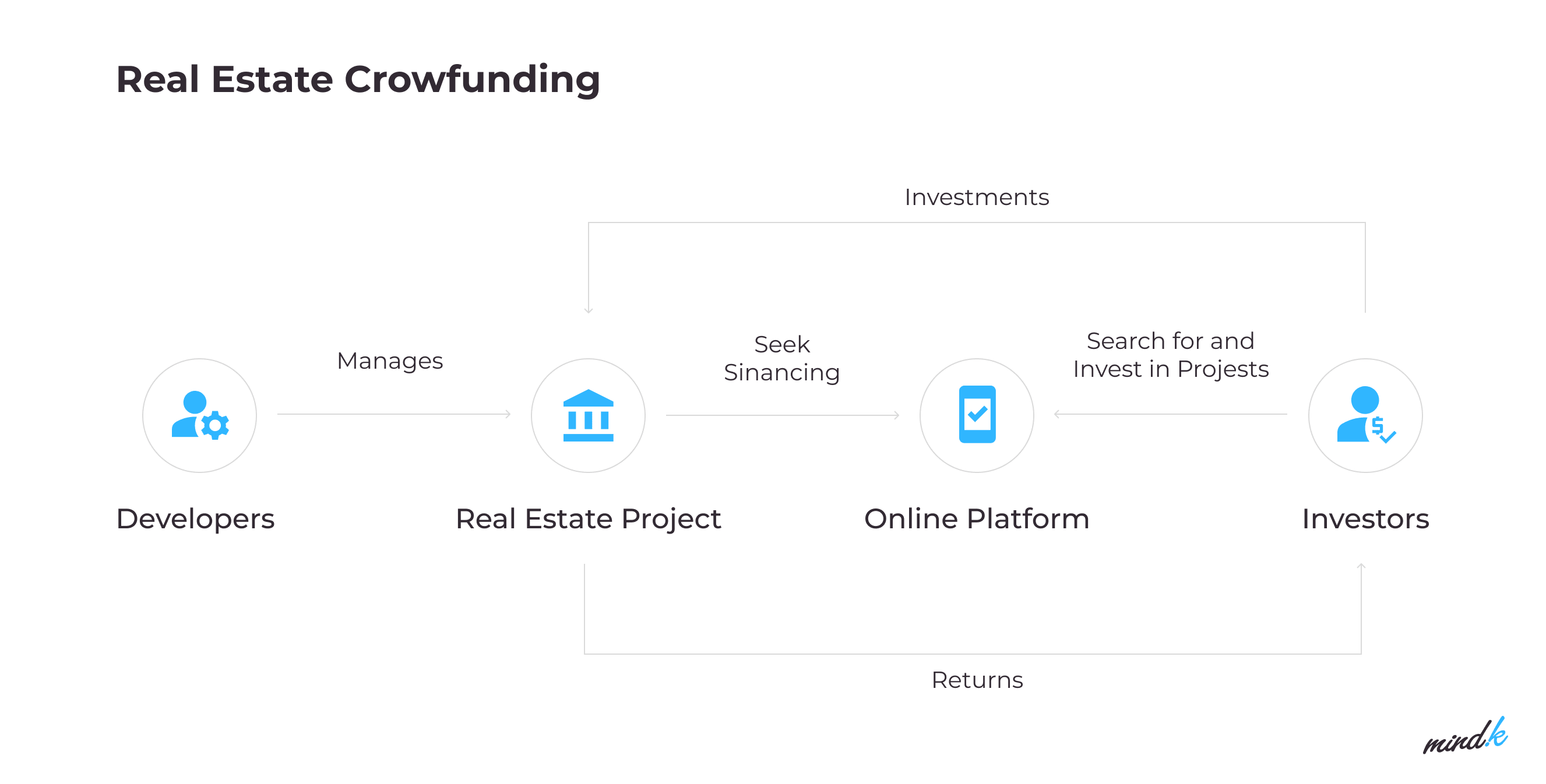

Real estate crowdfunding involves pooling funds from multiple investors to finance real estate projects. It allows investors to participate in real estate investment opportunities without having to directly buy, manage, or finance the properties. Platforms facilitate the process and provide detailed information about the investment opportunities, allowing investors to select projects based on their preferences and risk tolerance.

Types Of Projects To Invest In

There are various types of real estate projects available for investment through crowdfunding. These can include residential properties, commercial developments, hospitality ventures, and even infrastructure projects. Investors can choose to diversify their portfolios by investing in different types of real estate projects or focus on specific sectors based on their investment strategy and goals.

Maximizing Profits

When it comes to real estate crowdfunding, one of the main goals for investors is to maximize profits. By employing effective strategies and understanding the factors that influence returns, investors can increase their chances of achieving higher profits. In this section, we will explore some key strategies for success and discuss the factors that play a crucial role in maximizing profits in real estate crowdfunding.

Strategies For Success

Investors looking to maximize profits in real estate crowdfunding can benefit from the following strategies:

- 1. Diversify your investments: Spreading your investments across multiple properties or projects can help mitigate risks and increase potential returns.

- 2. Conduct thorough research: Before investing, it is essential to thoroughly research the platform, the property, and the sponsor. This includes analyzing historical performance, evaluating market conditions, and understanding the track record of the sponsor.

- 3. Choose the right investment structure: Each crowdfunding platform may have different investment structures, such as debt or equity investments. Understanding the differences and selecting the structure that aligns with your investment goals is crucial.

- 4. Stay updated: Real estate markets are dynamic. Staying updated with market trends, regulations, and emerging opportunities can provide an edge in making informed investment decisions.

Factors Influencing Returns

Several factors can influence the returns in real estate crowdfunding:

- 1. Location: The location of the property plays a significant role in determining its potential returns. Properties in prime locations with high growth prospects and strong rental demand often yield better returns.

- 2. Sponsor experience: The expertise and track record of the sponsor can impact the success of the project. Experienced sponsors with a proven track record tend to provide more predictable and higher returns.

- 3. Market conditions: The overall economic conditions and local real estate market dynamics can affect the performance of the investment. Investing during favorable market conditions can increase the chances of higher returns.

- 4. Property type: Different property types, such as residential, commercial, or industrial, have varying returns. Understanding the potential risks and rewards associated with each property type is essential for maximizing profits.

- 5. Exit strategies: Having a well-defined exit strategy in place is crucial for investors. Understanding how and when the investment can be liquidated can help maximize returns.

By implementing these strategies and considering the factors that influence returns, investors can enhance their chances of maximizing profits in real estate crowdfunding. Remember, thorough research, diversification, and staying updated are key elements to achieve success in this investment avenue.

Credit: retipster.com

Risk Management

Invest in properties online through real estate crowdfunding, a way to raise money from a large group of investors. This provides an opportunity to diversify your investments, while carefully managing the risk involved in real estate investing.

Real estate crowdfunding offers numerous advantages, including accessibility to a diverse range of properties and lower entry barriers in comparison to traditional real estate investments. However, it’s vital to acknowledge and address the associated risks effectively. Approaching real estate crowdfunding with a solid risk management strategy is crucial for safeguarding your investments and ensuring sustainable returns.Analyzing Risks

Careful assessment and analysis of potential risks associated with each property or project is paramount. Factors such as location, market trends, property condition, and macroeconomic indicators must be thoroughly evaluated to gauge the potential risks. Conducting due diligence on the crowdfunding platform itself, including its track record, regulatory compliance, and risk assessment protocols, is equally essential.Diversification Techniques

Diversification plays a pivotal role in mitigating risks in real estate crowdfunding. By spreading investments across multiple properties or projects, investors can minimize the impact of any adverse events on their overall portfolio. This strategy reduces vulnerability to the performance of individual assets and enhances the overall risk-adjusted returns. Implementing a well-diversified portfolio can help in safeguarding investments against market fluctuations and localized risks. Implementing these risk management strategies in real estate crowdfunding can fortify your investment portfolio and yield long-term financial benefits while navigating the dynamically evolving real estate market.Investor Insights

Real estate crowdfunding allows investors to pool funds online to invest in properties, offering a convenient and accessible way to diversify portfolios and build wealth. With pre-vetted projects and various investment options, individuals can generate passive income and enjoy promising returns in the real estate market.

Average Return On Real Estate Crowdfunding

Real estate crowdfunding offers investors the opportunity to earn attractive returns on their investment. However, it is important to understand that the average return on real estate crowdfunding can vary depending on various factors. These factors include the type of property, location, market conditions, and the performance of the crowdfunding platform itself. On average, investors can expect annual returns ranging from 8% to 12%, which can be significantly higher compared to traditional investments such as stocks or bonds.

One of the key advantages of real estate crowdfunding is the ability to diversify your investment portfolio. With crowdfunding, you can invest in multiple properties with smaller amounts of money, reducing the risk associated with investing in a single property. This diversification can help you maximize your returns while minimizing the overall risk of your investment.

Minimum Investment Requirements

Real estate crowdfunding platforms typically have minimum investment requirements in place. These requirements are set by the platform and can vary depending on the project and the platform itself. The minimum investment can range from as low as $1,000 to as high as $10,000 or more.

It is important to note that these minimum investment requirements are in place to ensure that the crowdfunding platform can effectively manage the investment and provide the necessary support to both the investors and the project developers. Additionally, some platforms may have certain criteria for accredited investors, who are individuals or entities that meet specific income or net worth thresholds.

Before investing, it is crucial to carefully review the minimum investment requirements and consider your own financial situation and investment goals. Ensure that you are comfortable with the minimum investment amount and the associated risks before committing your funds.

Credit: www.mindk.com

Top Platforms

When it comes to real estate crowdfunding, choosing the right platform is crucial. Here are some of the top platforms that offer opportunities for investors:

Fundrise

Fundrise is a leading real estate crowdfunding platform that allows individuals to invest in commercial real estate projects. It offers a diversified portfolio of properties across the United States.

Realtymogul

RealtyMogul is a platform that provides access to both debt and equity investments in real estate. Investors can choose from a variety of projects, including commercial properties, residential buildings, and more.

Crowdstreet

CrowdStreet is known for its focus on institutional-quality commercial real estate investments. The platform connects accredited investors with opportunities in development projects, office buildings, and other high-quality assets.

These platforms offer a user-friendly interface, detailed project information, and various investment options to cater to the needs of different investors. Consider exploring these platforms to start your real estate crowdfunding journey.

Future Trends

The future of real estate crowdfunding holds exciting prospects and innovative changes that are shaping the industry.

Emerging Opportunities

Emerging trends in real estate crowdfunding offer fresh opportunities for diverse investors to participate in property investments.

Regulatory Developments

Regulatory developments play a crucial role in shaping the landscape of real estate crowdfunding platforms and ensuring investor protection.

Frequently Asked Questions

Can I Crowdfund To Buy Property?

Yes, you can crowdfund to buy property through online platforms, pooling funds from multiple investors for real estate acquisitions.

What Is The Average Return On Real Estate Crowdfunding?

Real estate crowdfunding typically yields an average return ranging from 6% to 12% annually.

How To Invest $300,000 In Real Estate?

To invest $300,000 in real estate, consider real estate crowdfunding platforms, such as Fundrise or RealtyMogul. These platforms allow you to invest in a diversified portfolio of properties with a lower minimum investment. Another option is to buy fixer-uppers or rental properties in cost-effective areas.

In addition, build relationships with banks to finance your projects.

What Is The Minimum Investment For Crowdfunding?

The minimum investment for crowdfunding varies, but can be as low as $100.

Conclusion

Real estate crowdfunding is a lucrative investment avenue that offers accessibility and diversification. With lower barriers to entry and potential high returns, it has gained popularity among investors. The online platforms facilitate the process, connecting investors with various real estate projects.

It’s a promising opportunity for those looking to grow their wealth through real estate investments.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.