Cryptocurrency mining involves verifying transactions on the blockchain and adding new blocks of data, with miners being rewarded with cryptocurrency for their effort. Mining can be profitable, but it depends on factors like the cost of equipment, electricity, and the cryptocurrency’s value.

Cryptocurrency mining, particularly Bitcoin mining, can be a lucrative venture, but it requires specialized hardware and significant energy consumption. Miners use computational power to solve complex mathematical puzzles, which validates and secures transactions on the cryptocurrency network. Successful miners receive cryptocurrency rewards while contributing to the network’s functionality.

Despite its profitability potential, mining requires a substantial upfront investment in hardware and consumes a significant amount of energy. Furthermore, the profitability of mining is influenced by factors such as cryptocurrency market fluctuations and competition among miners. Understanding the intricacies of mining and considering the associated costs are crucial in determining its profitability.

Credit: www.youtube.com

How Cryptocurrency Mining Works

Cryptocurrency mining is the process of validating and adding transactions to the blockchain while securing the network from fraudulent activity. It involves the use of powerful computer hardware to perform complex mathematical calculations that confirm the validity of transactions. The mining process is crucial for maintaining the integrity and security of a decentralized blockchain system. Here’s a detailed breakdown of how cryptocurrency mining works:

Verifying Transactions

Cryptocurrency miners are responsible for verifying and authenticating transactions within the network. When a transaction occurs, it is broadcast to the network and added to a pool of unconfirmed transactions. Miners then select these transactions and verify their legitimacy by solving cryptographic puzzles.

Adding New Blocks To The Blockchain

Once miners have confirmed the validity of a set of transactions, they group them into a block and compete to solve a complex mathematical problem, known as proof of work. The first miner to solve this problem, and therefore create a valid block, broadcasts it to the network. This new block is then added to the existing blockchain, and the transactions within it are considered confirmed and irreversible.

Credit: www.bankrate.com

Methods Of Cryptocurrency Mining

Mining cryptocurrencies involves verifying transactions on the blockchain and adding new blocks of data to the chain. This process can be done in two different ways: through specialized hardware mining and cloud mining services.

Specialized Hardware Mining

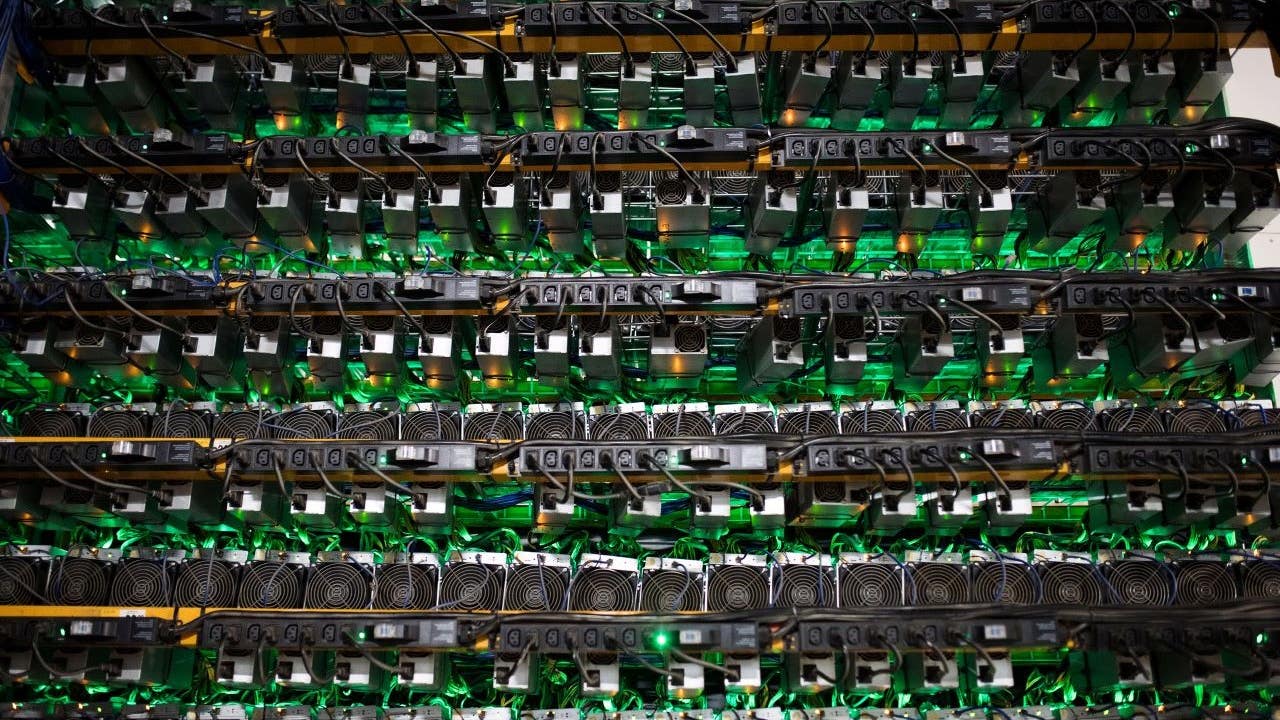

Specialized hardware mining, also known as traditional mining, involves using powerful computer systems specifically designed for mining cryptocurrencies. These systems are equipped with high-performance processors and graphics cards that can solve complex mathematical problems required by the mining process.

One of the most popular specialized hardware miners is the ASIC (Application-Specific Integrated Circuit) miner, designed specifically for mining cryptocurrencies like Bitcoin. These miners are highly efficient and can provide a significant hashing power, which is crucial for mining success.

Another type of specialized hardware mining is GPU (Graphics Processing Unit) mining. GPUs are widely used for mining various cryptocurrencies as they offer a better balance between cost and efficiency compared to ASIC miners. Miners using GPUs can mine different cryptocurrencies simultaneously, making it a versatile option.

Cloud Mining Services

Cloud mining services offer an alternative way to mine cryptocurrencies without the need for hardware investments or technical expertise. With cloud mining, individuals can rent mining power from remote data centers, allowing them to mine cryptocurrencies without the hassle of maintaining hardware equipment.

Cloud mining services typically offer various mining contracts, allowing users to choose the desired hashing power and duration of the contract. The mining rewards are then distributed among the users based on their rented hashing power.

While cloud mining services provide convenience and accessibility, it’s important to research and choose reputable providers. Due diligence is necessary to ensure the legitimacy and profitability of the cloud mining service.

Earning From Cryptocurrency Mining

Cryptocurrency mining is a way to earn digital currencies by validating transactions on the blockchain and adding new blocks of data. Miners are rewarded with cryptocurrency for their efforts, making it a potential source of income. Mining can be done using specialized hardware or through cloud mining services, and the reward system for miners plays a crucial role in determining the profitability of this activity.

Reward System For Miners

Miners are rewarded with cryptocurrency for verifying and adding transactions to the blockchain. This process involves solving complex mathematical puzzles to validate transactions and create new blocks. The rewards are typically in the form of the cryptocurrency being mined, such as Bitcoin or Ethereum. The reward system also includes transaction fees paid by users for faster processing of their transactions. The amount of reward depends on various factors such as the mining difficulty, network hash rate, and the specific cryptocurrency being mined.

:max_bytes(150000):strip_icc()/can-bitcoin-mining-make-a-profit-4157922_final-db1468c8cf124bd8bf28814939df1831.gif)

Credit: www.thebalancemoney.com

Factors Influencing Profitability

Cryptocurrency mining can be profitable, but several factors influence its profitability. These include the cost of hardware, electricity expenses, mining difficulty, and the price of the cryptocurrency being mined. It is essential to consider these factors before investing in cryptocurrency mining.

When it comes to cryptocurrency mining, profitability is influenced by several factors that every miner should consider before diving into the world of mining. These factors include network competition and upfront costs.

Network Competition

Network competition plays a crucial role in determining the profitability of cryptocurrency mining. With an increasing number of miners participating in the network, the competition becomes fierce, making it more difficult to mine new blocks and earn rewards. A higher level of competition means that miners have to invest in more powerful hardware and dedicate more resources to stay competitive.

To cope with the growing competition, miners need to continually upgrade their equipment and stay updated with the latest advancements in mining technology. By doing so, they can increase their chances of solving complex algorithms and earning rewards before their competitors do.

Upfront Costs

Another significant factor that directly impacts profitability is the upfront costs associated with cryptocurrency mining. Miners need to invest in specialized hardware, such as ASIC (Application-Specific Integrated Circuit) miners, to efficiently mine cryptocurrencies. The cost of these devices can range from hundreds to thousands of dollars.

Additionally, miners need to consider the cost of electricity, which can significantly impact their profitability. The electricity consumption of mining rigs can be substantial, especially when mining operations involve multiple high-powered devices running continuously. Miners should calculate the electricity costs and compare them with the potential mining rewards to determine whether mining is profitable in their specific circumstances.

Moreover, there are other expenses to consider, such as cooling equipment, maintenance, and operational costs. All of these upfront costs need to be factored in before embarking on a mining venture.

It’s essential to note that while these factors have a direct impact on profitability, they are not the only ones. Difficulty levels, cryptocurrency prices, and market trends are other crucial factors that can influence mining profitability. As the cryptocurrency landscape continues to evolve, miners need to stay informed and adapt their strategies accordingly to maximize their chances of profitability.

Is Cryptocurrency Mining Profitable?

Is Cryptocurrency Mining Profitable?

Current Profitability Of Bitcoin Mining

Bitcoin mining involves solving complex mathematical problems using computer processing power to validate and secure transactions on the blockchain. Miners compete to confirm the transaction and add a new block to the blockchain, for which they are rewarded with bitcoins.

current Profitability Of Bitcoin Mining

As of now, the profitability of Bitcoin mining depends on various factors such as the cost of electricity, mining hardware efficiency, and the current price of Bitcoin. The rewards for mining are halved approximately every four years, affecting the profitability of mining operations.

Tax Implications Of Cryptocurrency Mining

Tax Implications of Cryptocurrency Mining: Understanding the tax implications of cryptocurrency mining is crucial for miners to remain compliant with tax laws. One key aspect to consider is how mined cryptocurrency is treated by the IRS.

Treatment Of Mined Cryptocurrency By Irs

When you mine cryptocurrency, the IRS considers it as ordinary income. This means that the value of the cryptocurrency you mine is subject to taxation at your regular income tax rate. Let’s delve into how crypto mining income and staking rewards are taxed according to IRS guidelines:

| Income Type | Tax Treatment |

|---|---|

| Crypto Mining Income | Taxed as ordinary income on the day received |

| Staking Rewards | Treated similarly to mined cryptocurrency, taxed as ordinary income |

Frequently Asked Questions

How Do You Make Money From Crypto Mining?

To make money from crypto mining, you verify transactions on the blockchain and add new blocks of data, earning cryptocurrency as a reward. This can be done with specialized hardware or through cloud mining services.

How Do Crypto Miners Get Paid?

Crypto miners get paid by verifying transactions on the blockchain and adding new data blocks. They receive cryptocurrency rewards for their work, using specialized hardware or cloud mining services.

How Much Profit In Crypto Mining?

Crypto mining profit varies based on factors like equipment costs, electricity rates, and market conditions. Significant profits are possible, but success isn’t guaranteed due to high competition and costs.

Is Crypto Mining Earned Income?

Yes, crypto mining is considered earned income and is subject to income tax according to IRS guidelines. Mining rewards received in the form of cryptocurrency are treated as ordinary income and are taxable at your regular income tax rate.

Conclusion

Cryptocurrency mining can be profitable, but it requires significant investment and ongoing expenses. The potential for profit depends on factors such as energy costs, hardware efficiency, and market conditions. It’s essential to carefully consider these factors before venturing into cryptocurrency mining to ensure it’s a feasible and sustainable endeavor.