The possibility of Trump being re-elected brings both hope and fear. Some countries may face economic turmoil if it happens.

The global economy is interconnected. The policies of powerful nations can ripple across borders. Trump’s possible re-election could lead to significant changes in trade, foreign policy, and financial stability. These changes might disrupt the economies of several countries. Understanding which nations could be affected and why is crucial.

This blog will explore the potential financial chaos some countries might face if Trump wins another term. Learn how this election could impact global economics and the factors that make certain countries more vulnerable. Stay informed to navigate the uncertainties ahead.

Credit: www.bu.edu

Global Financial Markets

The re-election of Donald Trump could send shockwaves through global financial markets. Many countries could face significant financial disruptions. Uncertainty often causes markets to react strongly. Investors may respond to Trump’s policies with swift and dramatic moves.

Stock Market Volatility

Trump’s policies can lead to sudden stock market swings. His trade war approach, for instance, often unsettles investors. Markets dislike unpredictability. A sudden policy change can cause stock prices to plummet. This could create panic among global investors. High volatility can result in massive losses for some countries.

Currency Fluctuations

Trump’s stance on international trade affects currency values. Tariffs and sanctions can lead to currency depreciation. Countries dependent on exports to the U.S. may suffer. Their currencies could weaken significantly. This makes imports more expensive and fuels inflation. Export revenues may fall, leading to financial instability.

Credit: www.rollingstone.com

Economic Policies

When it comes to economic policies, the world holds its breath whenever a major election takes place in the United States. If Donald Trump gets re-elected, his economic strategies could shake the global financial markets to their core. Countries everywhere are watching closely, trying to predict what might come next. Let’s dive into some key areas that could spell financial chaos for many nations.

Trade Wars

Trade wars are like the financial equivalent of a heavyweight boxing match – intense and potentially damaging. During his first term, Trump initiated several trade wars, most notably with China. These battles led to higher tariffs, which hurt economies on both sides.

But it wasn’t just China that felt the heat. European countries, Canada, and Mexico also faced new tariffs, causing disruptions in their markets. If Trump gets re-elected, we might see an escalation in these trade wars. This could lead to:

- Increased prices on imported goods

- Strained international relations

- Market volatility

Imagine waking up to find that your favorite products cost more overnight. That’s the kind of impact these trade wars can have on everyday life.

Sanctions

Sanctions are another tool in Trump’s economic arsenal. These measures can cripple economies by cutting off access to essential goods and financial resources. Countries like Iran, Venezuela, and North Korea have already felt the sting of US sanctions.

So, what happens if Trump decides to extend or intensify these sanctions? We could see:

- Economic isolation for targeted countries

- Humanitarian crises due to shortages

- Increased global tension

Sanctions can be a double-edged sword. While they aim to pressure governments, they often hit ordinary people the hardest. Picture yourself living in a country where everyday items become scarce and expensive – that’s the harsh reality sanctions can create.

In conclusion, Trump’s potential re-election brings with it a wave of uncertainty for global economies. Trade wars and sanctions are powerful economic policies that can lead to financial chaos for many nations. As the world watches, the stakes are incredibly high. Will we see a repeat of past strategies, or will new policies emerge? Only time will tell.

European Union

The European Union (EU) stands as a significant player on the global stage, with its intricate web of political, economic, and social connections. However, if Donald Trump were to be re-elected, the EU could find itself navigating through some choppy financial waters. In this section, we’ll explore how Trump’s potential re-election could impact the EU, focusing on two key areas: Trade Relations and Financial Stability.

Trade Relations

Trade relations between the EU and the United States have always been critical. During Trump’s previous tenure, we witnessed a barrage of tariffs and trade wars that left many scratching their heads. If he returns to power, we might see a repeat of such policies. But what does this mean for the EU?

To put it simply, higher tariffs on European goods could lead to increased prices for consumers and businesses alike. Imagine paying more for your favorite Italian wine or German car. That’s just the tip of the iceberg. The ripple effects could be felt across various industries, from manufacturing to agriculture.

Financial Stability

Financial stability in the EU is another area of concern. The EU has a diverse economic landscape, and any major disruptions can have far-reaching consequences. If Trump re-imposes stringent economic policies, it could lead to market volatility. Remember the rollercoaster ride of the stock markets during his last term? Buckle up; it might happen again.

Moreover, uncertainties in trade policies could deter investments. Companies might think twice before expanding or investing in new projects. This could slow down economic growth and increase unemployment rates. It’s like a domino effect; one piece topples, and the rest follow.

In conclusion, while the future is always uncertain, the potential re-election of Donald Trump could bring about significant challenges for the European Union. From disrupted trade relations to financial instability, the EU must brace itself for a potentially tumultuous period. Stay tuned as we continue to explore how other countries might be affected.

China

If Donald Trump gets re-elected, China could be one of the countries facing significant financial turmoil. The two superpowers have had a tumultuous relationship, especially during Trump’s previous tenure. With his tough stance on trade and tariffs, the economic landscape for China could see some serious shake-ups. So, what exactly could happen? Let’s dive into the details.

Tariff Impact

One of Trump’s signature moves during his presidency was the imposition of tariffs on Chinese goods. These tariffs were meant to reduce the trade deficit and bring manufacturing jobs back to the United States. If he gets re-elected, it’s likely that we will see a similar approach. Higher tariffs could lead to increased costs for Chinese exports, making them less competitive in the global market.

Here’s a quick look at the potential impacts of tariffs:

| Impact | Description |

|---|---|

| Increased Costs | Tariffs would make Chinese goods more expensive for American consumers. |

| Reduced Exports | Higher prices could lead to a decrease in the volume of Chinese exports. |

| Economic Slowdown | Reduced exports might slow down China’s economic growth. |

Supply Chain Disruption

Trump’s re-election could also bring more stringent measures against Chinese companies. One area that could be severely affected is the global supply chain. We all remember the chaos of the trade war, right? Imagine that, but potentially worse.

- Manufacturing: Many U.S. companies rely on Chinese manufacturing. Increased tariffs and restrictions could force these companies to look for alternatives, which may not be as cost-effective.

- Technology: Companies like Huawei faced severe restrictions under Trump. A re-election could mean more bans and tighter controls, affecting everything from smartphones to 5G technology.

- Investment: Uncertainty may lead to reduced foreign investment in China, further destabilizing the economy.

The ripple effects could be felt worldwide. Remember when the trade war caused market fluctuations and uncertainty? We could be in for a repeat performance.

In summary, if Trump gets re-elected, China could face significant financial chaos through increased tariffs and supply chain disruptions. These changes could have global ramifications, affecting economies and industries far beyond China’s borders.

Mexico

When discussing the potential financial chaos that could arise if Donald Trump gets re-elected, Mexico stands out as a country that could be significantly impacted. As one of the United States’ closest neighbors and largest trading partners, Mexico’s economy is intricately linked with that of the US. Any shift in US policies, particularly those concerning trade, can send ripples through Mexico’s economic stability.

Trade Agreement Uncertainty

One of the primary concerns for Mexico is the potential renegotiation or even cancellation of trade agreements. The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, has already seen its fair share of turbulence. If Trump returns to power, the future of this agreement could be thrown into doubt once more.

Consider the implications of such uncertainty. For Mexican businesses, this could mean:

- Increased tariffs on exported goods

- Disruption in supply chains

- Decreased foreign investment

Imagine a Mexican factory that exports car parts to the US. If tariffs increase, the cost of their products rises, making them less competitive. This could lead to layoffs and economic downturns in local communities.

Economic Dependency

Mexico’s economy is highly dependent on the United States. A large portion of its GDP comes from exports to the US, and any disruption can have serious consequences. In 2019, the US accounted for nearly 80% of Mexico’s exports. That’s a staggering figure, showing just how closely tied these economies are.

What happens if these exports face new barriers? The results could be:

- Reduced economic growth

- Increased unemployment

- Currency devaluation

For the average Mexican worker, this could mean fewer job opportunities and a lower standard of living. Picture a family struggling to make ends meet because the factory where the parents work had to cut jobs due to decreased demand from the US.

In a nutshell, Mexico’s economic stability is precariously balanced on the policies of its northern neighbor. With Trump back in office, the potential for financial chaos looms large, and the ripple effects could be felt far and wide.

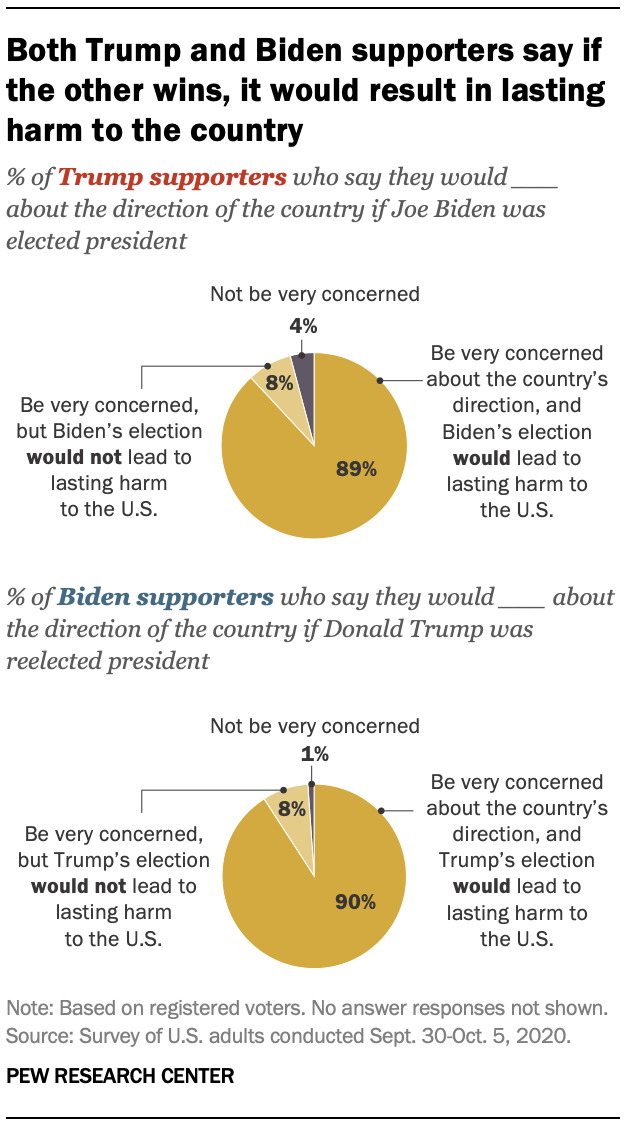

Credit: www.pewresearch.org

Middle East

The Middle East has always been a region of significant geopolitical interest. With its vast reserves of oil and strategic location, any political shift in global power dynamics can reverberate through its economies. If Trump were to be re-elected, the Middle East might face financial chaos due to various factors. Let’s delve into two major aspects: Oil Prices and Geopolitical Tensions.

Oil Prices

Oil is the lifeblood of many Middle Eastern economies. The price of oil affects everything from government budgets to the daily lives of its citizens. Under Trump’s previous administration, we saw a rollercoaster of oil prices. His policies, including sanctions on Iran and the withdrawal from the Iran nuclear deal, significantly impacted oil prices. Remember those days when filling up your car felt like gambling?

Should Trump be re-elected, we might witness similar volatility. The uncertainty could lead to fluctuating oil prices, leaving countries like Saudi Arabia, Iraq, and Kuwait in a financial limbo. They may have to adjust their budgets frequently, affecting public services and infrastructure projects. After all, who wants to plan their finances on a shaky foundation?

Geopolitical Tensions

If there’s one thing Trump’s presidency was known for, it’s stirring the geopolitical pot. The Middle East, being a hotspot for political tensions, could see a significant impact. Trump’s hardline stance on Iran, for instance, led to heightened tensions in the region. Ever had that uneasy feeling when your neighbors are constantly bickering? That’s pretty much what it was like in the Middle East.

Re-election could mean more of the same. Increased tensions between the U.S. and Iran might escalate into regional conflicts, affecting not just the countries involved but their neighbors as well. The financial markets don’t take kindly to uncertainty and conflict, leading to potential economic instability across the region. Who wants to invest in a place that feels like a powder keg?

In summary, the re-election of Trump could spell financial chaos for the Middle East, primarily through volatile oil prices and heightened geopolitical tensions. The region’s economies might find themselves on a precarious footing, navigating through uncertain waters. Let’s hope for smoother sailing ahead!

Developing Nations

Developing nations could face severe financial challenges if Trump gets re-elected. The global economic landscape may shift, causing instability in these vulnerable economies. From rising debt levels to decreasing foreign investments, the repercussions could be far-reaching.

Debt Crisis

Developing nations already struggle with debt. Trump’s re-election could exacerbate this. Policies that favor the U.S. may reduce financial aid to these countries. Less financial support could lead to higher debt levels. Struggling economies may find it difficult to repay existing loans. This could result in a severe debt crisis.

Investment Decline

Foreign investment is crucial for developing nations. Trump’s re-election could lead to a decline in foreign investments. Investors may feel uncertain about the global market. As a result, they may pull their investments. This would reduce the capital available to developing nations. A decrease in investment could hinder economic growth. It could also lead to higher unemployment rates.

Global Economic Predictions

Global economic predictions indicate potential turbulence if Trump gets re-elected. Various countries might experience financial chaos. This section explores recession risks and policy adjustments. Understanding these impacts helps prepare for possible economic shifts.

Recession Risks

Re-election could trigger global recession fears. Trade policies may disrupt international markets. Economies reliant on exports might suffer. Financial markets could become unstable. Investors may seek safer assets. Countries with fragile economies could face severe downturns.

Policy Adjustments

Re-election might lead to significant policy changes. Tariffs on imports could increase. This would affect global trade dynamics. Nations might adjust their economic strategies. Currency values could fluctuate widely. Central banks might alter interest rates. Economies may need to adapt quickly.

Frequently Asked Questions

How Could Trump’s Re-election Impact Global Markets?

Trump’s policies could create uncertainty in global markets. Trade wars and tariffs may disrupt international trade. This could lead to financial instability.

Which Countries Might Be Most Affected?

Countries heavily reliant on trade with the U. S. could suffer. Economies like China, Mexico, and Canada might face significant impacts.

Could Trump’s Policies Lead To A Recession?

Yes, aggressive trade policies could trigger economic downturns. Financial markets might react negatively, potentially leading to a recession.

How Might Europe Be Affected?

European economies could experience financial turmoil. Trade tensions and economic policies may disrupt their markets and financial stability.

Conclusion

Trump’s re-election could trigger financial chaos in many countries. Markets may become unstable. Investors might panic, leading to economic downturns. Trade relations could worsen, affecting global economies. Countries dependent on the U. S. Might suffer. Political tensions could rise, causing more uncertainty.

Preparation and awareness are crucial. Stay informed and proactive. Understanding these risks can help navigate potential challenges ahead. Stay vigilant and ready for any changes.

Corel Benzamin stands as a distinguished figure in the realms of real estate and startup investments, showcasing an impressive track record as an expert in these dynamic fields. Armed with a comprehensive understanding of market trends and investment strategies, Corel has carved a niche for themselves through insightful analyses and successful ventures. Their journey is marked by a blend of financial acumen and entrepreneurial foresight, translating into tangible success stories. Corel’s prowess in navigating the intricacies of real estate and startup landscapes has not only positioned them as a sought-after professional but has also contributed to the broader discourse on investment practices. Whether unraveling the intricacies of property markets or deciphering the intricacies of emerging startups, Corel Benzamin’s expertise continues to be a beacon for those seeking valuable insights and guidance in the world of real estate and startup investments.