Crypto trading strategies involve buying and selling cryptocurrencies within a day to capitalize on price changes. Day trading can be profitable with technical analysis skills and trend identification.

Cryptocurrency trading offers a dynamic landscape with various strategies. Beginners often opt for HODL and Dollar Cost Averaging for lower risk. Experienced traders leverage day trading, futures trading, and high-frequency trading. Understanding market trends, technical analysis, and risk management are crucial for successful crypto trading.

Implementing effective strategies can enhance profitability and mitigate risks in the fast-paced crypto market. Research, educate yourself, and stay updated on market dynamics to optimize your trading performance and achieve sustainable growth.

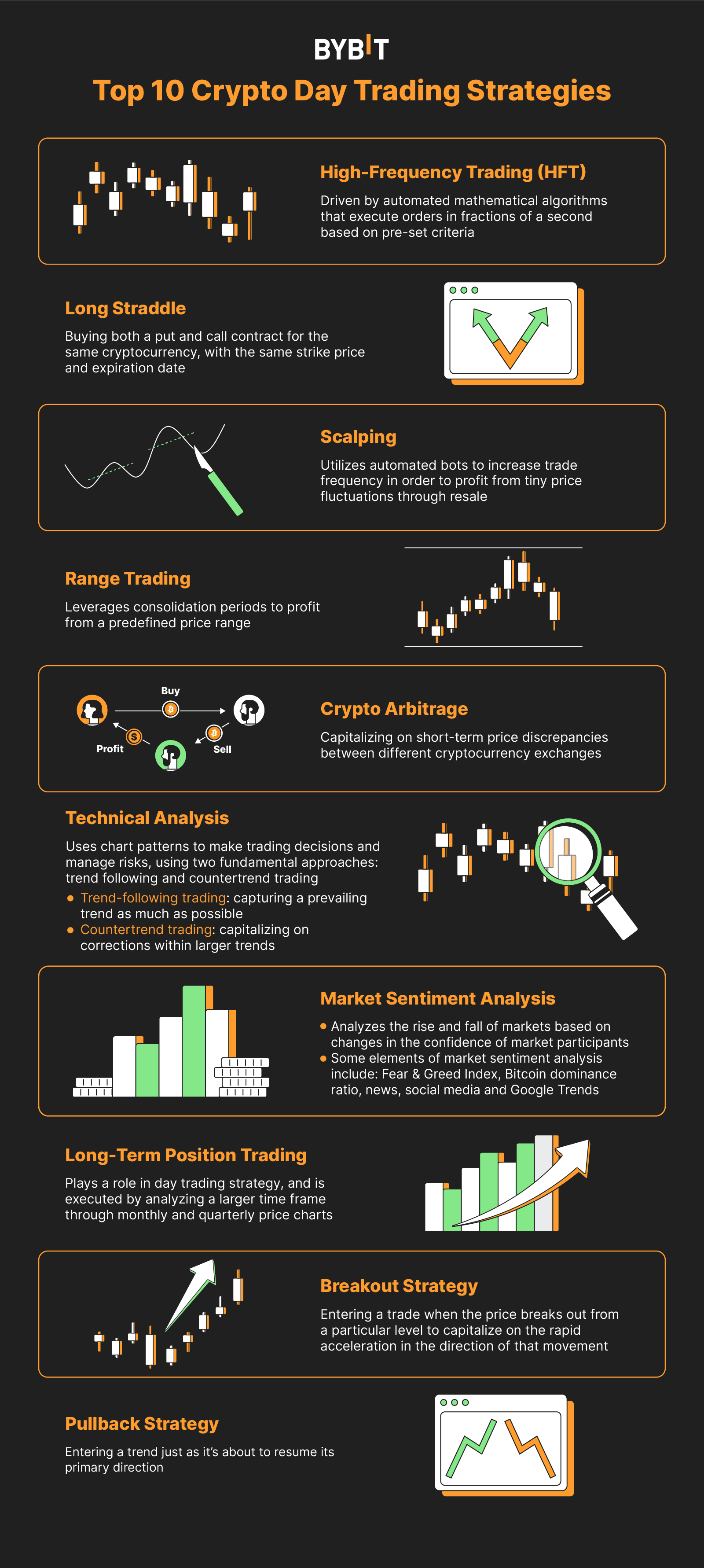

Day Trading Strategies

Day trading involves buying and selling cryptocurrencies within the same day, capitalizing on short-term price movements to make profits.

Taking Advantage Of Short-term Price Fluctuations

Day trading enables traders to profit from quick price changes in the cryptocurrency market.

Utilizing Technical Analysis And Identifying Trends And Patterns

Traders rely on technical analysis to spot trends and patterns, helping them make informed decisions.

Long-term Holding Strategies

Long-term holding strategies are a popular approach in crypto trading for investors who believe in the future potential of a particular cryptocurrency. These strategies involve holding onto assets for an extended period, usually years, with the expectation of substantial returns. Here, we will look at two common long-term holding strategies – the HODL (Hold On for Dear Life) strategy and the Dollar Cost Averaging (DCA) strategy for beginners.

Hodl (hold On For Dear Life) Strategy

The HODL strategy gained popularity during the early days of cryptocurrency trading and has since become a mantra for many investors. The principle behind HODL is simple: buy a cryptocurrency and hold onto it, regardless of short-term market fluctuations or price volatility.

The HODL strategy is based on the belief that over time, the value of a cryptocurrency will increase significantly, making it more profitable to hold onto the asset rather than engage in frequent buying and selling. This strategy requires patience and a long-term mindset, as it may take years for the cryptocurrency’s value to reach its full potential.

Dollar Cost Averaging (dca) Strategy For Beginners

For beginners looking to enter the world of crypto trading, the Dollar Cost Averaging (DCA) strategy is a simple and effective approach. DCA involves regularly investing a fixed amount of money into a cryptocurrency, regardless of its current price.

With DCA, an investor buys the same amount of a cryptocurrency at regular intervals, such as weekly or monthly. This strategy ensures that investments are made consistently over time, regardless of market conditions. By purchasing at different price points, DCA helps to reduce the impact of short-term price fluctuations and volatility.

One of the key advantages of the DCA strategy is that it removes the need to time the market. Instead of trying to predict the optimal entry point, investors can focus on accumulating assets over time, taking advantage of both high and low prices.

| Advantages of Long-Term Holding Strategies | Disadvantages of Long-Term Holding Strategies |

|---|---|

|

|

In conclusion, long-term holding strategies such as HODL and DCA provide investors with different approaches to crypto trading. The HODL strategy is based on the belief in the long-term potential of a cryptocurrency, while the DCA strategy allows beginners to enter the market consistently over time. Both strategies come with their own advantages and disadvantages, and investors should carefully consider their risk tolerance and investment goals before choosing a strategy.

Intraday Trading Strategies

Discover effective crypto trading strategies for intraday trading that can help you maximize profits. From analyzing trends and patterns to using leverage and managing risk, these strategies can be highly profitable if executed with careful consideration.

Intraday Trading Strategies

Intraday trading involves taking positions and exiting them within the same day. The primary goal is to book profits from intraday price movements.

Positions And Exits Within The Same Day

When engaging in intraday trading, traders enter and exit positions within a single day. This strategy allows traders to capitalize on short-term market movements.

Aiming To Book Profits Amid Intraday Price Movements

Traders focus on capturing small price changes throughout the day to maximize profits. This strategy requires swift decision-making and close monitoring of the market.

Ensure you have a solid understanding of technical analysis and market trends to successfully implement intraday trading strategies.

Credit: learn.bybit.com

Advanced Trading Strategies

Enhance your crypto trading game with advanced trading strategies for maximum profit potential. Dive into innovative techniques and tactics to navigate the dynamic world of cryptocurrency trading effectively. Master the art of strategic decision-making to stay ahead in the competitive crypto market landscape.

When it comes to crypto trading, advanced strategies can give traders an edge in the market. These strategies require a deeper understanding of market trends and technical analysis. In this section, we will explore some of the most popular advanced trading strategies used by experienced traders.

Arbitrage

Arbitrage is a strategy that involves taking advantage of price differences between different exchanges or markets. Traders execute trades simultaneously in two or more markets to profit from the temporary price discrepancy. This strategy relies on quick execution and requires a sophisticated trading system to identify and seize arbitrage opportunities.

Swing Trading, Scalping, And Other Advanced Methods

Swing trading is a strategy that aims to capture short to medium-term price movements. Traders look for price swings or trends and enter or exit positions based on these movements. This strategy requires technical analysis skills to identify potential entry and exit points.

Scalping, on the other hand, is a strategy that focuses on making small profits from frequent trades. Traders look for quick price movements and execute trades for small gains. This strategy requires quick decision-making, as well as advanced risk management techniques.

In addition to swing trading and scalping, there are other advanced methods that experienced traders employ. These include algorithmic trading, which involves using computer programs to execute trades based on predefined conditions, and options trading, which allows traders to profit from price fluctuations without actually owning the underlying asset.

It’s important to note that advanced trading strategies carry higher risks compared to basic strategies. Traders need to have a solid understanding of market dynamics and risk management techniques before implementing these strategies. Furthermore, it’s crucial to constantly analyze and adapt these strategies to ever-changing market conditions.

Risk Management In Crypto Trading

Risk management is an indispensable aspect of crypto trading that every trader must prioritize. Cryptocurrency markets are known for their volatility, which makes it crucial for traders to implement effective risk management strategies to protect their capital. Here, we’ll delve into essential risk management techniques for crypto trading, including utilizing stop-loss orders and implementing position size and leverage strategies.

Utilizing Stop-loss Orders

Stop-loss orders are a fundamental tool for minimizing losses and managing risk in crypto trading. By setting a predefined price at which a trade will automatically be closed, traders can mitigate potential downsides and protect their capital. This strategic approach allows traders to establish an exit plan, safeguarding their investments in the event of adverse price movements.

Implementing Position Size And Leverage Strategies

Effective risk management in crypto trading also involves implementing position size and leverage strategies. Traders must carefully assess the size of their positions relative to their overall capital to avoid overexposure to market fluctuations. Additionally, leveraging strategies should be employed judiciously, taking into account the potential impact on risk and overall portfolio management.

Credit: www.linkedin.com

Factors Influencing Crypto Trading Strategies

When devising crypto trading strategies, factors such as market volatility, risk tolerance, and technical analysis play a vital role. Traders must consider diverse elements, including market trends and news, to formulate effective strategies that align with their investment objectives and risk assessment.

Understanding these factors is crucial for successful implementation of crypto trading strategies.

Market Trends And Analysis

Market trends and analysis play a crucial role in determining crypto trading strategies. Traders need to constantly analyze the market to identify patterns, trends, and price movements that can help them make informed trading decisions. By monitoring market trends, traders can identify potential entry and exit points, determine the best time to buy or sell cryptocurrencies, and maximize profits.

There are various technical analysis tools and indicators that traders use to analyze market trends, such as moving averages, relative strength index (RSI), and Bollinger Bands. These tools help traders identify support and resistance levels, trend reversals, and price fluctuations, which are essential in developing effective trading strategies.

Additionally, traders often rely on market sentiment and investor psychology to gauge the overall market direction. By understanding the sentiment of other traders and investors, traders can adjust their strategies accordingly to align with market trends and sentiments.

Impact Of News And Global Events On Trading Decisions

The crypto market is highly influenced by news and global events. News about regulatory changes, technological advancements, partnerships, and market developments can significantly impact the prices of cryptocurrencies. Traders need to stay updated with the latest news and events and assess their potential impact on the market.

When significant news or events occur, there is often increased volatility in the market, resulting in rapid price movements. Traders can take advantage of these price fluctuations by developing strategies that capitalize on market reactions to news. For example, some traders may adopt a “buy the rumor, sell the news” strategy, where they anticipate market movements based on speculation and then quickly exit their positions when the news is officially announced.

Moreover, global events such as economic crises, geopolitical tensions, and macroeconomic indicators can also impact the crypto market. For instance, when there is a global financial crisis, investors may flock to cryptocurrencies as a safe haven asset, driving up prices. Traders need to consider these external factors when formulating their trading strategies.

Credit: www.coindesk.com

Frequently Asked Questions

What Is The Most Successful Crypto Trading Strategy?

The most successful crypto trading strategy is day trading, involving buying and selling within the same day to capitalize on short-term price fluctuations. It can be highly profitable with good technical analysis and trend identification skills.

Can You Make $100 A Day With Crypto?

To potentially make $100 a day with crypto, utilize day trading strategies on the same day.

What Is The Most Profitable Type Of Crypto Trading?

Day trading is the most profitable type of crypto trading. It involves buying and selling within the same day, taking advantage of short-term price fluctuations. If you have a good understanding of technical analysis, this strategy can be highly profitable.

Which Crypto Trading Strategy Is Best For Beginners?

For beginners, two recommended crypto trading strategies are HODL and Dollar Cost Averaging (DCA). These strategies are relatively low risk and easy to implement. HODL involves holding on to your investments for the long term, while DCA involves regularly buying a fixed amount of cryptocurrency regardless of its price.

Conclusion

In the ever-evolving world of cryptocurrency trading, implementing effective strategies is essential. Diving into day trading, understanding technical analysis, and grasping short-term price fluctuations can lead to profitable outcomes. Embracing beginner-friendly methods like HODL and Dollar Cost Averaging can help navigate the volatile market landscape with relative ease.

Mastering these strategies is key to success in the crypto realm.

Pavel Zelenka is a seasoned expert in the realms of long-term and value capital investment, as well as angel investing. With a robust background in finance and strategic investment, Pavel Zelenka has distinguished herself as a trusted advisor in the dynamic landscape of wealth creation. Her expertise in long-term investment strategies involves a meticulous approach to identifying opportunities that align with sustained growth and value creation over time. Additionally, Pavel Zelenka excels in valuing capital investments, employing a comprehensive understanding of market trends and asset valuation to guide her decision-making process.

Furthermore, as an angel investment expert, Pavel Zelenka actively engages in supporting and nurturing early-stage ventures. Her keen eye for promising startups, coupled with a strategic approach to angel investing, positions her as a valuable mentor for entrepreneurs seeking not just financial backing but also strategic guidance. Pavel Zelenka’s contributions to the fields of long-term investment, capital valuation, and angel investing underscore her commitment to fostering sustainable growth and innovation in the financial landscape.