Cryptocurrency exchanges implement multi-factor authentication, encryption, and continuous monitoring for robust security measures. These strategies safeguard user data during transactions and interactions on exchange platforms.

In the ever-evolving landscape of digital assets, ensuring the security of cryptocurrency holdings is paramount to protect against potential threats and cyber risks. As the popularity of cryptocurrencies continues to grow, investors and traders are increasingly concerned about the safety of their digital assets.

Given the decentralized and digital nature of cryptocurrencies, security measures are crucial to prevent unauthorized access and potential breaches. Understanding the various security protocols and best practices implemented by cryptocurrency exchanges is essential for users to protect their investments and maintain trust in the digital ecosystem. By exploring the effective security measures and regulatory frameworks in place, individuals can navigate the cryptocurrency landscape with confidence and peace of mind.

Importance Of Cryptocurrency Exchange Security

The protection of digital assets in cryptocurrency exchanges is paramount due to the increasing risks of cyber threats and attacks. Ensuring robust security measures is crucial to safeguard users’ investments and prevent unauthorized access to sensitive information.

Role Of Encryption

Encryption plays a vital role in securing cryptocurrency transactions by converting data into a code that can only be deciphered with the proper key. It helps protect user information, private keys, and transaction details from potential cyber threats.

Multi-factor Authentication

Multi-Factor Authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of identification before accessing their accounts. Methods like biometric scanning and public key infrastructure enhance the security of cryptocurrency exchanges.

Credit: us.norton.com

Common Security Measures

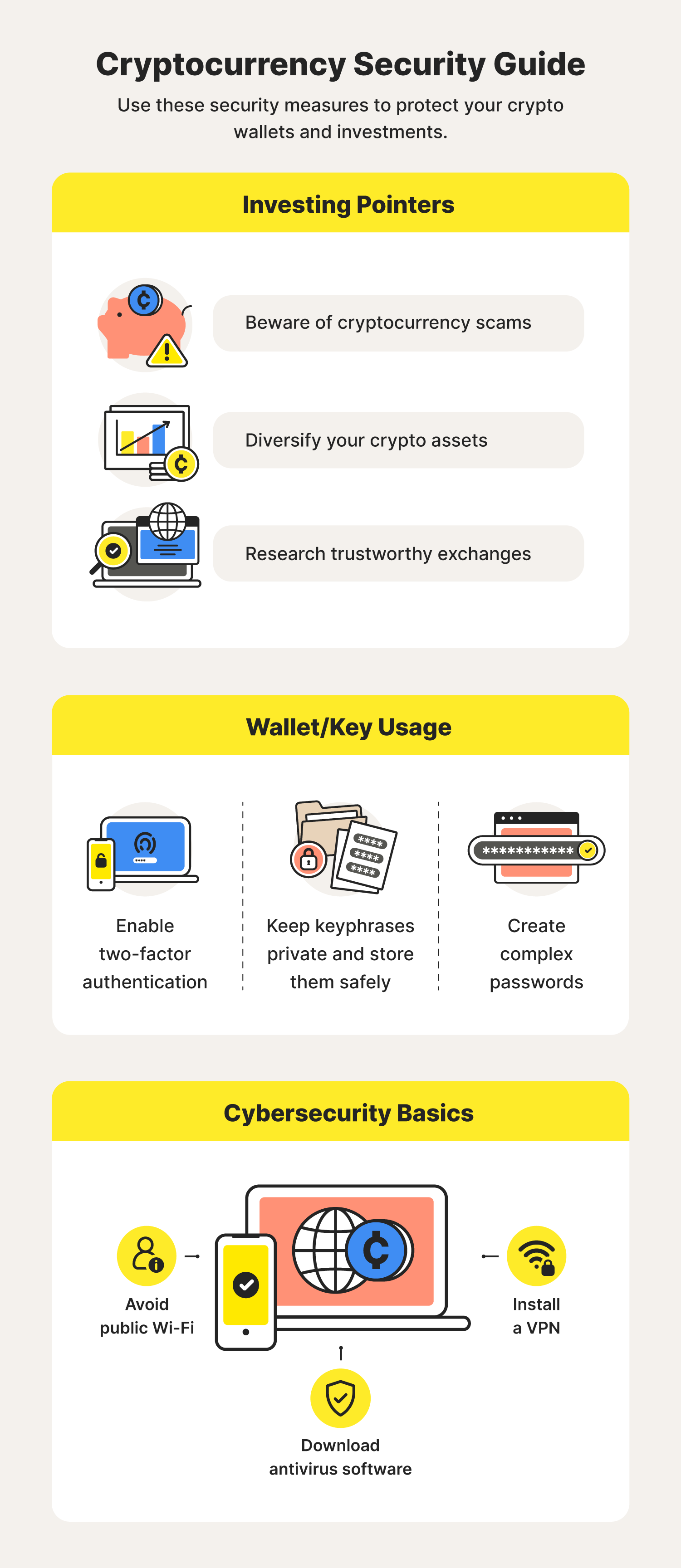

Cryptocurrency exchange security measures include two-factor authentication, complex passwords, encryption, and wallet security, to protect users’ data and transactions. Continuous monitoring, education on avoiding scams and phishing, and compliance with regulations also contribute to strengthening cryptocurrency security. Multi-factor authentication is increasingly used as a standard security measure, employing various identification methods like biometric scanning and public key infrastructure to safeguard crypto credentials from hacking and theft.

Complex Passwords

One of the most fundamental security measures for cryptocurrency exchanges is the use of complex passwords. Strong passwords are critical in protecting user accounts from unauthorized access. When creating a password, it is essential to use a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information such as birthdays or names. Additionally, do not use the same password for multiple accounts, as this increases the risk of a security breach. Remember, a strong and unique password is your first line of defense against hackers.

Wallet Security

Securing your cryptocurrency wallet is paramount to safeguarding your funds. Wallet security measures include using hardware wallets, which are offline devices specifically designed for storing cryptocurrencies. These hardware wallets provide an extra layer of protection by keeping your private keys offline and away from potential hackers. It is also crucial to regularly update your wallet software to ensure you have the latest security patches in place. Implementing these security measures will significantly mitigate the risk of losing your cryptocurrencies.

Continuous Monitoring

Continuous monitoring of cryptocurrency exchanges is essential to detect and respond to any potential security threats promptly. Exchange platforms employ advanced monitoring systems to track user activities, analyze transaction patterns, and identify any suspicious behavior. This continuous monitoring helps in detecting potential security breaches, unauthorized access attempts, or suspicious transaction activities. By proactively monitoring exchanges, potential security vulnerabilities can be identified and mitigated before they can cause substantial harm to the platform and its users.

Protecting Against Threats

When trading in cryptocurrencies, it’s crucial to implement robust security measures to safeguard your assets from potential threats. From phishing attacks to scams, and regulatory compliance, here are some essential strategies to protect your investments.

Phishing Vulnerability

Phishing remains a prevalent threat in the cryptocurrency space. Educate yourself and your team on how to identify and avoid phishing attempts to mitigate risks of unauthorized access to your accounts.

Avoiding Scams

Stay vigilant against cryptocurrency scams that target unsuspecting traders. Verify the legitimacy of platforms and projects before engaging, and never share your private keys with anyone.

Regulatory Compliance

Adhering to regulatory requirements is crucial for the long-term sustainability of cryptocurrency exchanges. Ensure continuous monitoring and compliance with laws to protect users and maintain the integrity of the market.

Cryptocurrency Transaction Security

Cryptocurrency exchange security measures encompass two-factor authentication, encryption, and robust wallet security protocols. Multi-factor authentication stands as a standard safeguard, offering diverse identification methods and shielding crypto credentials from potential theft. With advanced encryption techniques, exchanges secure users’ data during transactions and account interactions, ensuring enhanced protection.

Cryptography In Transactions

Cryptography plays a crucial role in maintaining the security of cryptocurrency transactions. Through the use of complex mathematical algorithms, this technology ensures that each transaction remains confidential and tamper-proof.

In a cryptocurrency transaction, cryptography is used to encrypt sensitive information such as the sender’s and recipient’s addresses, the transaction amount, and the transaction ID. This encryption makes it virtually impossible for unauthorized entities to access or modify the transaction details.

The use of cryptographic hash functions further strengthens transaction security. These functions generate a unique digital signature for each transaction, which acts as a proof of authenticity. By comparing the transaction signature with the stored signature, the recipient can verify the integrity of the transaction.

Ensuring Secure Cryptocurrency Transactions

When it comes to ensuring the security of cryptocurrency transactions, there are several measures that individuals and exchanges can take:

- Enable Multi-Factor Authentication: More and more, multi-factor authentication is becoming a security standard. By requiring multiple forms of identification, such as a password and a biometric scan, users can add an extra layer of protection to their crypto credentials.

- Create Complex Passwords: A strong password is essential for safeguarding cryptocurrency transactions. It is recommended to use a combination of uppercase and lowercase letters, numbers, and special characters, and to avoid using easily guessable information.

- Encrypt Wallets: Wallet encryption prevents unauthorized access to the private keys stored within the wallet. Choosing a wallet that supports encryption and regularly backing up wallet data can significantly enhance transaction security.

- Be Wary of Phishing Attacks: Phishing is a common attack vector used by cybercriminals to trick users into revealing their sensitive information. It is important to be cautious when clicking on suspicious links or providing personal information online.

- Stay Educated: Keeping up with the latest trends and developments in cryptocurrency security is crucial for protecting your transactions. By staying informed about potential scams and vulnerabilities, you can make better-informed decisions and minimize risks.

- Comply with Regulations: Cryptocurrency exchanges are subject to various regulatory requirements depending on the jurisdiction. Ensuring compliance with these regulations can help maintain the overall security and integrity of the cryptocurrency ecosystem.

- Implement Continuous Monitoring: Regularly monitoring transactions and account activities can help detect and prevent suspicious or fraudulent transactions. By identifying and addressing potential security breaches in real-time, users can mitigate any potential risks.

By implementing these security measures and adopting a proactive approach to transaction security, users can enhance the overall safety and trustworthiness of the cryptocurrency ecosystem.

Conclusion

In conclusion, cryptography plays a vital role in securing cryptocurrency transactions. By using encryption and cryptographic hash functions, transactions are protected from unauthorized access and tampering. Additionally, individuals and exchanges can take several security measures to further enhance transaction security. From enabling multi-factor authentication to staying educated about potential threats, proactive security practices can help safeguard cryptocurrency transactions.

Regulation Of Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms that allow users to trade digital currencies. Given the increasing popularity of cryptocurrencies, it’s crucial for exchanges to prioritize security measures to protect users’ assets and information. One important aspect of ensuring the security of cryptocurrency exchanges is regulation. Regulatory bodies play a key role in setting standards and guidelines for exchanges to follow, thereby enhancing transparency, reliability, and trust in the industry.

Regulatory Bodies In The Us

In the United States, a number of regulatory bodies oversee the operations of cryptocurrency exchanges. These include the Securities and Exchange Commission (SEC), which focuses on the regulatory aspects of securities and investments, and the Commodity Futures Trading Commission (CFTC), responsible for regulating the commodity futures and options markets. Additionally, the Financial Industry Regulatory Authority (FINRA) also plays a role in overseeing the activities of exchanges operating within the securities industry. The involvement of multiple regulatory bodies underscores the importance of compliance and adherence to established regulations for cryptocurrency exchanges in the US.

Global Regulations

Beyond the United States, cryptocurrency exchanges are subject to global regulations that vary by jurisdiction. While some countries have embraced cryptocurrencies and established specific regulatory frameworks, others have taken a more cautious approach or imposed stringent regulations. The diversity of global regulations highlights the complex landscape in which cryptocurrency exchanges operate. As a result, exchanges need to navigate and comply with a myriad of regulatory requirements to ensure their legitimacy and trustworthiness in the international market.

Credit: www.mxicoders.com

Exemplary Exchanges And Security Measures

When it comes to cryptocurrency exchange security, it’s crucial to choose platforms that prioritize protecting users’ assets. Several exchanges have placed a strong emphasis on security measures to ensure the safety of their customers’ investments. Let’s take a closer look at exemplary exchanges and the security measures they implement to safeguard users’ funds and information.

Etoro

eToro, a well-known cryptocurrency exchange platform, prioritizes security by employing stringent measures to protect users’ assets. They incorporate robust security protocols and regularly update their systems to mitigate potential vulnerabilities. With a focus on user protection, eToro has implemented multi-factor authentication and encryption methods to ensure secure transactions and account access.

Kraken

Kraken stands out as a prominent cryptocurrency exchange with a strong commitment to security. They have implemented a comprehensive security framework, including two-factor authentication, strong password requirements, and encryption of sensitive data. Kraken’s emphasis on continual security monitoring and compliance protocols demonstrates their dedication to maintaining a secure trading environment for their users.

Coinbase

Coinbase, a leading cryptocurrency exchange platform, places significant emphasis on security measures to safeguard users’ assets. In addition to their robust security infrastructure, Coinbase leverages wallet security features and educates users on avoiding potential scams and phishing attempts. Their proactive stance on compliance and regulatory standards contributes to creating a secure and reliable trading platform for cryptocurrency enthusiasts.

Strengthening Cryptocurrency Security

When dealing with cryptocurrency, it is crucial to prioritize security measures to safeguard your digital assets from potential threats. By implementing robust security practices, you can protect your investments and prevent unauthorized access to your funds. Here are some key strategies to enhance cryptocurrency security:

Be Aware Of Scams

Stay vigilant against fraudulent activities in the cryptocurrency space. Scammers often use deceptive tactics to trick users into sharing their sensitive information. Be cautious of phishing attempts and always verify the authenticity of any communication regarding your crypto assets.

Secure Wallet Usage

Utilize secure wallets to store your cryptocurrencies safely. Choose reputable wallets that offer strong encryption and multi-factor authentication for an added layer of protection. Keep your private keys offline and avoid sharing them with anyone.

Public Wi-fi Avoidance

Avoid accessing your cryptocurrency accounts on public Wi-Fi networks, as they are vulnerable to cyber attacks. Hackers can intercept your data on unsecured networks, putting your funds at risk. Use a secure connection, such as a virtual private network (VPN), when accessing your accounts remotely.

Adherence To Regulations

Ensure compliance with regulatory requirements when trading or investing in cryptocurrency. Familiarize yourself with the legal framework governing digital assets in your jurisdiction and adhere to industry standards to protect your investments. Stay informed about any changes in regulations to mitigate risks associated with non-compliance.

Importance Of Security In Cryptocurrency

Cryptocurrency exchanges prioritize security by implementing advanced encryption techniques to safeguard user data and transactions. Measures such as two-factor authentication, complex passwords, and continuous monitoring are crucial in protecting users’ cryptocurrency assets.

Protection Of Exchanges

Cryptocurrency exchanges play a vital role in the digital asset ecosystem, acting as platforms where individuals can buy, sell, and trade various cryptocurrencies. Given the sensitivity and value of these transactions, the security of these exchanges becomes paramount to safeguard users’ funds and information from potential threats.

Exchanges implement multiple security measures to protect their platforms and users, ensuring a safe and secure trading environment. These measures include:

- Two-factor authentication: By enabling two-factor authentication, users are required to provide an additional verification step, such as a unique code received on their smartphones, before accessing their accounts. This adds an extra layer of security, making it significantly harder for hackers to gain unauthorized access.

- Create complex passwords: Users are encouraged to create strong and unique passwords that are not easily guessable. A combination of uppercase and lowercase letters, numbers, and symbols is recommended to enhance the security of user accounts.

- Encryption: Cryptocurrency exchanges use encryption techniques to ensure that sensitive user data, such as passwords and financial information, is securely transmitted and stored. Encryption transforms the data into unreadable ciphertext, making it challenging for unauthorized individuals to decipher.

- Wallet security: To protect user funds, exchanges implement robust wallet security measures. These include offline cold storage wallets, multi-signature wallets, and hardware wallets. Reducing the exposure of funds to online platforms minimizes the risk of unauthorized access and theft.

- Continuous monitoring: Exchanges employ advanced monitoring systems to detect and prevent any suspicious activities or potential security breaches. Real-time alerts and automated security protocols help mitigate threats promptly.

- Phishing vulnerability education: Exchanges educate users about common phishing techniques and provide guidance on how to avoid falling victim to such attacks. Awareness and vigilance go a long way in ensuring the security of personal information and assets.

- Avoiding scams: Cryptocurrency exchanges actively work to identify and eliminate fraudulent activities within their platforms. Implementing strict verification processes and conducting thorough due diligence on listed projects help protect users from falling prey to scams.

- Compliance: Ensuring compliance with relevant regulatory frameworks and adopting industry best practices is crucial for exchanges. Adhering to compliance standards helps establish trust among users and provides an added layer of security.

Understanding Threats

As the cryptocurrency market continues to grow, threats to its security also evolve. It is essential to have a comprehensive understanding of these threats to effectively counter them. Common threats faced by cryptocurrency exchanges include:

- Cyber attacks: Hackers employ various techniques, such as DDoS attacks, malware, and phishing, to infiltrate exchange platforms and gain unauthorized access to user accounts and funds. Vigilant monitoring and proactive security measures are necessary to prevent such attacks.

- Insider threats: Internal employees with access to sensitive data can pose significant threats to exchanges. Strict access controls, regular audits, and employee awareness programs help minimize the risk of insider attacks.

- Social engineering: Attackers often try to manipulate individuals into disclosing confidential information or granting access to their accounts through social engineering techniques. Educating users about such tactics and promoting a culture of skepticism can mitigate the impact of social engineering attacks.

- Regulatory risks: Cryptocurrency exchanges operate in a regulatory environment that is still evolving. Adhering to evolving regulations and proactively addressing compliance requirements is crucial to avoid regulatory sanctions and maintain a secure operating environment.

- Market volatility: Rapid price fluctuations in the cryptocurrency market can also pose risks to exchanges and users. Ensuring proper risk management strategies and robust security measures help protect against potential losses associated with market volatility.

Credit: www.antiersolutions.com

Frequently Asked Questions

How Do You Ensure Security In Cryptocurrency?

To ensure security in cryptocurrency, use multi-factor authentication with strong passwords, encryption, secure wallets, and educate yourself on phishing and scams. Continuous monitoring and compliance with regulations are also crucial.

Which Security Measure Is Most Commonly Used To Protect Users Of Cryptocurrency?

The most commonly used security measure to protect cryptocurrency users is two-factor authentication. It adds an extra layer of security beyond just a password.

What Is The Security Of Cryptocurrency Transactions?

Cryptocurrency transactions are secured through encryption and authentication methods like two-factor authentication and complex passwords. Additionally, continuous monitoring and compliance measures are implemented to safeguard user data and prevent phishing attacks. These security measures are crucial for protecting transactions and ensuring the safety of cryptocurrency exchanges.

How Are Cryptocurrency Exchanges Regulated?

Cryptocurrency exchanges are regulated by entities such as the SEC, CFTC, and FINRA in the US.

Conclusion

In today’s digital landscape, ensuring cryptocurrency exchange security is paramount. Implementing multi-factor authentication and encryption are essential steps. Stay vigilant against potential threats and scams to protect your assets. Safeguarding your investments requires ongoing education and adherence to security best practices.

Trustworthy exchanges like eToro, Kraken, and Coinbase prioritize user safety.