Forex trading strategies for beginners involve selecting currency pairs, managing position size, and utilizing tools and guides to learn and test different strategies. By starting with swing trading, beginners can easily manage trading alongside other commitments.

Learning the basics, practicing with demo accounts, and seeking reliable service providers are key steps for beginners venturing into the forex market. Implementing effective strategies and understanding market dynamics are crucial components for success in forex trading. Discovering commonly used strategies, such as price action trading and trend trading, can help beginners navigate the complexities of the forex market.

Through continuous learning and practice, beginners can develop the skills needed to become successful forex traders.

The Basics Of Forex Trading

For beginners in forex trading, understanding the basics is crucial. Begin by learning different strategies such as swing trading, range trading, and trend trading. Start with demo accounts, find reliable service providers, and educate yourself using books and online resources.

Remember, patience and practice are key to mastering forex trading.

What Is Forex Trading?

Forex trading involves the buying and selling of currencies in the foreign exchange market.

Understanding Currency Pairs

Currency pairs represent the value of one currency against another in the forex market.

Importance Of Demo Accounts

Demo accounts allow beginners to practice trading with virtual money before risking real capital.

Credit: www.youtube.com

Essential Strategies For Beginners

When it comes to Forex trading, beginners often feel overwhelmed by the complexity of the market. However, with the right strategies in place, even novice traders can find success in the Forex market. In this article, we will discuss the essential strategies for beginners, including swing trading, range trading, trend trading, and price action trading.

Swing Trading Strategy

Swing trading is one of the easiest trading strategies for beginners to understand and implement. It involves taking advantage of short-term price fluctuations within a longer-term trend. Swing traders typically hold positions for a few days to a few weeks, allowing them to capture profits from both upward and downward market movements.

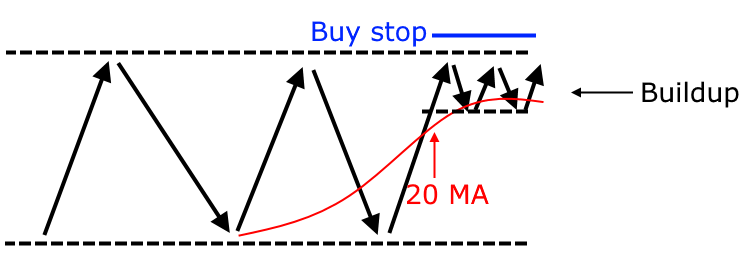

Range Trading Strategy

Range trading is a strategy that is suitable for beginners as it focuses on identifying price levels where the market tends to trade within a range. Traders using this strategy aim to buy at the lower end of the range and sell at the upper end, taking advantage of price reversals. Range trading is ideal for beginners as it requires patience and discipline to wait for price to reach the desired levels.

Trend Trading Strategy

Trend trading is another essential strategy for beginners as it capitalizes on the direction of the market. This strategy involves identifying and trading with the prevailing trend, whether it is up or down. Beginner traders can use technical indicators, such as moving averages, to confirm the trend and enter positions in line with the market direction.

Price Action Trading

Price action trading is a strategy that relies solely on the analysis of price movements without the use of indicators or other technical tools. This strategy is beneficial for beginners as it helps them to develop a deep understanding of market dynamics and price patterns. By studying price action, traders aim to predict future price movements and make informed trading decisions.

In conclusion, these essential strategies for beginners are designed to provide a solid foundation for trading in the Forex market. Whether you choose to employ swing trading, range trading, trend trading, or price action trading, it is important to practice and refine your skills through consistent learning and practical application to become a successful Forex trader.

Components Of An Effective Forex Strategy

An effective forex strategy for beginners involves selecting market currency pairs, position sizing, and risk management. It’s crucial to learn and test various trading strategies, including swing trading, as it requires minimal time commitment while allowing for account management even with a full-time job.

Mastering these components will help beginners navigate the forex market successfully.

Components of an Effective Forex Strategy When it comes to forex trading, having an effective strategy is crucial for success. An effective forex strategy consists of various components that work together to guide traders in making informed decisions. In this section, we will discuss the key components of an effective forex strategy: market selection and risk management through position sizing. H3: Market Selection Market selection is the first component of an effective forex strategy. Traders must determine which currency pairs they want to trade and become experts at reading them. This involves conducting thorough research and analysis to identify the most profitable opportunities. Some factors to consider when selecting a market include liquidity, volatility, and economic factors that affect the currency pair. By choosing the right market, traders can increase their chances of making successful trades and maximizing profits. H3: Risk Management through Position Sizing Risk management is another crucial component of an effective forex strategy. Traders must determine the appropriate position size for each trade to control the amount of risk taken. Position sizing involves considering factors such as account size, risk tolerance, and market conditions. By properly managing their positions, traders can minimize the potential losses and protect their capital. This allows them to stay in the game even during volatile market conditions and increase the likelihood of long-term profitability. To ensure effective risk management, traders can use various techniques such as setting stop-loss orders and implementing proper money management strategies. This includes establishing realistic profit targets and sticking to them, as well as limiting the amount of capital risked on each trade. By implementing sound risk management practices, traders can protect their accounts from excessive losses and increase their chances of success in the forex market. In conclusion, an effective forex strategy consists of market selection and risk management through position sizing. By carefully selecting the market to trade and managing their positions effectively, traders can increase their chances of making profitable trades and achieving long-term success in forex trading. Get started with forex trading strategies for beginners today and give yourself the best chance at success in the exciting world of forex trading.

Credit: dailypriceaction.com

Getting Started In Forex Trading

Finding A Reliable Service Provider

Before diving into Forex trading, it’s crucial to find a trustworthy service provider that offers the right tools and guidance for beginners.

Learning From Resources And Guides

One of the key steps in embarking on your Forex trading journey is to utilize educational resources like books and online videos to enhance your knowledge and understanding.

Educational Resources: Books And Online Videos

- Books: There are various books available that provide in-depth insights into Forex trading strategies, analysis, and market dynamics.

- Online Videos: Platforms like YouTube offer a plethora of educational videos that can help beginners grasp the basics and advanced concepts of Forex trading.

Best Practices For Forex Trading Beginners

Entering the forex market as a beginner can be overwhelming and risky without the right approach. Embracing the best practices for forex trading beginners is crucial to establish a strong foundation and set the stage for long-term success. From market analysis and forecasting to creating a well-defined trading plan and emphasizing the importance of practice and limit setting, implementing these strategies is key to navigating the complex world of forex trading.

Market Analysis And Forecasting

Conducting thorough market analysis and forecasting is essential for successful forex trading. It involves evaluating economic indicators, geopolitical events, and technical analysis to identify potential currency movements. Utilize a combination of fundamental and technical analysis to make informed trading decisions. Stay updated with market news and economic releases to anticipate potential price movements and minimize risks.

Creating A Well-defined Trading Plan

Developing a well-defined trading plan is paramount for forex trading beginners. Outline clear entry and exit points, risk management strategies, and profit targets. Include rules for trade execution, money management, and psychological aspects to maintain discipline. A well-structured trading plan serves as a roadmap to guide your trading activities and helps to avoid impulsive decisions.

Importance Of Practice And Limit Setting

Emphasize the significance of practice and limit setting in forex trading. Utilize demo accounts to practice and refine your trading strategies without risking real capital. Set realistic and achievable trading goals while implementing strict risk management practices. Establishing predefined risk limits and adhering to them is crucial to safeguard your trading capital and mitigate potential losses.

Credit: www.tradingwithrayner.com

Mastering Forex Trading For Consistent Profits

Utilizing Moving Averages

One of the key Forex trading strategies for beginners is utilizing moving averages. This technical analysis tool helps smooth out price data to identify trends over a specific period. Traders can use moving averages to spot potential entry and exit points, as well as to confirm trend direction. By combining different moving averages, traders can develop a reliable trading strategy to ride profitable trends effectively.

Building A Personalized Trading Approach

When it comes to mastering Forex trading for consistent profits, it’s essential for beginners to build a personalized trading approach. Each trader has unique risk tolerance, trading goals, and preferences. By building a personalized approach, beginners can focus on trading strategies that align with their strengths and preferences. This can include setting clear risk management rules, using specific technical indicators, and developing a disciplined trading routine.

Guidance And Mentorship In Forex Trading

For beginners, seeking guidance from experienced forex experts is crucial. Expert advice can help navigate the complexities of the forex market efficiently.

Online Courses And Educational Resources

Online courses and educational resources play a vital role in equipping beginners with the necessary knowledge and skills to thrive in forex trading.

Resourceful Tools And Platforms

When it comes to forex trading, having access to resourceful tools and platforms is crucial for beginners to enhance their trading experience. These tools and platforms act as a support system, providing valuable information, analysis, and execution options. By exploring trading platforms and leveraging technology for analysis and execution, beginners can make informed decisions and improve their chances of success in the forex market.

Exploring Trading Platforms And Tools

Trading platforms serve as the foundation for conducting forex trades. They provide access to the global forex market, allowing traders to buy and sell currency pairs. Beginner traders should take the time to explore different trading platforms to find the one that suits their needs best.

Here are a few popular trading platforms:

- MetaTrader 4 (MT4): Known for its user-friendly interface, MT4 offers advanced charting tools, technical indicators, and Expert Advisors (EAs) for automated trading.

- MetaTrader 5 (MT5): Considered an upgraded version of MT4, MT5 provides additional features such as more advanced analytical tools and access to other financial markets like stocks and commodities.

- cTrader: This platform is favored by professional traders for its advanced trading capabilities and customizable interface.

By exploring different trading platforms, beginners can choose the one that aligns with their trading style and preferences, helping them execute trades effectively.

Leveraging Technology For Analysis And Execution

Technology plays a crucial role in forex trading, offering a wide range of tools and resources for analysis and execution. Beginner traders can leverage these technological advancements to make better-informed decisions and execute trades efficiently.

Here are some valuable tools and technologies for analysis and execution:

- Trading Indicators: These tools help traders identify potential entry and exit points based on market trends and patterns. Common indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

- Forex Signal Providers: These services provide traders with buy and sell signals, offering insights into potential profitable trades. Subscribing to a reliable signal provider can help beginners gain confidence and make better trading decisions.

- Automated Trading Systems: Also known as algorithmic trading, these systems use predefined rules and parameters to automatically execute trades. They can be especially beneficial for beginners who may not have extensive trading experience.

By leveraging technology for analysis and execution, beginners can save time, reduce human errors, and have a more systematic approach to forex trading.

Frequently Asked Questions

What Is The Easiest Forex Strategy For Beginners?

The swing trading strategy is the easiest for forex beginners as it requires less time and can be managed alongside a full-time job. It’s a simple and effective way to start trading forex.

What Should A Beginner Do In Forex Trading?

To start in forex trading, learn the basics, use demo accounts, find a reliable service provider, explore resources, and practice various trading strategies.

What Is The Best Strategy For Forex Trading?

The best strategy for forex trading is to select the market and become an expert at reading currency pairs. Traders should also determine the size of each position to control risk. It is important to learn various trading strategies and test them to find what works best.

Is $1000 Enough To Start Forex?

$1000 is often not enough to start forex trading due to high risk and volatility.

Conclusion

Ultimately, mastering forex trading strategies as a beginner is about education, practice, and persistence. By learning the basics, exploring different tactics, and utilizing resources, you can navigate the forex market confidently. Remember, consistency and discipline are key to honing your skills and achieving success in forex trading.