Technical analysis tools are essential for every forex trader. These tools help traders analyze market trends, identify potential entry and exit points, and make informed trading decisions.

By using tools such as trend analysis tools, market analysis tools, forex pair correlation tools, and sentiment analysis tools, traders can gain valuable insights into the market and improve their trading strategies. Additionally, tools like the RSI indicator, MACD indicator, and Bollinger Bands can provide further technical analysis to support trading decisions.

It is important for traders to familiarize themselves with these tools and understand how to use them effectively in order to maximize their chances of success in the forex market.

Introduction To Forex Technical Analysis

Forex traders should familiarize themselves with various technical analysis tools to make informed trading decisions. These tools include chart patterns, moving averages, Bollinger Bands, RSI indicator, and Fibonacci extensions. Understanding these tools can help traders identify trends, support and resistance levels, and potential entry and exit points in the Forex market.

Mastering technical analysis can enhance traders’ ability to analyze price movements and improve their overall trading strategies.

The Role Of Technical Analysis In Forex Trading

Technical analysis plays a vital role in Forex trading as it helps traders make informed decisions based on historical price data and market trends. By analyzing charts and indicators, traders can identify patterns, support and resistance levels, and potential entry and exit points for trades.

Comparing Technical And Fundamental Analysis

When it comes to analyzing the Forex market, traders have two main approaches: technical analysis and fundamental analysis.

| Technical Analysis | Fundamental Analysis |

|---|---|

| Focuses on price patterns, trends, and indicators | Examines economic, political, and social factors |

| Uses historical data to predict future price movements | Studies macroeconomic indicators and news events |

| Short-term trading approach | Long-term investment approach |

While technical analysis is more suitable for short-term trading and provides insights into the market sentiment, fundamental analysis looks at the underlying factors that drive the market in the long run.

By combining both approaches, traders can gain a comprehensive understanding of the Forex market and make well-informed trading decisions.

Best Tools For Forex Analysis

- Trend Analysis Tools

- Market Analysis Tools

- Forex Pair Correlation Tools

- Carry Trade Calculator

- Forex Volatility Calculator

- Pivot Point Calculator

- Position Sizing Calculator

- Pip Value Calculator

- Technical Analysis Tools (RSI indicator, MACD Indicator, Bollinger Bands)

- Sentiment Analysis Tools

These tools can assist traders in analyzing market trends, identifying key levels, and determining optimal entry and exit points for their trades.

What Every Forex Trader Should Know

Every Forex trader should have a good understanding of their broker’s policies and how they operate in the market. It is important to be aware of the differences between trading in the over-the-counter market and exchange-driven markets.

Additionally, traders should ensure that their broker’s trading platform is suitable for the analysis they want to perform. Familiarity with charts and price patterns is essential, as they provide valuable insights into the currency pair’s price movement over time.

By mastering these fundamental concepts and utilizing the right tools, traders can enhance their technical analysis skills and improve their overall trading performance in the Forex market.

Credit: www.dailyfx.com

Essential Chart Types For Forex Traders

When it comes to forex trading, utilizing essential chart types is crucial for making informed decisions. Here are the key chart types that every forex trader should be familiar with:

Candlestick Patterns And Their Significance

Candlestick patterns are vital for forex traders as they provide valuable insights into price movements. By identifying patterns such as doji, hammer, and engulfing, traders can anticipate potential trend reversals or continuations.

Line And Bar Charts Simplified

Line charts offer a simplified view of price movements over a specific period, making it easier to identify trends. On the other hand, bar charts display the open, high, low, and close prices for a given period, aiding traders in analyzing price volatility.

Key Technical Indicators And Their Uses

Technical analysis is a crucial aspect of forex trading, and understanding key technical indicators is essential for making informed trading decisions. By leveraging these indicators, traders can gain valuable insights into market trends, momentum, and potential entry and exit points.

Moving Averages: Identifying Trends

Moving averages are essential tools for identifying and confirming trends in the forex market. They smooth out price data to create a single flowing line, making it easier to spot trends and potential trend reversals.

Traders commonly use two types of moving averages: the simple moving average (SMA) and the exponential moving average (EMA). The SMA provides a straightforward average of a security’s price over a specified period, while the EMA places greater weight on more recent data points, making it more responsive to price changes.

Rsi And Macd: Understanding Momentum

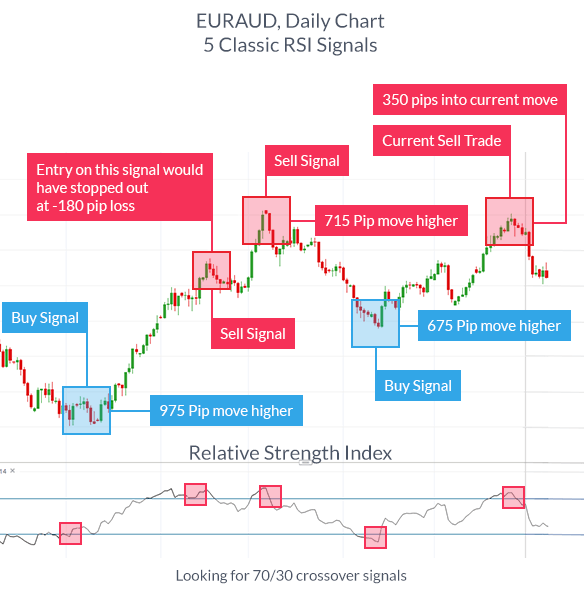

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are powerful indicators for understanding the momentum of price movements in the forex market.

The RSI measures the speed and change of price movements, indicating whether a currency pair is overbought or oversold. Traders use the RSI to identify potential trend reversals and generate buy or sell signals.

On the other hand, the MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps traders identify changes in the strength, direction, momentum, and duration of a trend.

Credit: www.dailyfx.com

The Power Of Trend Analysis Tools

Technical analysis is an essential part of forex trading, and utilizing trend analysis tools can give traders a significant advantage. Trend analysis tools allow traders to identify trends in the market and make informed decisions based on those trends.

Utilizing Trend Lines And Channels

One of the most common trend analysis tools is trend lines and channels. A trend line is a straight line that connects two or more price points and is used to identify the direction of a trend. A channel is created by drawing two parallel trend lines, one above and one below the price, to identify the range of a trend.

Traders can use trend lines and channels to identify support and resistance levels, which can help them determine when to enter or exit a trade. By drawing trend lines and channels on price charts, traders can easily identify trends and make informed decisions based on those trends.

The Importance Of Chart Patterns

Another important trend analysis tool is chart patterns. Chart patterns are formed by the movement of prices on a price chart, and they can help traders identify trends and potential trading opportunities.

There are several types of chart patterns, including head and shoulders, triangles, and flags. By recognizing these patterns, traders can make informed decisions on when to enter or exit a trade.

It is essential to ensure that traders have a solid understanding of chart patterns and how to use them effectively. Traders can use chart patterns in conjunction with other technical analysis tools to increase their chances of success in the forex market.

In conclusion, trend analysis tools are essential for forex traders who want to make informed decisions based on market trends. By utilizing tools such as trend lines and channels and chart patterns, traders can identify trends and potential trading opportunities, ultimately increasing their chances of success in the forex market.

Volume Indicators: Gauging Market Interest

Volume indicators play a crucial role in gauging market interest for forex traders. By analyzing trading volume, traders can determine the strength of price movements and identify potential trends. Understanding volume indicators is essential for effective technical analysis in the forex market.

When it comes to forex trading, understanding market interest is crucial. Volume indicators are a popular tool used by traders to gauge market interest. These indicators track the number of shares or contracts traded within a specific timeframe and help traders make informed decisions based on market activity. In this article, we will cover two essential volume indicators that every forex trader should know: the Volume Oscillator and On-Balance Volume (OBV).

Volume Oscillator: Measuring Trade Volumes

The Volume Oscillator is a technical analysis tool that measures trade volumes. This indicator is used to identify trend reversals by comparing two moving averages of volume data. The Volume Oscillator is calculated by subtracting a longer-term moving average of volume from a shorter-term moving average of volume. The result is plotted as a histogram, which makes it easy for traders to identify whether trade volumes are increasing or decreasing.

The Volume Oscillator is an effective tool for traders who want to identify changes in volume trends. When the Volume Oscillator is above zero, it indicates that trade volumes are increasing, and when it is below zero, it indicates that trade volumes are decreasing.

On-balance Volume (obv): Tracking Flow Of Funds

On-Balance Volume (OBV) is a volume indicator that tracks the flow of funds into and out of a currency pair. OBV adds volume on up days and subtracts volume on down days, providing traders with a cumulative total. OBV helps traders identify trend confirmations and divergences by comparing the OBV line with the price of the asset.

OBV is an effective tool for traders who want to confirm price trends by analyzing volume trends. When OBV is moving in the same direction as the price trend, it confirms the trend, and when OBV is moving in the opposite direction, it indicates a potential trend reversal.

In conclusion, the Volume Oscillator and On-Balance Volume are two essential volume indicators that every forex trader should know. These indicators help traders make informed decisions based on market interest and provide valuable insights into trade volumes and trend confirmations. By incorporating these tools into their trading strategy, traders can gain a competitive edge in the forex market.

The Significance Of Support And Resistance

Support and resistance are key concepts in technical analysis, providing important levels for Forex traders. These tools help identify potential buying and selling opportunities based on historical price levels, allowing traders to make informed decisions and manage risk effectively.

Support and resistance are two of the most important concepts in technical analysis when it comes to forex trading. Identifying key levels is crucial in determining where the price is likely to encounter support or resistance, and this can be done through the use of various technical analysis tools such as trend lines, moving averages, and Fibonacci retracements. These tools can help traders identify potential areas of support and resistance, which can be used to make informed trading decisions.

The psychology behind support and resistance zones is also important to understand. Support and resistance levels are created by market participants’ collective actions and reactions to market events. Traders who see the price approaching a support or resistance level may become more cautious, and this can lead to a decrease in trading activity and a subsequent increase in volatility. Understanding this psychology can help traders anticipate potential market movements and better manage their trades.

To further delve into the significance of support and resistance, let’s take a closer look at identifying key levels and the psychology behind support and resistance zones.

Identifying Key Levels

One of the most effective ways to identify key support and resistance levels is through the use of price charts. Price charts provide a visual representation of the price action of a currency pair over a given period of time. Technical analysis tools such as trend lines, moving averages, and Fibonacci retracements can be used to identify potential areas of support and resistance.

Trend lines are a popular tool used to identify support and resistance levels. They are drawn by connecting two or more price points, and can help traders identify potential areas where the price is likely to encounter support or resistance. Moving averages are another popular tool used to identify key levels. They can help traders identify the overall trend of a currency pair, as well as potential areas of support and resistance.

Psychology Behind Support And Resistance Zones

Support and resistance levels are created by the collective actions and reactions of market participants. Traders who see the price approaching a support or resistance level may become more cautious, and this can lead to a decrease in trading activity and a subsequent increase in volatility.

For example, if the price of a currency pair is approaching a key support level, traders who are long on the currency pair may become more cautious and may take profits or close their positions. This can lead to a decrease in buying activity and an increase in selling activity, which can cause the price to drop further.

Understanding the psychology behind support and resistance levels can help traders anticipate potential market movements and better manage their trades. By identifying potential areas of support and resistance, traders can set realistic profit targets and stop-loss levels, which can help them maximize their profits and minimize their losses.

In conclusion, support and resistance are crucial concepts in technical analysis when it comes to forex trading. By identifying key levels and understanding the psychology behind support and resistance zones, traders can make informed trading decisions and better manage their trades.

Fibonacci Tools: More Than Just Math

Uncover the power of Fibonacci tools in forex trading. These versatile tools offer more than just math; they provide valuable insights for technical analysis. Every forex trader should harness the potential of Fibonacci tools to make informed trading decisions.

Fibonacci Tools: More Than Just Math

Fibonacci retracements: Key levels in market pullbacks

Fibonacci retracements are a popular tool among forex traders. They use these levels to identify key areas of support and resistance in the market. These levels are based on the Fibonacci sequence, a mathematical concept that is found in nature and the financial markets. Traders use these levels to predict where the market may turn around or continue in the same direction. The most common retracement levels are 38.2%, 50%, and 61.8%.

Fibonacci extensions: Projecting potential targets

Fibonacci extensions are another tool that forex traders use to identify potential profit targets. These levels are based on the same mathematical concept as the retracements, but they project future levels beyond the current price. Traders use these levels to identify where the market may continue to move in the same direction, and where they should take profit. The most common extension levels are 127.2%, 161.8%, and 261.8%.

Using Fibonacci Tools Together

Fibonacci retracements and extensions are often used together to identify key levels in the market. Traders may use retracements to identify areas of support or resistance, and then use extensions to identify potential profit targets. By using these tools together, traders can gain a better understanding of the market and make more informed trading decisions.

Conclusion

Fibonacci tools are more than just math. They are powerful tools that forex traders use to identify key levels in the market and predict future price movements. Fibonacci retracements and extensions are two of the most popular tools, and they can be used together to gain a better understanding of the market. By incorporating these tools into your trading strategy, you can improve your chances of success in the forex market.

Advanced Technical Tools For Experienced Traders

When it comes to forex trading, advanced technical tools play a crucial role in the decision-making process for experienced traders. These tools provide in-depth insights into market dynamics, helping traders make informed decisions and maximize their potential for profit.

Bollinger Bands: Assessing Market Volatility

Bollinger Bands are a popular technical analysis tool that helps traders assess market volatility and identify potential trend reversals. By calculating the standard deviation of price movements, Bollinger Bands create upper and lower bands around the moving average, offering a visual representation of price volatility. Traders can use Bollinger Bands to identify overbought or oversold conditions and anticipate potential breakout opportunities.

Pivot Points: Predicting Market Turns

Pivot Points are widely used by experienced forex traders for predicting potential market turning points. These levels are calculated based on the previous day’s high, low, and close prices, providing traders with key support and resistance levels for the upcoming trading session. By utilizing Pivot Points, traders can anticipate potential price reversals and adjust their trading strategies accordingly.

Integrating Multiple Technical Tools

Integrating multiple technical tools is a crucial aspect of forex trading, as it allows traders to gain a comprehensive understanding of market conditions and make well-informed decisions. By combining various indicators and analytical methods, traders can create a cohesive trading strategy that enhances their ability to identify potential trade opportunities and manage risk effectively.

Creating A Cohesive Trading Strategy

When integrating multiple technical tools, traders should aim to create a cohesive trading strategy that aligns with their trading objectives and risk tolerance. This involves selecting a combination of indicators and tools that complement each other and provide a holistic view of the market. By incorporating tools such as moving averages, trend lines, and oscillators, traders can develop a strategy that encompasses different aspects of price analysis, trend identification, and market momentum.

Avoiding Common Pitfalls When Combining Indicators

While integrating multiple technical tools can offer valuable insights, traders must be cautious of common pitfalls that may arise when combining indicators. It’s essential to avoid overcomplicating the analysis by using too many indicators, as this can lead to conflicting signals and confusion. Additionally, traders should ensure that each indicator serves a specific purpose and contributes to a well-defined trading strategy, rather than relying on a cluster of unrelated tools.

:max_bytes(150000):strip_icc()/Technical_Analysis_Final-4a96fc1863cf4dbc8a5c6f315ee49871.jpg)

Credit: www.investopedia.com

Practical Tips For Applying Technical Analysis

Discover practical tips for applying technical analysis in forex trading. Learn about essential tools like the RSI indicator, MACD indicator, Bollinger Bands, and sentiment analysis tools. Understand how to read price charts and use technical indicators to forecast future price movements.

Master the art of technical analysis with these valuable insights.

When it comes to forex trading, technical analysis is an essential tool that helps traders make informed decisions based on historical price data. To effectively apply technical analysis, there are some practical tips that every trader should know. In this section, we will discuss two important tips: backtesting strategies for reliability and continuous learning and adaptation.

Backtesting Strategies For Reliability

Backtesting is a crucial step in technical analysis that involves testing a trading strategy using historical data to determine its viability and profitability. By backtesting your strategies, you can gain insights into their performance in different market conditions and assess their reliability.

Here are some practical tips for backtesting strategies:

- Choose a reliable backtesting software or platform that provides accurate historical data.

- Select a sufficient time period for backtesting, considering both bull and bear market conditions.

- Define clear entry and exit rules for your strategy.

- Implement realistic transaction costs and slippage in your backtesting to simulate real-world trading conditions.

- Analyze the performance metrics of your strategy, such as win rate, maximum drawdown, and risk-reward ratio.

By diligently backtesting your strategies, you can identify potential flaws, optimize them, and increase their reliability before applying them in real trading scenarios.

Continuous Learning And Adaptation

In the dynamic forex market, continuous learning and adaptation are crucial for successful technical analysis. Markets evolve, and strategies that worked in the past may not be as effective in the future. Therefore, it is essential to stay updated and adapt your analysis techniques accordingly.

Here are some practical tips for continuous learning and adaptation:

- Stay informed about the latest market news, economic indicators, and geopolitical events that can impact currency prices.

- Expand your knowledge by studying different technical analysis tools and indicators.

- Attend webinars, workshops, and seminars conducted by experienced traders and experts.

- Join online trading communities and forums to share insights and learn from fellow traders.

- Regularly review your trading performance and analyze the effectiveness of your analysis techniques.

By continuously learning and adapting your technical analysis skills, you can enhance your ability to identify trading opportunities and make informed decisions in the ever-changing forex market.

Technical Analysis Software And Platforms

Discover the essential technical analysis tools every forex trader should know. From RSI and MACD indicators to Bollinger Bands and Fibonacci extensions, these tools provide valuable insights for making informed trading decisions. With access to platforms like TradingView and Trading Central, mastering these tools can help traders navigate the dynamic forex market with confidence and precision.

Features To Look For In Trading Platforms

When choosing a trading platform for forex, it’s crucial to consider various features to ensure a seamless trading experience. Some key features to look for include:

- User-friendly interface for easy navigation

- Real-time quotes and charting tools

- Customizable indicators and drawing tools

- Reliable execution speed and order types

- Advanced analysis tools and technical indicators

- Risk management features such as stop-loss and take-profit orders

Popular Software Among Forex Traders

Forex traders often rely on specific software and platforms to conduct their technical analysis. Some of the popular software and platforms include:

| Software/Platform | Description |

|---|---|

| MetaTrader 4 (MT4) | Known for its user-friendly interface, extensive technical analysis tools, and support for automated trading through expert advisors. |

| MetaTrader 5 (MT5) | Offers advanced features such as additional timeframes, an economic calendar, and access to more markets beyond forex. |

| cTrader | Recognized for its intuitive interface, advanced charting capabilities, and algorithmic trading options. |

| NinjaTrader | Popular for its powerful analysis tools, customizable interface, and support for futures and forex trading. |

Conclusion: Building A Technical Toolbox

To wrap up, mastering a range of technical analysis tools is essential for forex traders. From chart patterns to indicators like MACD and RSI, building a diverse technical toolbox is crucial for making informed trading decisions and staying ahead in the forex market.

Evaluating Tools Based On Trading Style

When it comes to building a technical toolbox as a forex trader, it is crucial to evaluate the tools based on your trading style. Each trader has their own unique approach and preferences, which should guide the selection of the most suitable technical analysis tools.

Whether you are a day trader, swing trader, or position trader, understanding your trading style is essential. For day traders who focus on short-term price movements, tools such as moving averages, RSI indicator, and Bollinger Bands can be valuable. Swing traders, on the other hand, may find Fibonacci extensions, supply-demand indicators, and sentiment analysis tools more useful.

By evaluating tools based on your trading style, you can build a technical toolbox that aligns with your strategies and goals. This tailored approach enhances the effectiveness of your analysis and decision-making process.

The Journey Of A Disciplined Forex Trader

A disciplined forex trader understands the importance of having a well-rounded technical toolbox. It is not just about acquiring a multitude of tools, but rather developing the skills to utilize them effectively. The journey of a disciplined forex trader involves continuous learning, practice, and refinement of technical analysis techniques.

Starting with the basics, such as understanding price charts and candlestick patterns, is crucial. These visual representations provide valuable insights into market trends and potential reversals. As you progress, you can explore more advanced tools like MACD indicators, pivot point calculators, and carry trade calculators.

Consistency and patience are key throughout this journey. It is important to avoid jumping from one tool to another, but rather focus on mastering a select few that align with your trading style. By doing so, you can develop a deep understanding of these tools and leverage them to make informed trading decisions.

Building a technical toolbox is an essential aspect of every forex trader’s journey. By evaluating tools based on your trading style and continuously expanding your knowledge and skills, you can create a powerful arsenal of technical analysis tools.

Remember, the key is not to overwhelm yourself with too many tools, but rather to focus on mastering a select few that align with your strategies. This approach allows you to gain a deeper understanding of these tools and utilize them effectively in your trading decisions.

Frequently Asked Questions

What Is The Best Analysis Tool For Forex?

The best analysis tools for forex are trend analysis tools, market analysis tools, forex pair correlation tools, carry trade calculator, forex volatility calculator, pivot point calculator, position sizing calculator, pip value calculator, technical analysis tools, RSI indicator, MACD indicator, Bollinger Bands, and sentiment analysis tools.

Traders using technical analysis must learn how to read price charts as their first tool. It’s important to understand each broker’s policies and ensure their trading platform is suitable for your analysis needs. Technical indicators and chart analysis tools can help forecast future price movements.

What Every Forex Trader Should Know?

Every forex trader should have a good understanding of technical and fundamental analysis. Technical analysis tools like RSI, MACD, Bollinger Bands, and pivot point calculator can be helpful in predicting future price movements. It’s also important to know your broker’s policies and ensure their trading platform is suitable for your analysis.

Learning chart analysis is the first step for every trader using technical analysis. Lastly, always keep up-to-date with market news and events.

What Is The First Tool That Every Trader Using Technical Analysis Needs To Learn?

The first tool every trader using technical analysis needs to learn is a price chart. It’s a visual representation of a currency pair’s price over a set period of time. Technical analysts will study these charts, recent price movements, support and resistance levels, and technical indicators to forecast future price movements.

How To Understand Technical Analysis In Forex Trading?

To understand technical analysis in forex trading, one must study charts and other data to forecast future price movements. This includes analyzing recent price movements, high-volume areas, levels of support and resistance, and technical indicators such as moving averages. Learning to read a price chart is the first tool every trader using technical analysis needs to know.

Various tools such as MACD, RSI, Bollinger Bands, Pivot Point Calculator, and TradingView can aid in technical analysis.

Conclusion

Understanding and utilizing technical analysis tools is crucial for every forex trader. These tools, such as RSI indicators, MACD indicators, Bollinger Bands, and pivot point calculators, provide valuable insights into market trends and help traders make informed decisions. By incorporating these tools into their trading strategies, forex traders can enhance their chances of success in the dynamic and competitive forex market.

So, make sure to familiarize yourself with these essential tools and harness their power to gain an edge in your trading endeavors.

Victoria Banks is a respected figure in the financial realm, specializing as an investment and savings expert. With a robust background in finance and wealth management, Victoria Banks has established herself as a trusted advisor in the delicate balance between investment growth and prudent savings strategies. Her career is marked by a strategic approach to financial planning, where she assists individuals and businesses in optimizing their investment portfolios while prioritizing long-term savings goals.

Victoria Banks’s expertise lies in crafting personalized investment and savings strategies tailored to the unique needs and aspirations of her clients. Her insightful analyses and ability to navigate market dynamics enable her to guide individuals towards sound investment decisions that align with their overall financial objectives. As an investment and savings expert, Victoria Banks contributes to the financial well-being of her clients by fostering a comprehensive understanding of the symbiotic relationship between strategic investments and disciplined savings practices. Her commitment to financial literacy and wealth-building has positioned her as a go-to authority for those seeking a harmonious approach to building and safeguarding their financial futures.