The top 5 forex trading strategies include trading based on technical analysis and price patterns, Fibonacci retracements, candlestick patterns, trend trading, and fundamental analysis. These strategies are popular among traders and can be effective in maximizing profits and minimizing risks.

Carry trade strategy, which involves shorting a currency with a low interest rate and buying a currency with a higher interest rate, is also considered a good strategy for forex trading. Another profitable strategy for beginners is the buy-and-hold strategy, where investors research companies with solid fundamentals and hold their stocks for a long time without being influenced by short-term market fluctuations.

These strategies offer different approaches to forex trading and can be customized to fit individual trading styles, risk tolerance, and goals.

Top 5 Forex Trading Strategies

Discover the top 5 forex trading strategies that can help you navigate the foreign exchange market with confidence. From technical analysis and price patterns to trend trading and fundamental analysis, these strategies offer a range of approaches to suit different trading styles and goals.

Start implementing these proven strategies to improve your forex trading success.

Forex trading strategies play a crucial role in the success of every trader. Whether you are a beginner or an experienced trader, having a solid strategy is essential to navigate the dynamic forex market. In this blog post, we will explore the top 5 forex trading strategies that can help you achieve your trading goals. Let’s dive in!

Key Factors For Success

When it comes to forex trading, there are certain key factors that contribute to success. These factors include:

- Technical Analysis and Price Patterns: This strategy involves analyzing historical price data and identifying patterns to predict future market movements.

- Fibonacci Retracements: Utilizing the Fibonacci sequence, this strategy helps traders identify potential support and resistance levels.

- Candlestick Trading: By analyzing candlestick patterns, traders can gain insights into market sentiment and make informed trading decisions.

- Trend Trading: This strategy focuses on identifying and following market trends to capitalize on potential profit opportunities.

- Flat Trading: Also known as range trading, this strategy involves identifying price levels where the market is moving sideways and taking advantage of price fluctuations within that range.

Risk Management Essentials

Risk management is a crucial aspect of forex trading that should never be overlooked. Here are some essential risk management practices:

- Position Sizing: Determine the appropriate position size for each trade based on your account size and risk tolerance.

- Stop Loss Orders: Set stop loss orders to limit potential losses and protect your capital.

- Take Profit Orders: Set take profit orders to secure profits and avoid emotional decision-making.

- Diversification: Spread your risk by trading multiple currency pairs and assets.

- Keep Emotions in Check: Avoid making impulsive decisions driven by fear or greed.

By following these risk management essentials, you can safeguard your trading capital and improve your chances of long-term success in the forex market.

Remember, finding the right forex trading strategy that suits your trading style and goals may require some experimentation and practice. It’s essential to stay disciplined, continuously learn, and adapt to market conditions.

So, which forex trading strategy will you choose to take your trading to the next level?

Credit: www.cmcmarkets.com

Technical Analysis And Price Patterns

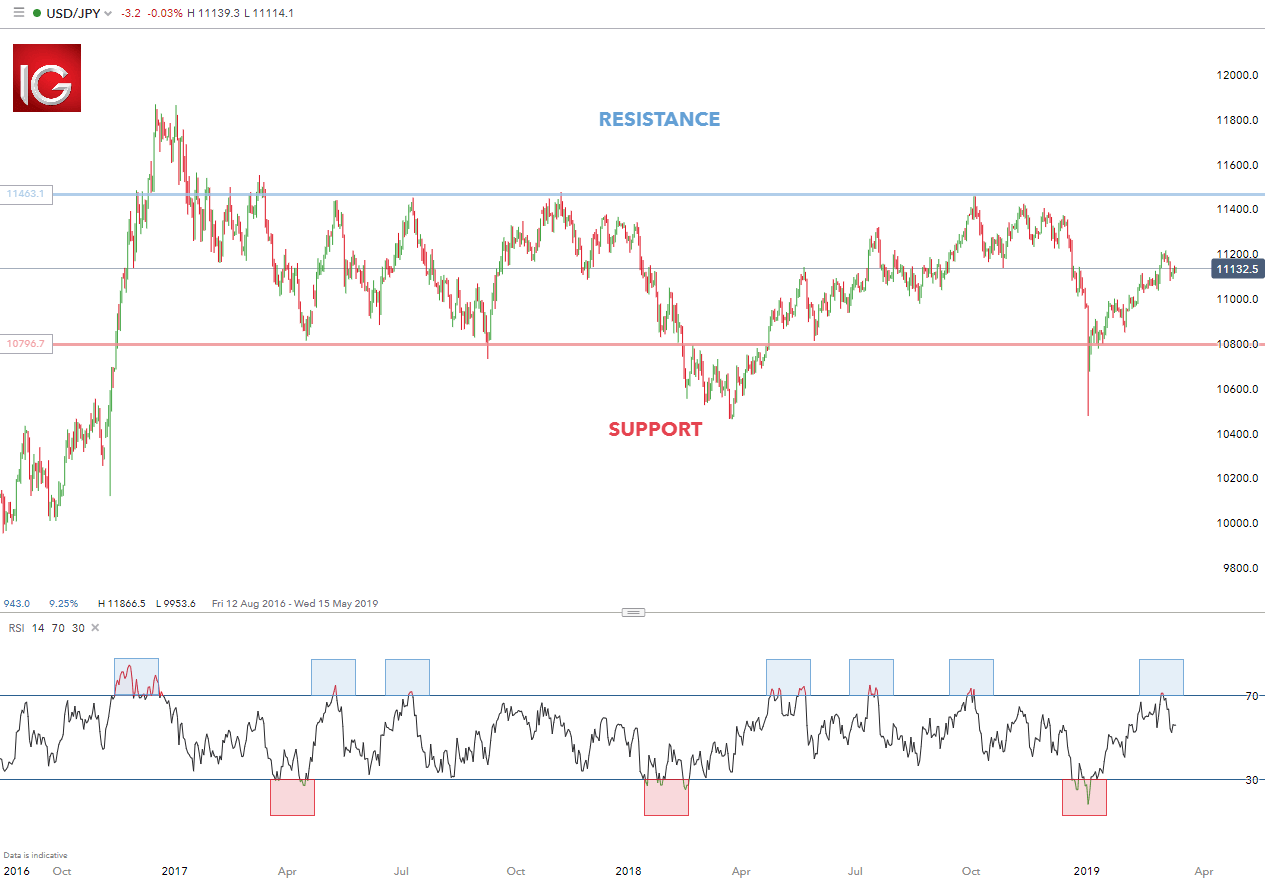

Technical analysis and price patterns are essential components of successful forex trading strategies. By analyzing historical price data and identifying key patterns, traders can make informed decisions about when to enter and exit trades. This section will explore the charting basics, as well as the process of identifying key patterns in the forex market.

Charting Basics

Charting is the foundation of technical analysis in forex trading. Traders use price charts to visualize and analyze historical price data of currency pairs. The two primary types of charts used in forex trading are line charts and candlestick charts. Line charts provide a simple visualization of price movements over a specific period, while candlestick charts offer more detailed information, including open, high, low, and close prices within a given timeframe.

Traders also utilize various technical indicators, such as moving averages, relative strength index (RSI), and stochastic oscillators, to identify trends, momentum, and potential reversal points in the market.

Identifying Key Patterns

Price patterns play a crucial role in technical analysis and are used to forecast future price movements. Some of the key patterns that traders look for include head and shoulders, double tops and bottoms, triangles, flags, and pennants. These patterns provide valuable insights into potential trend reversals, continuation patterns, and breakout opportunities.

By recognizing and understanding these key patterns, traders can develop effective trading strategies based on the principles of technical analysis, enhancing their ability to make informed trading decisions in the dynamic forex market.

Fibonacci Retracement Techniques

Fibonacci retracement techniques are a popular tool used by traders to identify potential reversal levels in the financial markets. These techniques are based on the mathematical principles discovered by the Italian mathematician Leonardo Fibonacci. Traders use Fibonacci retracement levels to determine potential support and resistance areas, as well as to identify entry and exit points for their trades.

Understanding Fibonacci Levels

Fibonacci retracement levels are based on the key ratios derived from the Fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones. The most important Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels are used to identify potential areas of price reversal during a market trend.

Application In Market Trends

Traders apply Fibonacci retracement techniques to different market trends, including uptrends, downtrends, and sideways trends. In an uptrend, traders use Fibonacci retracement levels to identify potential areas of support where they can enter long positions. Conversely, in a downtrend, Fibonacci retracement levels are used to pinpoint potential resistance areas for entering short positions. In a sideways market, Fibonacci retracement levels help traders identify potential price reversal points within the range-bound market.

Credit: www.dailyfx.com

Candlestick Trading Mastery

Master the art of candlestick trading with the top 5 forex trading strategies. Learn to analyze price patterns, Fibonacci retracements, trend trading, flat trading, and scalping for successful trading. Embrace these diverse and tailored strategies to match your trading style, risk tolerance, and financial goals.

Candlestick Trading Mastery is one of the most popular and effective trading strategies in the Forex market. As the name suggests, this strategy involves analyzing candlestick patterns to determine market trends and potential entry and exit points. In this article, we will delve into the psychology behind candlesticks and explore some profitable candlestick formations that can help traders make informed decisions.The Psychology Behind Candlesticks

Candlestick charts are a type of financial chart used to represent the price movements of an asset. Each candlestick represents a specific time interval and shows the opening, closing, high, and low prices of the asset. The body of the candlestick is colored to indicate whether the asset’s price increased or decreased during that interval. Understanding the psychology behind candlesticks is crucial for successful trading. Candlestick patterns can reveal the emotions and sentiment of market participants, which can help traders anticipate future price movements. For example, a long bullish candlestick with a small wick at the bottom indicates strong buying pressure and suggests that the price will continue to rise.Profitable Candlestick Formations

There are many profitable candlestick formations that traders can use to make informed trading decisions. Here are a few:- Hammer: A bullish reversal pattern that forms after a downtrend. It has a small body and a long lower wick, indicating that buyers are stepping in and pushing the price up.

- Doji: A pattern that indicates indecision in the market. It has a small body and occurs when the opening and closing prices are the same.

- Bullish Engulfing: A pattern that occurs when a small bearish candlestick is followed by a larger bullish candlestick. It indicates a bullish reversal and suggests that buyers have taken control of the market.

- Three White Soldiers: A pattern that consists of three long bullish candlesticks that occur after a downtrend. It indicates a bullish reversal and suggests that buyers are taking control of the market.

Trend Trading Insights

Discover the top 5 forex trading strategies with Trend Trading Insights. From technical analysis and price patterns to Fibonacci retracements and trend trading, this blog provides valuable insights for successful forex trading.

Trend Trading Insights Trend trading is a popular forex trading strategy that focuses on identifying and following market trends. This approach involves analyzing charts and identifying strong trends, then entering trades in the direction of the trend and using appropriate entry and exit strategies to maximize profits. Identifying Strong Trends Identifying strong trends is the first step in successful trend trading. Traders can use technical analysis tools such as moving averages, trend lines, and chart patterns to identify trends. It is important to confirm the trend with multiple indicators before entering a trade. Traders must also be able to differentiate between strong and weak trends to avoid false breakouts. Entry and Exit Strategies Once a strong trend is identified, traders must develop appropriate entry and exit strategies to maximize profits. The most common entry strategy is to wait for a pullback or retracement to enter a trade in the direction of the trend. Traders can use support and resistance levels, moving averages, or Fibonacci retracement levels to determine entry points. Exit strategies can be based on profit targets, trailing stops, or technical indicators such as moving averages. In conclusion, trend trading is a popular and effective forex trading strategy that can provide traders with consistent profits. By identifying strong trends and developing appropriate entry and exit strategies, traders can take advantage of market trends and maximize their profits.Scalping Strategy For Quick Profits

Looking for quick profits in forex trading? Consider the scalping strategy, one of the top 5 forex trading strategies. It involves making multiple trades with small profit targets and tight stop-loss orders, allowing traders to take advantage of short-term price fluctuations.

Scalping is a trading strategy that involves making quick trades for small profits. It is a popular strategy among traders who want to make fast profits in a short period of time. The art of scalping lies in identifying market movements that can be exploited for quick profits. In this article, we will discuss the scalping strategy for quick profits and provide some tips for successful implementation.The Art Of Scalping

Scalping is a high-speed trading technique that requires traders to make quick decisions based on short-term price movements. The goal of scalping is to make a small profit on each trade and to repeat this process many times throughout the day. Scalpers typically use technical analysis tools such as moving averages, Bollinger Bands, and Fibonacci retracements to identify short-term trends and price movements. They also pay close attention to market news and events that can impact prices in the short term.Time Management For Scalpers

Successful scalpers know that time management is critical to their success. They need to be able to monitor market movements and make quick trading decisions throughout the day. This requires a high level of focus and concentration, as well as the ability to stay calm under pressure. Many scalpers use a trading plan that includes specific entry and exit points, as well as stop-loss orders to limit their risk. Scalping is a popular trading strategy that can be very profitable if executed correctly. To be successful at scalping, traders need to have a solid understanding of market dynamics and be able to make quick decisions based on short-term price movements. They also need to be disciplined and patient, as well as have good time management skills. With the right tools and strategies, scalping can be a profitable addition to any trader’s arsenal.Carry Trade Strategy

The Carry Trade strategy is one of the top 5 Forex trading strategies. It involves shorting a currency with a low interest rate and using the proceeds to purchase a currency offering a higher interest rate, targeting earnings from daily accrued interest.

Carry Trade Strategy is one of the most popular Forex trading strategies that involves borrowing a currency with a low interest rate and investing in a currency with a higher interest rate. The goal is to earn daily accrued interest and generate profit from minimal shifts in exchange rates. In this section, we will discuss the key aspects of Carry Trade Strategy including currency pairs, interest rates, and execution.Currency Pairs And Interest Rates

Carry Trade Strategy involves selecting currency pairs with a significant interest rate differential. Typically, traders look for pairs where the currency they are borrowing has a low-interest rate, and the currency they are investing in has a higher interest rate. For example, a trader may borrow Japanese yen with a low-interest rate and invest in Australian dollars with a higher interest rate. This allows traders to earn daily accrued interest on the currency they are investing in.Long-term Carry Trade Execution

One of the key advantages of Carry Trade Strategy is its suitability for long-term trading. As the strategy relies on minimal shifts in exchange rates, traders can hold positions for an extended period, sometimes for months or even years. This approach can result in significant profits from accumulated interest, as well as capital gains from exchange rate movements.Html Table Example

| Currency Pair | Interest Rate Differential | Direction |

|---|---|---|

| USD/JPY | 2.5% | Borrow USD, Invest JPY |

| AUD/JPY | 0.5% | Borrow JPY, Invest AUD |

| NZD/JPY | 0.25% | Borrow JPY, Invest NZD |

Credit: m.youtube.com

Adapting Strategies To Market News

Adapting strategies to market news is crucial in forex trading. Discover the top 5 forex trading strategies that can help you navigate the ever-changing market conditions and make informed trading decisions.

Trading On Economic Announcements

Adapting forex trading strategies to market news is crucial for success in the dynamic foreign exchange market. Trading on economic announcements requires a proactive approach to capitalize on market movements triggered by key economic indicators and central bank decisions. By staying informed about scheduled economic releases and understanding their potential impact on currency pairs, traders can adapt their strategies to take advantage of the resulting price volatility.

Staying Ahead With Market News

Staying ahead with market news involves monitoring geopolitical events, economic data, and central bank statements that influence forex markets. By leveraging news sources, traders can anticipate and react to market-moving developments, adjusting their trading strategies accordingly. Being proactive in staying informed about global economic and political events can help traders make informed decisions and manage risk effectively in the forex market.

Strategies In Action

Explore the top 5 forex trading strategies in action, including technical analysis, price patterns, Fibonacci retracements, candlestick trading, and trend trading. Each strategy offers unique opportunities for success in the dynamic forex market. Master these strategies to enhance your trading game and achieve your financial goals.

Backtesting For Confidence

Before executing a forex trading strategy, it’s crucial to backtest it thoroughly. This involves analyzing historical data to assess the strategy’s performance under various market conditions. By backtesting, traders can gain confidence in the efficacy of their chosen strategy, identifying its strengths and weaknesses. This process helps in refining the strategy and instills the discipline necessary for successful trading.

Real-life Success Stories

Real-life success stories serve as powerful inspirations for forex traders. Hearing about the triumphs of others who have effectively implemented specific trading strategies can provide valuable insights and motivation. These stories often highlight the practical application of strategies in diverse market scenarios, offering tangible examples of how strategies can lead to profitable outcomes. Learning from these experiences can help traders make informed decisions and adapt their own approaches for greater success.

Frequently Asked Questions

What Is The Most Successful Strategy In Forex Trading?

The most successful strategy in forex trading includes technical analysis and price patterns, Fibonacci retracements, candlestick trading, trend trading, flat trading, scalping, and fundamental analysis. The buy-and-hold strategy is also profitable for long-term investors.

What Is The 5-3-1 Strategy In Forex?

The 5-3-1 strategy in forex is a trading approach that focuses on risk management and maintaining a positive risk-reward ratio. This strategy aims to limit losses and maximize profits by setting specific parameters for each trade.

Which Strategy Is Good For Forex?

The carry trade strategy is good for forex, involving shorting a currency with a low interest rate and using the proceeds to purchase a currency offering a higher interest rate. This targets earnings from daily accrued interest, often relying on major pairs and anticipating minimal shifts in exchange rates.

Which Trading Strategy Is Most Profitable?

There is no one trading strategy that is the most profitable. Popular strategies include technical analysis, Fibonacci retracements, candlestick trading, trend trading, flat trading, scalping, and fundamental analysis. However, beginners can implement the buy-and-hold strategy by researching companies with solid fundamentals and holding their stocks for a long time without being swayed by short-term market fluctuations.

Conclusion

These top 5 forex trading strategies offer valuable insights and techniques for traders looking to maximize their profits. From technical analysis and price patterns to trend trading and scalping, each strategy has its own advantages and potential for success. By understanding and implementing these strategies, traders can enhance their decision-making process and increase their chances of achieving profitable trades.

Remember to always adapt these strategies to your own risk tolerance and trading style for optimal results. Happy trading!