Cryptocurrency is regulated differently around the world, with some countries partially regulating while others actively oversee the space. For example, crypto exchanges in the U.S. Are subject to specific regulations, while the EU has laws governing crypto service providers.

In some cases, regulation is considered beneficial for investor protection and market stability. As countries implement well-structured laws and regulations, this could contribute to increased investor confidence and market growth. It’s essential for investors to understand the specific regulations within the regions they operate in to ensure compliance and mitigate potential risks.

Additionally, keeping an eye on global regulatory developments is crucial for informed investment decisions in the cryptocurrency market.

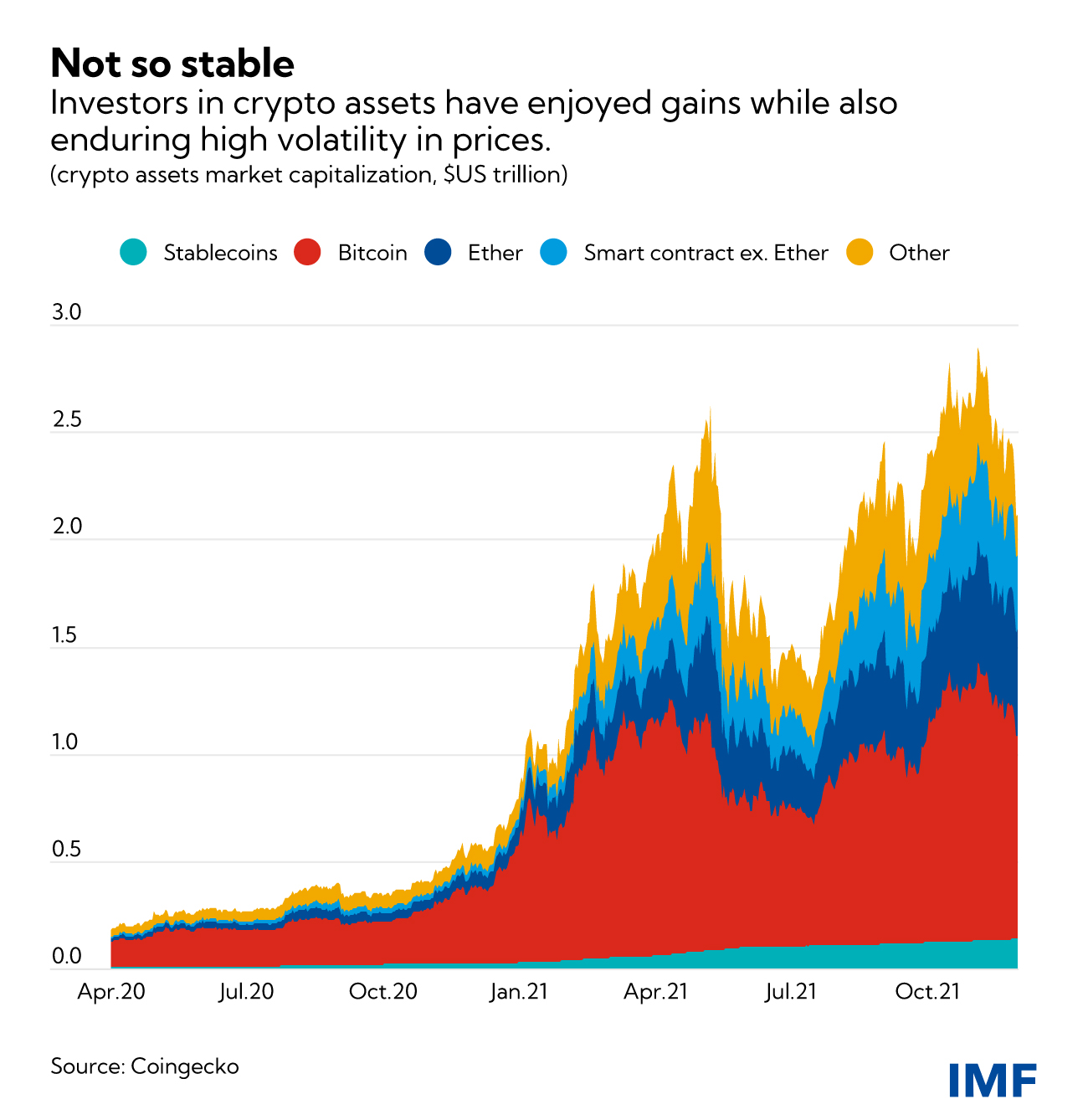

Credit: www.imf.org

Current State Of Cryptocurrency Regulation

As the popularity of cryptocurrencies continues to rise, regulation plays a crucial role in shaping the industry. The current state of cryptocurrency regulation varies across different countries, with some implementing partial regulation and others taking more comprehensive steps to oversee the cryptocurrency space.

Partial Regulation In Some Countries

In some countries, there is partial regulation surrounding cryptocurrencies. This partial regulation often focuses on specific aspects of the cryptocurrency market, such as crypto exchanges or crypto service providers. For instance, in the United States, crypto exchanges are subject to regulations, while in the European Union, laws govern crypto service providers.

Regulatory Bodies Involved

Various regulatory bodies are involved in overseeing cryptocurrency regulation. These may include entities such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Reserve, and others. These bodies are grappling with the best approaches to regulate and oversee the crypto market, aiming to ensure transparency, investor protection, and market stability.

:max_bytes(150000):strip_icc()/CryptoSpotlight-Recirc2-52a72e7b82124c83b1818c6f4fa14344.jpg)

Credit: www.investopedia.com

Key Players In Cryptocurrency Regulation

Cryptocurrency regulation around the world varies, with some countries implementing partial regulations while others aim for comprehensive oversight. The United States and the European Union have established regulations for crypto exchanges and service providers, respectively. Implementing well-structured laws and regulations can foster market growth and attract more investors, contributing to increased transactions and liquidity in the cryptocurrency space.

The regulation of cryptocurrencies is a topic of increasing importance as digital assets continue to gain traction with investors worldwide. Several key players play a crucial role in shaping the regulatory landscape for cryptocurrencies. These players include:

Securities And Exchange Commission

Securities and Exchange Commission (SEC) is one of the primary regulatory bodies governing cryptocurrencies in the United States. With its mission to protect investors and maintain fair and efficient markets, the SEC focuses on ensuring that digital assets are not considered securities and fall within the existing regulatory framework. It has enforced regulations against fraudulent initial coin offerings (ICOs) and has also initiated legal actions against individuals and companies involved in fraudulent activities within the cryptocurrency space.

Commodity Futures Trading Commission

Commodity Futures Trading Commission (CFTC) is another crucial player in cryptocurrency regulation in the United States. As the federal agency overseeing futures markets, the CFTC has taken steps to regulate cryptocurrencies as commodities. It has implemented strict regulations on cryptocurrency derivatives, such as futures and options, to protect investors from fraud and manipulation. The CFTC actively pursues enforcement actions against entities and individuals engaged in fraudulent practices within the cryptocurrency market.

Other Regulatory Bodies

In addition to the SEC and the CFTC, other key players in cryptocurrency regulation include the Federal Deposit Insurance Corporation (FDIC), the Comptroller of the Currency, and the Federal Reserve. These regulatory bodies are all grappling with the best approaches to oversee the crypto industry and mitigate potential risks for investors. While debates exist on whether cryptocurrencies should be regulated by the federal government, a well-implemented regulatory framework can foster market growth and drive greater participation from investors.

In conclusion,

The regulatory landscape for cryptocurrencies varies across different countries and regions. While some nations have embraced cryptocurrencies and implemented comprehensive regulations, others are still in the process of formulating their approach. As an investor in the cryptocurrency market, it is essential to stay informed about the regulations and guidelines set forth by these key players to ensure compliance and mitigate any potential risks.

Benefits Of Cryptocurrency Regulation

Regulation of cryptocurrency brings about several benefits that are important for investors to understand. By implementing well-defined laws and regulations, governments can foster market growth and increase investor confidence, which are crucial for the long-term success of the cryptocurrency industry.

Market Growth

One of the key benefits of cryptocurrency regulation is the potential for market growth. When cryptocurrencies are subject to clear and transparent regulations, it creates a sense of stability and trust in the market. Increased investor confidence leads to more participation and investment, driving the growth of the overall market.

Regulation also helps to attract institutional investors who may have been hesitant to enter the cryptocurrency space due to concerns about fraudulent activities and lack of legal protections. This influx of institutional money can further stimulate market growth and liquidity.

Key Takeaway: Clear and well-implemented regulations can foster market growth by instilling investor confidence and attracting institutional investors.

Increased Investor Confidence

Another significant benefit of cryptocurrency regulation is the increased confidence it provides to investors. When regulations are in place, investors have assurance that their investments are protected by law and that there are mechanisms to address any potential grievances or issues that may arise.

Regulation also helps to combat fraudulent activities, scams, and unscrupulous practices that have been prevalent in the unregulated crypto market. By setting standards for transparency, security, and ethical conduct, regulations help to weed out bad actors and promote a safer environment for investors.

Key Takeaway: Cryptocurrency regulation enhances investor confidence by providing legal protections, addressing grievances, and promoting transparency and ethical practices in the market.

Overall, the benefits of cryptocurrency regulation are instrumental in creating a robust and sustainable industry. Market growth and increased investor confidence go hand in hand, and when combined with well-defined regulations, they contribute to the establishment of a healthy and secure cryptocurrency ecosystem.

Global Perspectives On Cryptocurrency Regulation

Cryptocurrency regulation varies worldwide, with partial regulations in some countries and strict laws in others. For example, the U. S. subjects crypto exchanges to regulations, while the EU governs crypto service providers. Well-implemented laws can drive market growth by increasing investor confidence and liquidity.

Explore how leading countries are regulating this emerging asset class.

Global Perspectives on Cryptocurrency Regulation

Cryptocurrency regulation varies across the globe, reflecting diverse perspectives on this emerging asset class. Understanding these global perspectives is crucial for investors looking to navigate the evolving regulatory landscape and mitigate potential risks.

Regulation In Eu

Across the European Union (EU), cryptocurrency regulation has been a focal point, with efforts to establish comprehensive frameworks for crypto service providers. With the implementation of laws governing crypto activities, the EU aims to enhance consumer protection and foster trust in the digital asset market. The regulatory landscape in the EU continues to evolve, shaping the environment for cryptocurrency investments.

Regulation In Emerging Markets

In emerging markets, cryptocurrency regulation presents a unique set of challenges and opportunities. Governments in these regions are grappling with the need to balance innovation and risk mitigation, seeking to harness the potential benefits of cryptocurrencies while safeguarding against illicit activities. As these markets aspire to establish regulatory frameworks, investors should monitor developments closely to gauge the implications for their investment strategies.

As the global regulatory landscape for cryptocurrencies continues to evolve, investors must stay abreast of shifting policies and compliance requirements to navigate this dynamic market effectively. Whether in established financial centers or burgeoning economies, understanding the nuances of cryptocurrency regulation is paramount to informed decision-making.

Challenges In Implementing Cryptocurrency Regulation

Cryptocurrency regulation faces several challenges worldwide. From tech-savvy criminals to complex cross-border regulatory issues, authorities encounter obstacles in effectively implementing regulations to govern the volatile digital asset market.

Tech-savvy Criminals

The rise of tech-savvy criminals poses a significant challenge to regulating cryptocurrencies. Cybercriminals leverage the anonymity and decentralized nature of cryptocurrencies for illicit activities like money laundering, ransomware attacks, and fraud, making it difficult for authorities to track and prosecute offenders.

Cross-border Regulatory Issues

Cryptocurrencies transcend geographical boundaries, leading to complex cross-border regulatory challenges. Varying regulatory frameworks and conflicting policies between countries create ambiguity and legal uncertainties, hindering the harmonization of cryptocurrency regulations on a global scale.

Future Of Cryptocurrency Regulation

Cryptocurrency regulations are evolving globally with varied approaches in different countries.

Regulatory changes can significantly alter the crypto market landscape.

The regulation of cryptocurrencies continues to be a topic of significant importance in the financial world.

Global efforts are underway to establish clear guidelines for the use and trading of cryptocurrency.

Investors must stay informed about upcoming regulatory changes that can impact their investments.

Adapting to regulatory frameworks will be crucial for the sustainable growth of the cryptocurrency market.

Credit: www.bankrate.com

Frequently Asked Questions

How Is Crypto Regulated Around The World?

Crypto regulations vary worldwide, with some countries implementing partial regulations and others aiming for comprehensive oversight. For instance, the U. S. regulates crypto exchanges, while the EU has laws for crypto service providers. Overall, global efforts are being made to regulate the crypto space effectively.

Who Should Regulate Cryptocurrency?

Regulate cryptocurrency with Securities and Exchange Commission, Commodity Futures Trading Commission, and other related authorities.

Why Is Cryptocurrency Regulation Actually A Good Thing For Investors According To These Experts?

Cryptocurrency regulation is a good thing for investors because it promotes market growth and increases investor confidence. Proper regulations ensure asset safety, price stability, and improved liquidity, attracting more investors to the market and increasing cryptocurrency transactions.

What Are The Rules And Regulations Of Cryptocurrency?

Cryptocurrency rules and regulations vary globally, with different countries imposing partial or comprehensive regulations. In the U. S. , the SEC and CFTC oversee crypto, while the EU enforces laws for crypto service providers, aiming to enhance market safety and investor confidence.

Conclusion

As governments around the world continue to grapple with the regulation of cryptocurrencies, it is clear that investors need to stay informed and proactive. Understanding the evolving regulatory landscape will be crucial for making sound investment decisions. With the right regulations in place, the cryptocurrency market could see sustained growth and increased investor confidence.