Part One Identifying Accounting Terms presents key definitions fundamental to understanding the accounting discipline. It sets the stage for deeper exploration into financial record-keeping.

Mastering the language of accounting is essential, whether you’re a student new to the field or a professional honing your skills. As the foundation of effective business communication, accounting terms allow for clear and accurate financial reporting and analysis. In this introductory guide, we’ll delve into the essentials of accounting vocabulary, ensuring that each concept is thoroughly understood.

The clarity of these terms enriches the comprehension of financial statements and facilitates informed decision-making. As businesses operate in a realm where financial clarity is paramount, a strong grasp of these terms not only aids in compliance with regulations but also enhances strategic planning and performance evaluation. By fully understanding Part One Identifying Accounting Terms, you lay the groundwork for financial literacy that is indispensable in today’s business environment.

Introduction To Accounting Terminology

Understanding essential accounting terms and concepts is crucial for interpreting financial documents and making informed business decisions. This knowledge not only aids professionals within the field but also enhances the financial literacy of individuals managing personal finances or running small businesses. A grasp of this terminology lays the foundation for analyzing financial statements, assessing fiscal health, and communicating effectively with accountants and financial advisors.

The journey into the realm of accounting begins with familiarization with basic definitions such as assets, liabilities, equity, revenue, and expenses. Each term represents a fundamental aspect of any financial transaction and subsequent record-keeping. Assets refer to the resources owned by a person or business, whereas liabilities are the obligations or debts owed to others. Equity symbolizes the owner’s interest in the business. Revenue indicates the income generated, and expenses represent the costs incurred in the process of earning revenue.

Fundamental Accounting Principles

The Accounting Equation serves as the cornerstone of a company’s financial statement, articulating that Assets are funded by Liabilities and Equity. This principle ensures that a company’s balance sheet remains in harmony, where Assets must always equal the sum of Liabilities and Equity. Understanding this equation is pivotal for accurate financial analysis and reporting.

Exploring the world of Double-Entry Bookkeeping, each financial transaction impacts two different accounts—hence the term ‘double-entry’. Transactions are entered as either a Debit or a Credit, which maintain the integrity of the accounting equation. Debits typically increase asset or expense accounts, while credits usually augment liability, equity, or revenue accounts.

Choosing between Accrual Basis and Cash Basis Accounting significantly affects how transactions are recorded. Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when the cash is exchanged. Conversely, cash basis accounting records revenues and expenses only when the cash transaction occurs. Each method has implications for financial transparency and timing of income and expense recognition.

Core Financial Statements

The Balance Sheet serves as a snapshot of a company’s financial condition at a specific point in time. It outlines three key components: Assets, which are resources owned by the company; Liabilities, which represent obligations the company must meet; and Shareholder’s Equity, the residual interest in the assets of the company after deducting liabilities.

Moving onto the Income Statement, this financial document reveals the company’s financial performance over a period. It primarily focuses on Revenue and Expenses, leading to the bottom line of Profit or loss. This statement is crucial for assessing the company’s operational efficiency and potential for growth.

Last is the Cash Flow Statement, which is segmented into three activities: Operating, encompassing daily business activities; Investing, detailing transactions involving long-term assets; and Financing, which includes activities that impact the equity and debt of the business. The statement provides insight into the company’s ability to generate cash, fund operations, and finance expansion.

Credit: www.scribd.com

Recording And Reporting Transactions

Understanding Journals and Ledgers involves recognizing their roles within the accounting process. Journals act as the initial point of entry for all transactions, where they are recorded chronologically. Postings from journals are then transferred to ledgers, which categorize these entries by account, providing a clearer view of how each transaction affects the financial statements. To maintain financial accuracy and prepare for financial reporting, businesses must meticulously manage these records.

The Importance of Trial Balances cannot be overstated as they provide a critical checkpoint in the accounting cycle. This balance is a worksheet where debits and credits are laid out side by side to ensure they are equal, a concept known as the double-entry accounting system. Discrepancies in the trial balance indicate errors in the recording process, necessitating adjustments before the preparation of financial statements.

Adjusting Entries and Closing the Books are subsequent steps to ensure the financial records accurately reflect the business’s financial status at the end of an accounting period. Adjusting entries are made to account for accrued or deferred items, whilst closing the books involves clearing out temporary accounts to restart the accounting cycle afresh with zero balances. Proper execution of these steps is crucial for the reliability of financial reporting.

Key Terms And Definitions In Accounting

Understanding the language of finance is crucial for navigating the complex world of accounting. For those not fluent in financial terminology, here’s a concise guide to some of the most common accounting terms that are critical for interpreting financial statements and reports.

- Assets: Resources with economic value owned by a company, expected to provide future benefits.

- Liabilities: Financial obligations or debts a company owes to others, which must be settled over time through the transfer of assets, provision of services, or other economic benefits.

- Equity: The residual interest in the assets of a company after deducting liabilities. Also referred to as “shareholder’s equity” or “owner’s equity”.

- Revenue: The income generated from normal business operations and includes discounts and deductions for returned goods.

- Expenses: The costs incurred in the process of earning revenue, including overhead, payroll, and cost of goods sold (COGS).

- Balance Sheet: A financial statement that summarizes a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

- Income Statement: A financial statement that shows company performance over a period, representing revenues and expenses to calculate net income or loss.

- Cash Flow: The total amount of money transferred in and out of a business, especially affecting liquidity.

This glossary serves to demystify the jargon, empowering individuals to gain a clearer understanding of financial documents and the overall financial health of a business.

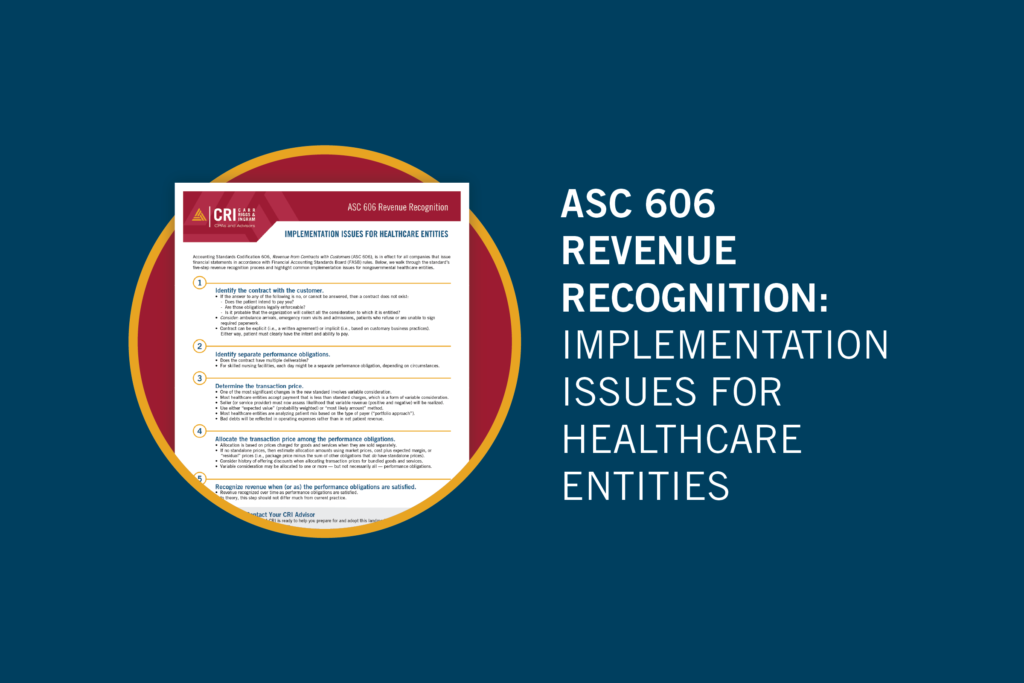

Credit: cricpa.com

Applying Accounting Knowledge

Applying accounting knowledge in the real world is crucial for making informed business decisions. For example, understanding the matching principle ensures expenses are reported with related revenues, providing a clear picture of profitability. Grasping the concept of accruals helps businesses recognize expenses and revenues when they are incurred, not just when cash is exchanged, leading to more accurate financial statements.

Financial statements, such as balance sheets and income statements, play a pivotal role in decision-making. Leaders use them to assess financial health, gauging liquidity, solvency, and operational efficiency. This information helps in making strategic choices like investment opportunities, budget allocations, and cost management.

Building a solid understanding of these principles is fundamental for tackling advanced financial topics. Mastering the basics paves the way for more complex areas such as financial modeling, investment analysis, and risk assessment.

Credit: cricpa.com

Frequently Asked Questions On Part One Identifying Accounting Terms

What Are Common Accounting Terms?

Accounting terms refer to financial expressions used in bookkeeping and business management. Common ones include assets, liabilities, revenue, expenses, equity, and debits and credits. Understanding these helps in analyzing financial health.

How Do Debits And Credits Work In Accounting?

Debits and credits are fundamental concepts in accounting, used for recording transactions. Debits increase asset or expense accounts and decrease liability, revenue, or equity accounts. Credits do the opposite, ensuring the accounts balance.

Why Are Assets Vital In Accounting?

Assets are crucial in accounting as they represent valuable items a company owns. They can be cash, inventory, or property. Assets indicate financial strength and are essential for operational sustainability and growth investment.

What’s The Difference Between Revenue And Income?

Revenue is the total amount earned from business activities, like sales, before any expenses are subtracted. Income, often called net income, is what remains after all costs are deducted from the revenue.

Conclusion

Understanding accounting terms lays the groundwork for financial mastery. This guide aimed to demystify key concepts, paving the way for deeper insight. Stay tuned for our upcoming segments, where we’ll dive further into the language of finance. Embrace this knowledge; it’s the first step in your journey to fiscal proficiency.

Karon Smith stands as a distinguished figure in the world of online business, showcasing a profound expertise in navigating the digital landscape. With a background firmly grounded in business strategy and technology, Karon Smith has emerged as a seasoned online business expert. Her career is marked by an adept understanding of e-commerce, digital marketing, and the intricacies of online operations. Known for her innovative approaches to building and scaling online ventures, Karon Smith has been a guiding force for businesses seeking to thrive in the digital realm. Her insights into the ever-evolving dynamics of online markets, coupled with a keen eye for emerging trends, make Karon Smith a valuable contributor to the evolving narrative of online entrepreneurship. As an advocate for strategic digital transformation, she continues to influence and shape the online business landscape, providing invaluable guidance to those navigating the complexities of the digital business world.