Diversification reduces risk by spreading investments across various assets. It helps achieve more stable and reliable returns.

Investing in a single asset class can be risky. Diversification, the practice of spreading investments across different asset types, can mitigate this risk. By allocating funds into stocks, bonds, real estate, and other assets, investors can protect their portfolios from market volatility.

This strategy ensures that poor performance in one area doesn’t drastically impact overall returns. Diversification also provides opportunities for growth in different market conditions. It’s a key principle for building a resilient investment portfolio. Understanding the benefits of diversification can help investors make smarter decisions and achieve long-term financial goals.

Credit: www.pacificlife.com

Introduction To Diversification

Investing can be risky. Diversification helps reduce that risk. It involves spreading your investments. This way, if one fails, others might succeed. Diversification is a key strategy for smart investors. It balances potential gains and losses.

Concept And Benefits

Diversification means putting your money in different places. Think of it as not putting all your eggs in one basket. Each type of investment has its own risks and rewards. By mixing them, you protect yourself.

Here are some benefits of diversification:

- Risk Reduction: Losses in one area can be offset by gains in another.

- Steady Returns: A diverse portfolio can provide more stable returns.

- Flexibility: You can adjust your investments as markets change.

Historical Context

Diversification has been used for centuries. Early traders spread their goods across many ships. This way, losing one ship didn’t mean losing everything. The same idea applies to investments.

In the 1950s, economist Harry Markowitz formalized the concept. He introduced the Modern Portfolio Theory. His work showed how diversification can optimize returns. Today, it’s a fundamental principle in finance.

Look at the table below to see how diversification affects risk and return:

| Portfolio Type | Risk Level | Expected Return |

|---|---|---|

| Single Stock | High | Variable |

| Diversified Portfolio | Lower | More Stable |

As shown, a diversified portfolio tends to have lower risk. It offers more stable returns compared to a single stock.

Credit: infinityinvesting.com

Types Of Diversification

Diversification is crucial for a balanced investment portfolio. It helps reduce risk and improve returns. There are different types of diversification. Let’s explore them.

Asset Classes

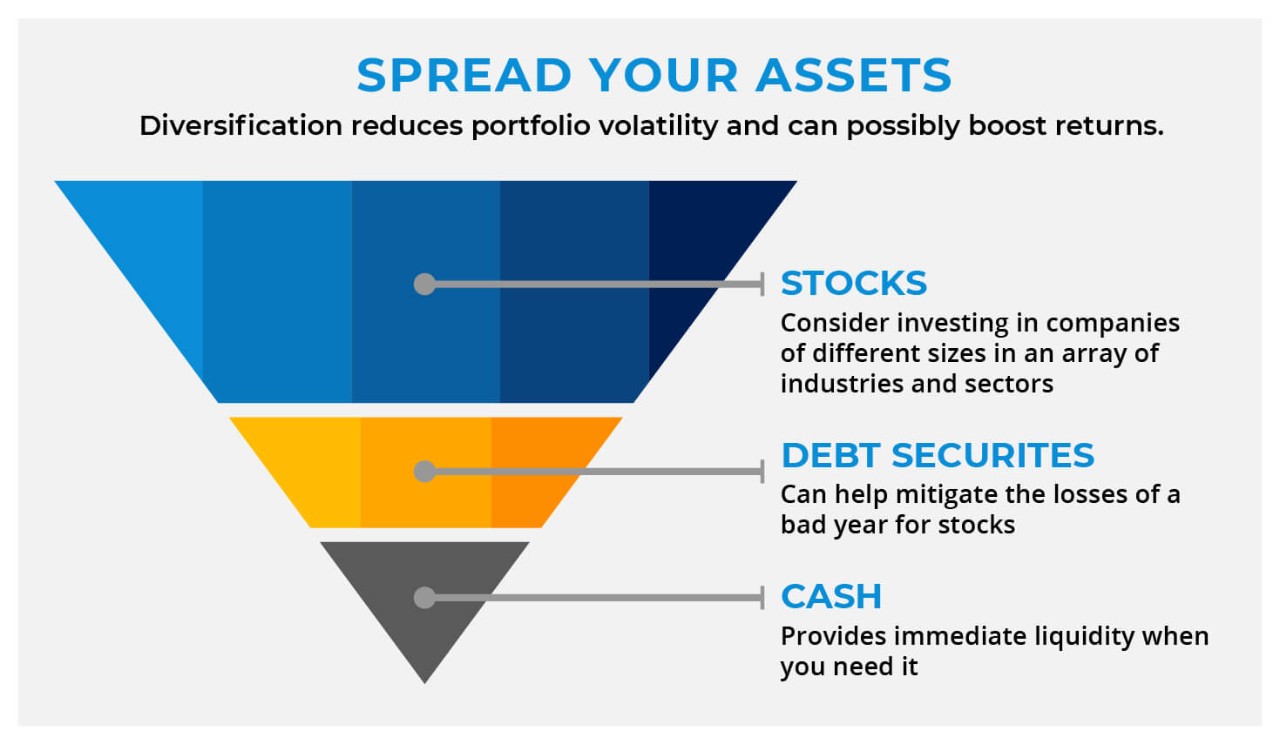

Diversify by investing in various asset classes. These include:

- Stocks: Shares in companies.

- Bonds: Loans to governments or corporations.

- Real Estate: Property investments.

- Commodities: Physical goods like gold and oil.

- Cash Equivalents: Savings accounts and money market funds.

Each asset class has different risks and rewards. By spreading investments, you can balance the risks.

Geographic Regions

Investing in different geographic regions also helps diversify your portfolio. Consider these regions:

- North America: Stable economies like the USA and Canada.

- Europe: Diverse markets from the UK to Germany.

- Asia: Rapidly growing markets in China and India.

- Emerging Markets: Countries with high growth potential.

Each region has unique opportunities and risks. Investing globally can provide better growth and reduce regional risks.

Risk Management

Investing is not just about earning returns. It’s also about protecting your money. Diversification helps reduce the risk in your investment portfolio. This strategy spreads your investments across different assets. It ensures that you don’t lose everything if one investment fails.

Reducing Volatility

Volatility means how much the value of your investments can change. High volatility means values can go up or down quickly. Low volatility means values change slowly. Diversification helps lower volatility. It does this by spreading risk over different assets. If one asset goes down, others may go up or stay stable.

Here’s an example of how diversification reduces volatility:

| Asset Type | Volatility |

|---|---|

| Stocks | High |

| Bonds | Low |

| Real Estate | Medium |

By investing in stocks, bonds, and real estate, the overall volatility reduces. Each asset type reacts differently to market changes. This balance keeps your investments more stable.

Protecting Against Market Downturns

Markets can go down, causing losses. Diversification helps protect against these downturns. If one market crashes, not all your money is lost. Other investments may not be affected or may recover faster.

Consider a diversified portfolio:

- 30% in Stocks

- 40% in Bonds

- 20% in Real Estate

- 10% in Cash

Stocks might drop sharply. Bonds and real estate might remain steady. Cash can be used to buy more assets at lower prices. This way, you are not heavily impacted by one market downturn.

Diversification acts like a safety net. It ensures that your investments are not tied to one market’s fate. This reduces the risk of large losses and keeps your portfolio safer.

Maximizing Gains

Investing wisely is crucial for financial growth. One way to achieve this is by maximizing gains through diversification. By spreading your investments, you can protect yourself against market volatility. This approach ensures that your portfolio is balanced and geared for growth.

Balancing Risk And Reward

Balancing risk and reward is a key aspect of diversification. This strategy helps manage potential losses while capturing gains. Here are some ways to balance your investment portfolio:

- Stocks and Bonds: Combining stocks with bonds can reduce risk.

- Geographical Diversification: Invest in different regions to spread risk.

- Sector Diversification: Spread investments across various industries.

Strategies For Growth

Effective growth strategies are essential for maximizing gains. Here are some ways to enhance your investment portfolio:

- Long-Term Investments: Focus on assets that grow over time.

- Regular Monitoring: Keep track of your investments regularly.

- Rebalancing: Adjust your portfolio to maintain your desired risk level.

By using these strategies, you can ensure steady growth. A well-diversified portfolio maximizes gains while minimizing risks. This balanced approach is key to successful investing.

| Investment Type | Risk Level | Potential Gain |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| Real Estate | Medium | Medium |

Diversifying your investments across different types, regions, and sectors helps manage risk. By doing so, you can maximize your gains. This approach ensures your portfolio remains healthy and balanced.

Common Diversification Strategies

Investing wisely requires spreading risk. Diversification is key. Different strategies can help achieve this. Here are some common diversification strategies.

Modern Portfolio Theory

Modern Portfolio Theory (MPT) focuses on maximizing returns. It aims to minimize risk. MPT advocates for a mix of assets. This includes stocks, bonds, and real estate. Different assets perform differently. This reduces the impact of a single asset’s poor performance.

MPT uses historical data. This helps predict future returns. The theory suggests that a diversified portfolio is less volatile. Investors often use MPT to balance their portfolios. The goal is to achieve the best possible return with the least risk.

Sector Rotation

Sector Rotation involves moving investments between different industry sectors. This strategy is based on economic cycles. Some sectors perform better in certain phases. For example, technology may thrive in growth periods. Utilities might do well in downturns.

Investors watch economic indicators. These include GDP growth, interest rates, and employment rates. By rotating sectors, investors can capitalize on market trends. This helps in achieving steady returns across different market conditions.

| Strategy | Objective | Key Elements |

|---|---|---|

| Modern Portfolio Theory | Maximize returns, minimize risk | Mix of assets, historical data |

| Sector Rotation | Capitalize on economic cycles | Economic indicators, market trends |

- Diversification spreads risk.

- MPT uses asset mix.

- Sector Rotation focuses on economic cycles.

- Identify your investment goals.

- Choose a diversification strategy.

- Monitor and adjust your portfolio regularly.

Both strategies offer unique benefits. Choose the one that aligns with your goals. Stay informed and make adjustments as needed.

:max_bytes(150000):strip_icc()/diversification.asp-FINAL-b2f2cb15557b4223a653c1389389bc92.png)

Credit: www.investopedia.com

Tools And Resources

Understanding the importance of diversification is crucial for every investor. Utilizing the right tools and resources can significantly enhance your investment strategy. Below, we explore some essential tools and resources to help you diversify your investment portfolio effectively.

Investment Platforms

Investment platforms are essential tools for modern investors. They provide access to various asset classes and investment options.

- Online Brokers: Platforms like ETRADE and TD Ameritrade offer a wide range of investment options. These include stocks, bonds, ETFs, and mutual funds.

- Robo-Advisors: Services like Betterment and Wealthfront use algorithms to create diversified portfolios. They are cost-effective and user-friendly.

- Mobile Apps: Apps like Robinhood and Acorns make investing accessible. They offer features like fractional shares and automated investing.

Financial Advisors

Enlisting the help of a financial advisor can provide personalized guidance. They offer tailored strategies to meet your specific financial goals.

| Type | Benefits |

|---|---|

| Traditional Advisors | Face-to-face consultations, personalized plans, comprehensive financial advice |

| Online Advisors | Convenient, often more affordable, uses technology to streamline services |

Financial advisors assist in assessing risk tolerance. They help in creating a well-balanced, diversified portfolio. They also provide ongoing monitoring and adjustments as needed.

Case Studies

Exploring case studies provides valuable insights into the importance of diversification. These real-life examples highlight both successes and lessons. Let’s examine how diversification impacts investment portfolios.

Successful Portfolios

Many investors have achieved success by diversifying their portfolios. For instance, John’s portfolio included stocks, bonds, and real estate. This mix helped him weather market downturns. When stocks fell, his bonds provided stability. Real estate offered steady returns.

Another example is Mary’s approach. She invested in various industries like technology, healthcare, and energy. This spread reduced risks associated with sector-specific downturns. Her portfolio remained strong even when one sector struggled.

Lessons Learned

Not all investors understand the power of diversification. Tom’s portfolio was heavily invested in a single tech company. When that company faced issues, Tom’s investments plummeted. This taught him the importance of spreading risk.

Similarly, Susan’s experience highlights the dangers of lack of diversification. She invested only in her home country’s market. When the local economy declined, her portfolio suffered. Diversifying globally could have mitigated her losses.

| Investor | Strategy | Outcome |

|---|---|---|

| John | Stocks, Bonds, Real Estate | Stable Returns |

| Mary | Multi-Sector Investments | Reduced Risks |

| Tom | Single Tech Company | Significant Losses |

| Susan | Local Market Only | Economic Downturn Impact |

Diversification offers protection against market volatility. These case studies show its importance. By spreading investments, you can achieve more stable returns.

Maintaining A Diversified Portfolio

Maintaining a diversified portfolio is crucial for long-term investment success. This approach helps manage risks by spreading investments across various assets. A well-diversified portfolio contains different asset classes such as stocks, bonds, and real estate. This strategy ensures that poor performance in one area doesn’t significantly impact the overall portfolio.

Regular Rebalancing

Regular rebalancing keeps your portfolio aligned with your investment goals. Over time, some assets may grow faster than others, altering your desired asset mix. Rebalancing involves adjusting your holdings to maintain your target allocation. For instance, if stocks outperform bonds, you may sell some stocks and buy bonds.

This process helps in risk management and ensures your portfolio stays diversified. It also allows you to take advantage of market opportunities. Rebalancing can be done quarterly, semi-annually, or annually. Consistency is key to maintaining a balanced portfolio.

Monitoring Market Trends

Monitoring market trends helps you make informed investment decisions. Staying updated with market conditions can guide your rebalancing strategy. For example, knowing which sectors are growing can influence your asset allocation. Market trends provide insight into economic conditions and potential risks.

Use reliable sources to track market trends. Financial news websites, reports, and expert opinions are useful tools. Staying informed helps you anticipate market shifts and adjust your portfolio accordingly. This proactive approach ensures your investments remain diversified and resilient.

Frequently Asked Questions

Why Is Diversification Important In An Investment Portfolio?

Diversification reduces risk by spreading investments across various assets. It minimizes losses if one asset underperforms. This strategy enhances potential returns and provides portfolio stability. Diversification helps investors achieve long-term financial goals with reduced volatility.

Why Is Diversification Important In An Investment Portfolio Quizlet?

Diversification reduces risk by spreading investments across various assets. It helps protect against market volatility and potential losses.

What Is The Primary Benefit Of Diversification?

The primary benefit of diversification is risk reduction. It minimizes potential losses by spreading investments across various assets. Diversification helps achieve more stable returns and protects against market volatility. This strategy enhances long-term financial growth and security.

Why Is Diversification Important In An Investment Portfolio Budget Challenge?

Diversification reduces risk by spreading investments across various assets. It helps protect against market volatility. A balanced portfolio enhances potential returns and minimizes losses.

Conclusion

Diversification is crucial for a stable investment portfolio. It helps mitigate risks and enhances potential returns. By spreading investments across various assets, you protect yourself against market volatility. Embrace diversification for long-term financial health and peace of mind. Make informed decisions to achieve a balanced and resilient portfolio.

Olga L. Weaver is a distinguished figure in both the realms of real estate and business, embodying a unique blend of expertise in these interconnected domains. With a comprehensive background in real estate development and a strategic understanding of business operations, Olga L. Weaver has positioned herself as a trusted advisor in the complex intersection of property and commerce. Her career is marked by successful ventures in real estate, coupled with a keen ability to integrate sound business principles into property investments. Whether navigating the intricacies of commercial transactions, optimizing property portfolios, or providing strategic insights into market trends, Olga L. Weaver’s expertise encompasses a wide spectrum of both real estate and business-related topics. As a dual expert in real estate and business, she stands as a guiding force, empowering individuals and organizations with the knowledge and strategies needed to thrive in these intertwined landscapes. Olga L. Weaver’s contributions continue to shape the dialogue around the synergy between real estate and business, making her a respected authority in both fields.