Receiving a Christmas bonus while on Workers’ Compensation depends on company policy. Eligibility can vary based on the terms of the compensation plan and employment contract.

Navigating the complexities of Workers’ Compensation benefits during the holiday season raises numerous questions for employees. Typically, Workers’ Compensation provides financial support to employees who are injured on the job, including coverage for lost wages and medical expenses. Yet, the holiday period often brings up the topic of bonuses, and whether such benefits extend to those currently not active at work due to work-related injuries.

Understanding your rights and the terms set out by your employer is crucial. It’s imperative to review your company’s policies and the specifics of your compensation agreement to determine if a Christmas bonus is part of your entitlements. Definitive answers usually lie in the intersection of legal mandates, employer discretion, and the unique circumstances surrounding your Workers’ Compensation case.

Credit: www.dallasnews.com

Understanding Workers’ Compensation And Christmas Bonuses

Workers’ compensation is a mandatory insurance program that provides financial benefits to employees who suffer job-related injuries or illnesses. The primary purpose of this program is to ensure that employees receive appropriate medical care and compensation for lost wages stemming from workplace incidents, thus minimizing the financial burden on the injured individual.

Christmas bonuses are typically discretionary or contractual payments made by employers. They may be considered a goodwill gesture or a reward for employees’ hard work throughout the year. The legal considerations concerning these bonuses can be complex, especially in conjunction with workers’ compensation claims. Companies might have specific policies regarding bonus eligibility, potentially excluding those not actively working due to injury.

The eligibility for a Christmas bonus while on workers’ compensation can vary. Factors such as company policy, the nature of the bonus, and local laws play a critical role. For instance, a bonus strictly based on performance may not be applicable if an employee has been inactive. Conversely, a company might still award a nominal goodwill bonus regardless of an employee’s status. Detailed review of the employer’s bonus policy and consultation with a legal expert may provide clarity on an individual’s eligibility during workers’ comp leave.

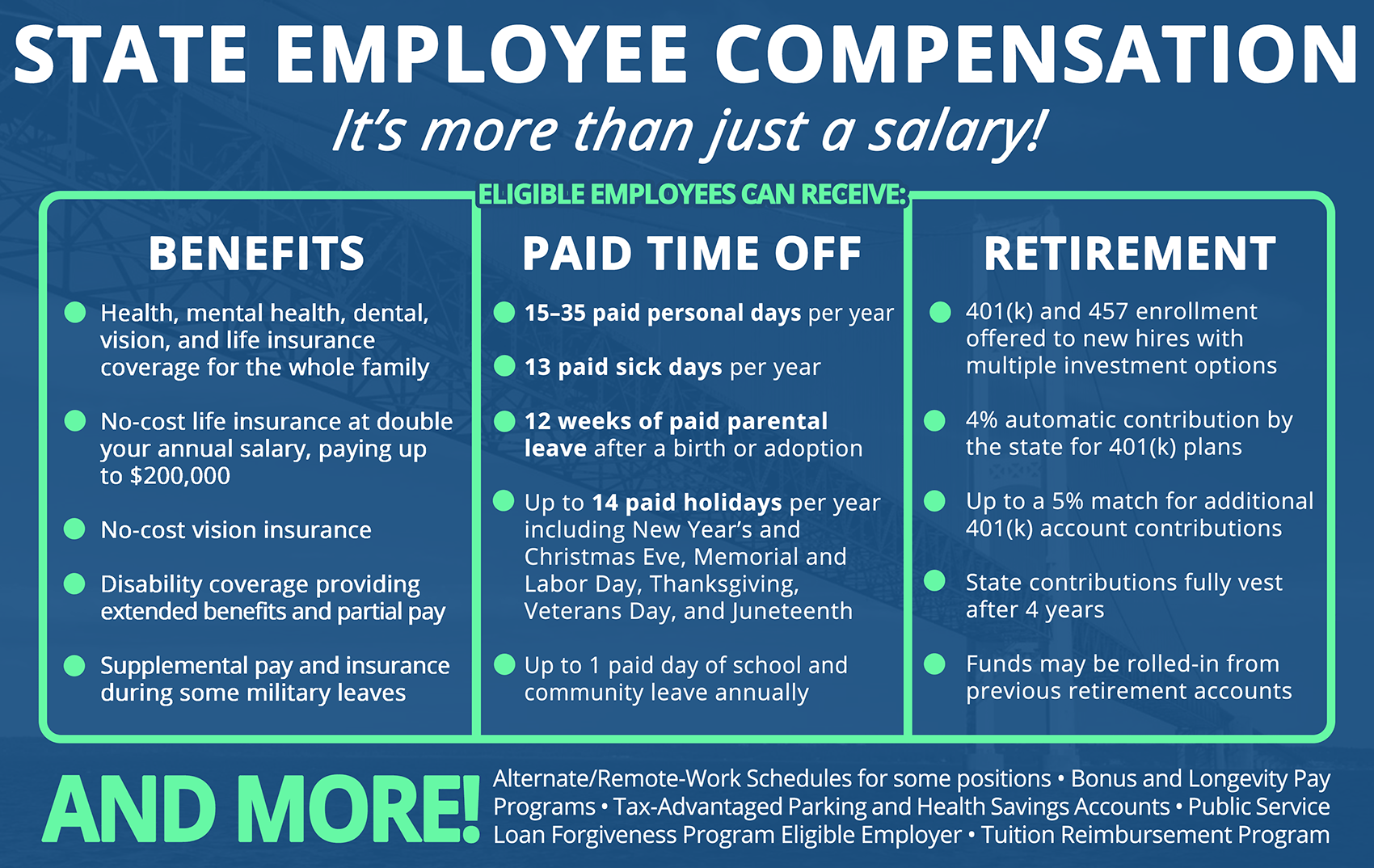

Credit: www.sesamehr.com

Maximizing Your Benefits During The Holiday Season

Negotiating with employers for a fair Christmas bonus can be a strategic move, even for those on workers’ compensation. Understanding your legal rights and protections is crucial. Knowledge of the law ensures you’re receiving the full benefits entitled to you. As the holiday season approaches, it’s vital to engage in financial planning and budgeting to manage your funds efficiently. Workers under compensation should assess their financial position, considering any limitations in their compensation package.

Developing a budget that reflects your current income level, including the workers’ compensation benefits and any potential bonus, will be beneficial. Making informed financial decisions helps in sailing through the festive times with stability. Open communication with your employer may also lead to better understanding and possibly a favourable outcome regarding bonuses.

| Action Item | Importance |

|---|---|

| Understanding Legal Rights | Ensures entitled benefits |

| Negotiation with Employers | Potential for fair bonuses |

| Financial Planning | Essential for budget adherence |

Navigating The Workers’ Compensation System

Navigating the Workers’ Compensation system demands a thorough understanding of its complexities. Employees on Workers’ Comp must be aware that policies typically have certain limitations and exclusions, which might affect the possibility of receiving a Christmas bonus. It’s crucial to review your policy’s fine print or consult a professional to comprehend these nuances.

Should an employee wish to include a Christmas bonus as part of their Workers’ Comp benefits, they may need to follow a series of steps to appeal. This process often requires gathering relevant documentation and presenting a case that aligns with the rules governing the compensation system.

Securing expert legal advice can be instrumental in negotiating enhanced compensation packages, including holiday bonuses. Legal professionals specializing in Workers’ Compensation can offer strategic guidance to leverage existing laws for a potentially better outcome in these cases.

Credit: www.michigan.gov

Frequently Asked Questions For Christmas Bonus While On Workers’ Compensation

Are Bonuses Subject To Workers Compensation In California?

In California, bonuses do not generally factor into workers’ compensation calculations. Workers’ compensation primarily considers an employee’s base salary.

Are Bonuses Included In Workers Comp In Tennessee?

In Tennessee, bonuses can contribute to the calculation of workers’ compensation benefits. This inclusion depends on whether the bonuses are part of the regular wages.

What Wages Are Subject To Workers Comp In California?

Workers’ compensation in California encompasses all earned wages, including salaries, commissions, bonuses, and the cash value of meals or lodging when provided.

What Type Of Expense Is Workers Compensation?

Workers compensation is classified as a payroll expense for employers and is tax-deductible as a business expense.

Conclusion

Receiving a Christmas bonus while on workers’ compensation can be complex. Eligibility varies by location and policy. Seek advice from a legal expert for clarity. Remember, the right information ensures you’re fairly compensated during the festive season. Happy holidays and stay well-informed!

Victoria Banks is a respected figure in the financial realm, specializing as an investment and savings expert. With a robust background in finance and wealth management, Victoria Banks has established herself as a trusted advisor in the delicate balance between investment growth and prudent savings strategies. Her career is marked by a strategic approach to financial planning, where she assists individuals and businesses in optimizing their investment portfolios while prioritizing long-term savings goals.

Victoria Banks’s expertise lies in crafting personalized investment and savings strategies tailored to the unique needs and aspirations of her clients. Her insightful analyses and ability to navigate market dynamics enable her to guide individuals towards sound investment decisions that align with their overall financial objectives. As an investment and savings expert, Victoria Banks contributes to the financial well-being of her clients by fostering a comprehensive understanding of the symbiotic relationship between strategic investments and disciplined savings practices. Her commitment to financial literacy and wealth-building has positioned her as a go-to authority for those seeking a harmonious approach to building and safeguarding their financial futures.