Looking for successful crypto trading strategies? Prioritize liquidity, conquer emotions, diversify, and stick to your plan.

These basic tips can help you minimize risk and maximize gains in the crypto market. Crypto trading involves various approaches, from day trading to long-term holding strategies like HODLing. Effective trading strategies can make a significant difference in your crypto investment journey.

By understanding market trends, leveraging tools, and managing risks, you can enhance your chances of success in the dynamic world of cryptocurrency trading. Whether you are a beginner or an experienced trader, having a well-defined strategy tailored to your goals and risk tolerance is crucial for navigating the volatile crypto market effectively.

Credit: learn.bybit.com

Basic Cryptocurrency Investment Strategies

When delving into the world of cryptocurrency trading, having a solid investment strategy is paramount to success. Understanding basic principles can help navigate the volatile market effectively.

Prioritize Liquidity

Maximize your ability to buy and sell by prioritizing liquid assets. Choose cryptocurrencies with high trading volume to avoid liquidity issues.

Conquering Emotions

Emotions like fear and greed can cloud judgment. Stick to your strategy and avoid impulsive decisions based on market fluctuations to mitigate risks.

Diversification

Diversify your investment across different cryptocurrencies to spread risk. It can help offset losses in one asset with gains in others.

Dollar-cost Averaging

Consistently invest a fixed amount at regular intervals. This strategy reduces the impact of price volatility by averaging out the cost of investment over time.

Tax-loss Harvesting

Optimize your tax liabilities by selling losing assets to offset gains. Strategic tax-loss harvesting can enhance overall returns while managing tax obligations.

Stick To Your Strategy

Maintain discipline and adhere to your predetermined investment plan. Avoid succumbing to market hype or FOMO by staying focused on your long-term objectives.

Credit: www.coindesk.com

Most Profitable Forms Of Crypto Trading

When it comes to crypto trading, there are various strategies that traders can employ to maximize profit. Whether you are looking for long-term growth or short-term gains, understanding the most profitable forms of crypto trading is essential. In this article, we will explore two popular strategies that have proven to be highly lucrative: Long-Term Growth with Bitcoin (BTC) and Short-Term Trading with Internet Computer (ICP) and Solana (SOL).

Long-term Growth With Bitcoin (btc)

If you are looking for less risky long-term growth, Bitcoin (BTC) is probably the most profitable cryptocurrency for you to invest in.

Bitcoin has consistently shown strong growth over the years, making it a preferred choice for many crypto investors. Its limited supply and increasing demand have contributed to its upward trajectory. By holding onto Bitcoin for an extended period, investors have the potential to reap substantial profits.

However, it is important to remember that the crypto market is volatile, and there are risks associated with any investment. It is crucial to conduct thorough research and make informed decisions when investing in Bitcoin.

Short-term Trading With Internet Computer (icp) And Solana (sol)

For traders who prefer short-term gains, Internet Computer (ICP) and Solana (SOL) offer exciting opportunities.

ICP and SOL have gained significant attention in recent years for their impressive price performances and potential for quick profits. These cryptocurrencies have shown substantial volatility, creating ample opportunities for traders to capitalize on price movements.

However, it is important to note that short-term trading comes with higher risk due to increased price volatility. Traders must stay vigilant and be prepared to react quickly to market changes.

To maximize profits in short-term trading, it is crucial to implement appropriate risk management strategies. This includes setting stop losses, monitoring the market closely, and having a clear entry and exit plan.

By understanding the different strategies available and staying informed about market trends, traders can increase their chances of profitability in the crypto market. Whether you choose long-term growth with Bitcoin or opt for short-term trading with ICP and SOL, it is essential to approach crypto trading with caution and always remember to invest only what you can afford to lose.

Hodl Strategy

HODL is a popular crypto trading strategy where investors hold onto their cryptocurrencies long-term, anticipating value growth despite market fluctuations. The approach involves resisting the impulse to sell during downturns in anticipation of long-term gains.

Understanding Hodl Strategy

In the world of crypto trading, there are various strategies that traders employ to maximize their profits. One popular strategy is the HODL strategy. HODL (which stands for “Hold On for Dear Life”) is a long-term holding strategy where investors buy and hold onto their cryptocurrencies for an extended period of time, regardless of short-term market fluctuations.

With the HODL strategy, investors believe in the long-term value of their chosen cryptocurrencies. They resist the urge to sell during market downturns, believing that the value will eventually rise. This strategy is based on the assumption that cryptocurrencies will continue to gain value over time.

Benefits Of Long-term Holding

Long-term holding, as a crypto trading strategy, offers several benefits to investors:

- 1. Minimizes the impact of market volatility: By holding onto their cryptocurrencies for the long term, investors are less affected by short-term price fluctuations. They are focused on the potential long-term growth of their investments.

- 2. Maximizes potential gains: The HODL strategy allows investors to benefit from long-term price appreciation. By holding onto their cryptocurrencies, they can potentially capture significant gains when the market rises.

- 3. Reduces transaction costs: Holding onto cryptocurrencies means fewer transactions, which translates to reduced transaction fees. This can be especially beneficial for traders who engage in frequent buying and selling.

- 4. Saves time and effort: Long-term holding requires less active management and monitoring compared to other trading strategies. Investors can focus on their other activities while still having the potential to profit from the rise in cryptocurrency prices.

Overall, the HODL strategy is favored by many crypto traders who believe in the long-term potential of cryptocurrencies. By holding onto their investments through market ups and downs, they aim to reap the benefits of long-term price appreciation and minimize the impact of short-term volatility. So, if you’re considering a crypto trading strategy, don’t overlook the power of HODL.

Credit: arbismart.com

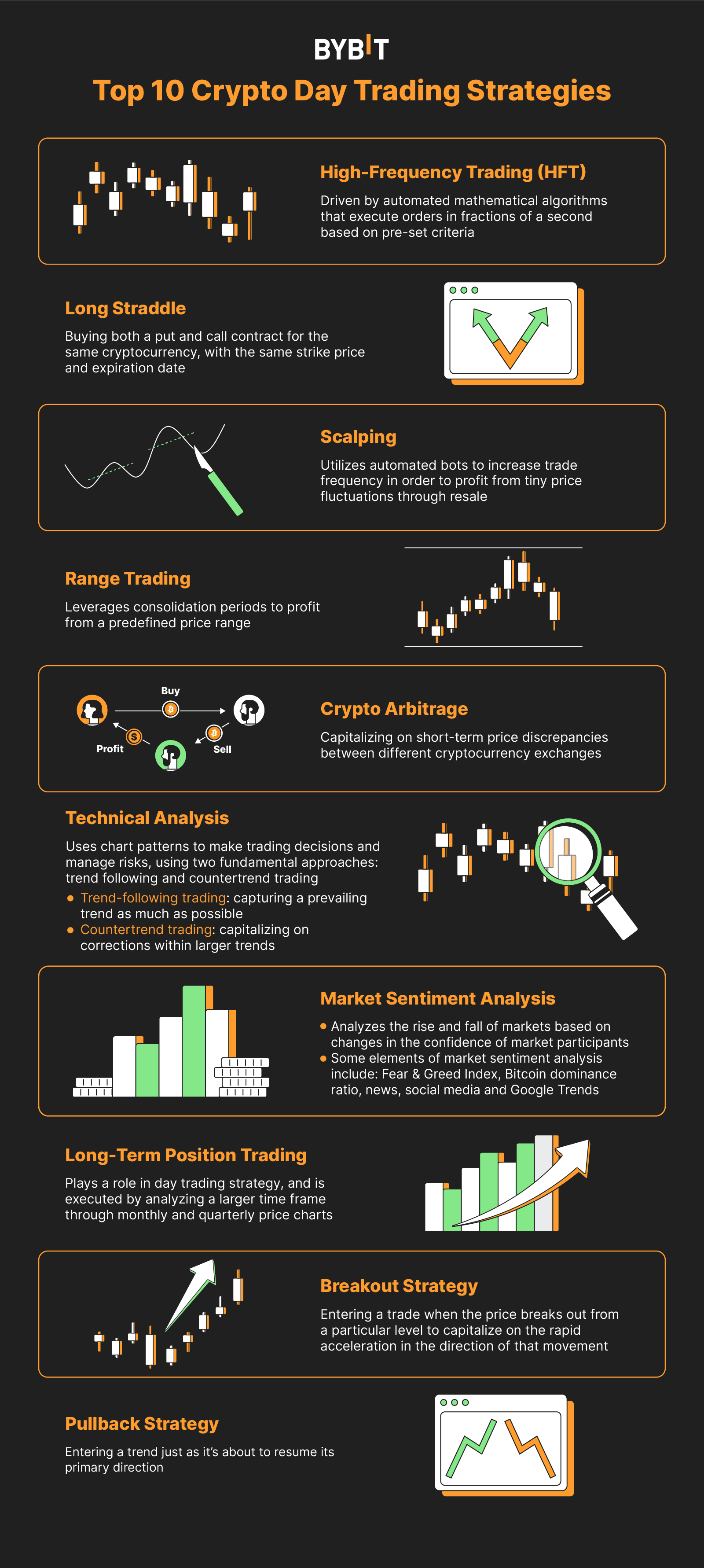

Crypto Day Trading Strategies

Day trading in the cryptocurrency market involves executing trades within the same day to take advantage of short-term price fluctuations. This strategy requires a specific trading setup, the ability to manage drawdowns, accurate entries, effective stop-loss placement, and appropriate position sizing. Let’s delve deeper into these aspects.

Trading Setup

A successful day trading setup begins with selecting a reliable platform that offers real-time data, advanced charting tools, and a user-friendly interface. It’s important to have access to accurate market information to make informed trading decisions. Additionally, having a stable internet connection and a suitable computer setup is crucial to avoid technical glitches during trading sessions.

Long Position Strategy

A long position strategy involves buying a cryptocurrency with the expectation that its price will rise. To execute this strategy effectively, it’s important to identify trending cryptocurrencies with positive market sentiment and strong fundamentals. Conducting thorough research, analyzing price patterns, and keeping an eye on market news can help in making informed decisions about which cryptocurrencies to buy and hold for the day.

Drawdowns

Drawdowns are inevitable in day trading. They refer to the temporary decline in portfolio value during losing trades. The key to managing drawdowns is to set realistic profit targets and stop-loss levels. Additionally, it’s essential to maintain emotional discipline and not let losses affect decision-making. Having a well-defined risk management plan in place helps in minimizing the impact of drawdowns.

Entries

Accurate entries are crucial to maximize profits and minimize losses in day trading. It’s important to identify entry points that align with the overall market trend and show potential for price appreciation. Traders often use technical indicators, such as moving averages, relative strength index (RSI), or stochastic oscillators to identify favorable entry signals. However, it’s essential to combine technical analysis with fundamental analysis to make well-informed entry decisions.

Stop Loss

Placing a stop-loss order is a vital risk management strategy in day trading. It helps protect traders from significant losses in case the trade moves against their expectations. Traders should determine their acceptable risk level and set the stop-loss order at a price point that, if reached, would signal that their trading thesis is invalidated. It’s crucial to stick to the predetermined stop-loss level and not let emotions dictate decision-making.

Position Sizing

Proper position sizing is essential to manage risk in day trading. Traders should allocate a percentage of their trading capital to each trade based on their risk tolerance. It’s important to avoid overexposing oneself to a single trade by not investing a significant portion of the trading capital. Implementing a position sizing method, such as the Kelly criterion or fixed ratio, helps in systematically determining the appropriate position size for each trade.

Effective Tools And Software For Crypto Trading

Daily Analysis And Finding Trades

Crypto trading requires staying up-to-date with market movements and trends. Utilizing daily analysis tools, traders can identify potential trades and capitalize on market opportunities. Such tools can include technical analysis indicators, price action patterns, and market sentiment analysis to make informed trading decisions.

Using Leverage

Utilizing leverage can amplify the potential returns in crypto trading. However, it is crucial to exercise caution and employ risk management strategies when using leverage. Traders can utilize leverage through margin trading on platforms to amplify their trading positions and potentially enhance profitability.

Delta Neutral Strategy

The delta neutral strategy involves creating a hedged position to mitigate the directional risk of the underlying asset. By balancing the risk exposure, traders aim to profit from volatility without speculating on the price direction. This strategy requires the use of options and derivatives to maintain a neutral market exposure.

Altcoin Trading Strategies

Crypto traders often find opportunities in altcoins, the alternative cryptocurrencies to Bitcoin, and develop unique strategies to capitalize on their fluctuations. Understanding market cap, micro cap opportunities, and other crucial factors play a significant role in formulating successful altcoin trading strategies. Below are essential insights into altcoin trading strategies.

Understanding Market Cap

Market capitalization (market cap) reflects the total value of a cryptocurrency. It’s calculated by multiplying its current price by the total number of coins in circulation. Understanding market cap is crucial in evaluating the potential growth and risk associated with an altcoin investment.

Micro Cap Opportunities

Micro cap altcoins refer to cryptocurrencies with relatively low market capitalization. These coins often present high growth potential, but they also come with higher volatility and risk. Traders seeking micro cap opportunities must conduct thorough research and analysis to identify promising assets for potential investment.

When engaging in altcoin trading, traders should diversify their portfolio, prioritize liquidity, and use dollar-cost averaging to minimize risks. Furthermore, they should adopt a disciplined approach and manage emotions to avoid impulsive decisions. These strategies can help navigate the complex and dynamic altcoin market successfully.

Advanced Crypto Trading Strategies

Cryptocurrency trading offers various advanced strategies for experienced traders. These strategies go beyond the basics and require a deeper understanding of the market dynamics. Let’s explore some of the key advanced strategies in crypto trading:

Arbitrage

Involves exploiting price differences of the same cryptocurrency across different exchanges to make a profit.

Swing Trading

Focuses on capturing short to medium-term gains in a cryptocurrency’s price movements, based on technical analysis.

Scalping

Involves making quick trades to profit from small price changes, often aiming for multiple trades within a short timeframe.

Frequently Asked Questions

Can You Make $100 A Day With Crypto?

Yes, it is possible to make $100 a day with crypto trading by using effective strategies and staying informed about market trends and opportunities.

How Do You Trade Crypto Successfully?

To trade crypto successfully, prioritize liquidity, control emotions, invest wisely, diversify, and stick to your strategy. It’s essential to minimize risk and take advantage of tax-loss harvesting. Additionally, consider the long-term growth of Bitcoin or short-term trading in Internet Computer or Solana.

What Is The Best Strategy To Make Money In Crypto?

To profit in crypto, prioritize liquidity, conquer emotions, invest wisely, diversify, use dollar-cost averaging, and stick to your strategy.

What Is The Most Profitable Form Of Crypto Trading?

The most profitable form of crypto trading depends on your investment goals. For long-term growth, Bitcoin (BTC) is a popular choice. If you prefer short-term trading, Internet Computer (ICP) or Solana (SOL) may offer more profitable opportunities. Diversification and sticking to a strategy are key for success.

Conclusion

To thrive in crypto trading, diversify, stick to strategy, manage emotions, and prioritize liquidity. Aim for long-term growth with Bitcoin or seek short-term profits with altcoins. Embrace HODL strategy for lasting value and resist market fluctuations. Explore various trading tools and stay informed for success.