Psychology of Forex Trading refers to the mental states and emotions that influence trading decisions in the forex market. It involves understanding the psychological factors that can lead to impulsive decisions, biased thinking, and lack of discipline in trading.

Mastering forex psychology requires practice, back testing, and maintaining a consistent trading strategy. It also involves managing emotions, such as fear and greed, and avoiding biases like confirmation bias and anchoring bias. By understanding and controlling these psychological aspects, traders can improve their decision-making process and increase their chances of success in forex trading.

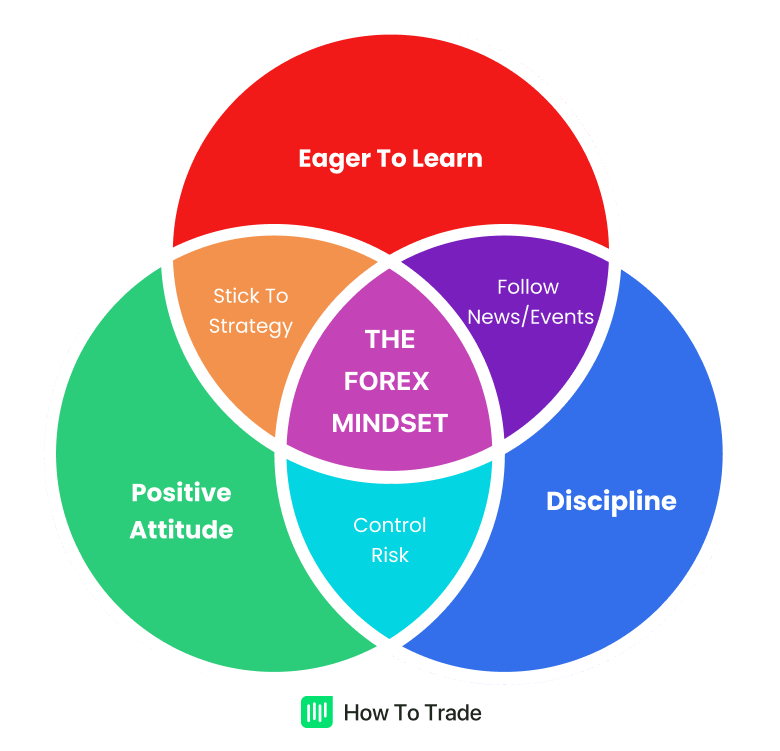

Credit: howtotrade.com

The Role Of Emotions In Forex Trading

Forex trading is not just about numbers and charts; it is heavily influenced by human emotions. The psychology of forex trading plays a crucial role in determining success or failure in the financial markets. Traders’ emotions can significantly impact their decision-making process, leading to impulsive actions and irrational choices.

Identifying Emotional Triggers

Recognizing emotional triggers is essential for forex traders. Fear and greed are common emotional triggers that can lead to poor decision-making. Traders must identify these triggers to prevent emotional biases from influencing their trades.

Consequences Of Emotional Trading

Emotional trading can have severe consequences, including impulsive decisions, biased thinking, and lack of discipline. These consequences can lead to significant financial losses in the forex market. Traders need to develop strategies to manage their emotions effectively and make rational trading decisions.

Importance Of Mental Discipline

Understanding the psychology of forex trading is crucial as it plays a significant role in influencing trading decisions. The mental states and emotions of traders can lead to impulsive decisions, biased thinking, and indiscipline. This makes it essential to master the importance of mental discipline in forex trading.

Strategies For Developing Discipline

Developing discipline in forex trading requires consistent effort and adherence to a well-defined plan. Setting clear trading rules, establishing a routine, and practicing self-control are essential strategies for fostering mental discipline.

Maintaining Focus Under Pressure

When trading under pressure, it’s crucial to maintain focus and composure. Utilizing relaxation techniques, such as deep breathing or visualization, can help in staying calm and focused during high-pressure trading situations.

Cognitive Biases And Forex Trading

Psychology plays a crucial role in forex trading, influencing the decisions and behaviors of traders. Cognitive biases, in particular, can significantly impact trading outcomes. Understanding these biases and learning to overcome them is essential for success in the forex market.

Common Trading Biases

Traders often fall victim to cognitive biases that can cloud their judgment and lead to irrational decisions. Anchoring bias, confirmation bias, and loss aversion are some of the common biases that can negatively impact trading performance.

Overcoming Cognitive Distortions

Traders can overcome cognitive distortions by developing a consistent trading strategy, maintaining a trading journal, and cultivating mental discipline. Understanding and avoiding the fear of missing out (FOMO) and managing emotions effectively are also crucial in overcoming cognitive biases in forex trading.

Risk Management Techniques

Mastering risk management techniques is crucial in the psychology of Forex trading. Traders need to develop mental discipline and understand and avoid biases such as anchoring and confirmation bias. Consistent trading strategy, maintaining a trading journal, and controlling emotions are key elements in effective risk management.

Setting Realistic Goals

One of the most important risk management techniques in forex trading is setting realistic goals. It is crucial to have a clear idea of what you want to achieve and how you plan to achieve it. Setting unrealistic goals can lead to taking unnecessary risks, which can result in significant losses. It’s essential to set achievable targets and plan the steps to achieve them. This way, you can measure your progress and adjust your strategy if needed.

Effective Use Of Stop-loss Orders

Another critical risk management technique in forex trading is the effective use of stop-loss orders. A stop-loss order is an order that automatically closes a trade when the market moves against you to a certain level. This technique is useful to limit potential losses and protect your trading capital. It’s important to set stop-loss orders at a reasonable distance from the entry point, taking into account market volatility and your risk tolerance.

Understanding And Avoiding Fomo

One of the most common mistakes in forex trading is making decisions based on fear of missing out (FOMO). FOMO can lead to impulsive trading decisions that can result in significant losses. To avoid FOMO, it’s crucial to have a consistent trading strategy and stick to it. It’s also essential to avoid making emotional decisions and focus on the facts and data.

Consistent Trading Strategy

Having a consistent trading strategy is another crucial risk management technique in forex trading. A consistent trading strategy helps you make rational and objective decisions based on facts and data. It’s important to have a trading plan that includes entry and exit points, risk management techniques, and profit targets. A consistent trading strategy helps you avoid making impulsive decisions based on emotions and biases.

Maintaining A Trading Journal

Maintaining a trading journal is another essential risk management technique in forex trading. A trading journal is a record of your trades, including entry and exit points, profit or loss, and notes on the trade. A trading journal helps you analyze your performance, identify your strengths and weaknesses, and improve your trading strategy. It’s important to review your trading journal regularly and make adjustments to your strategy if necessary.

Emotions And Trading

Finally, it’s essential to understand the role of emotions in forex trading. Emotions can influence your trading decisions and lead to irrational and impulsive behavior. It’s important to develop mental discipline and emotional control to make rational and objective decisions. It’s also essential to avoid common biases such as anchoring bias and confirmation bias, which can cloud your judgment and lead to poor decisions.

In conclusion, effective risk management techniques are crucial for success in forex trading. Setting realistic goals, using stop-loss orders, understanding and avoiding FOMO, having a consistent trading strategy, maintaining a trading journal, and managing emotions are essential techniques to minimize risk and maximize profits.

Building A Consistent Trading Strategy

Developing a consistent trading strategy in forex involves mastering the psychology of trading. Understanding and managing emotions, avoiding biases, and maintaining mental discipline are crucial. By anchoring bias, managing risk, and maintaining a trading journal, traders can improve decision-making and navigate the psychological aspects of forex trading effectively.

Components Of A Solid Strategy

Creating a solid trading strategy is crucial for success in forex trading. A consistent trading strategy should have a clear set of rules and guidelines that help traders make informed decisions. A solid strategy should include components such as technical analysis, risk management, and money management. Technical analysis helps traders identify market trends and patterns, while risk management helps to minimize losses. Money management helps traders to manage their capital effectively and reduce the risk of losing all their investment.

Adapting To Market Changes

The forex market is constantly changing, and traders need to adapt to these changes. A consistent trading strategy should allow for flexibility and adaptation to market conditions. Traders should constantly monitor market conditions and adjust their strategy accordingly. This could involve changing entry and exit points, adjusting risk management techniques, or even switching to a different trading strategy altogether.

Maintaining Mental Discipline

Maintaining mental discipline is crucial for building a consistent trading strategy. Traders must be able to control their emotions and avoid making impulsive decisions. This requires developing mental discipline and sticking to a set of predefined rules and guidelines. Traders should also maintain a trading journal to track their progress and identify areas for improvement.

Building a consistent trading strategy is essential for success in forex trading. A solid strategy should include components such as technical analysis, risk management, and money management. Traders should also be able to adapt to market changes and maintain mental discipline. By following these guidelines, traders can increase their chances of success and minimize their risk of losses.

Loss Aversion And Its Impact On Trading

Loss aversion is a psychological bias that can greatly impact forex trading. Traders tend to feel the pain of losses more strongly than the pleasure of gains, leading them to make irrational decisions and hold on to losing trades for too long.

Understanding and managing loss aversion is crucial for successful trading.

Understanding Loss Aversion

Loss aversion is a psychological phenomenon that describes people’s tendency to feel the pain of a loss more strongly than the pleasure of a gain. In forex trading, this can lead to traders holding onto losing positions for too long, hoping that the market will turn in their favor.

Traders who are affected by loss aversion may also take excessive risks to try and recover their losses, which can lead to even greater losses. It’s essential for traders to understand loss aversion and its impact on their decision-making processes to avoid making emotional and irrational trades.

Strategies To Combat Loss Aversion

One of the most effective strategies for combating loss aversion is to have a solid trading plan in place. This plan should include entry and exit points, stop-loss orders, and a clear risk management strategy.

Traders should also consider using a trading journal to track their trades and identify patterns in their behavior. By keeping a record of their trades and emotions, traders can learn from their mistakes and avoid repeating them in the future.

Another strategy for combating loss aversion is to practice mindfulness and self-awareness. Traders should take breaks and step away from the markets when they feel overwhelmed or emotional. They should also focus on the process of trading rather than the outcome, which can help them make more rational and objective decisions.

Overall, understanding loss aversion and implementing strategies to combat it is crucial for successful forex trading. By staying disciplined, following a solid trading plan, and practicing self-awareness, traders can overcome their biases and make more rational and profitable trades.

The Power Of A Trading Journal

The power of a trading journal lies in its ability to uncover the psychology behind forex trading. By keeping a record of your trades, emotions, and decision-making processes, you can identify patterns, biases, and areas for improvement. This self-reflection helps you master your emotions, develop discipline, and make more rational and informed trading decisions.

As a forex trader, keeping a trading journal is one of the most powerful tools you can use to improve your trading skills. A trading journal is a record of your trades, including the entry and exit points, the reasons for entering the trade, the emotions you felt during the trade, and the outcome of the trade. In this section, we’ll explore the benefits of journaling trades and analyzing journal entries for improvement.

Benefits Of Journaling Trades

There are many benefits to keeping a trading journal. Here are some of the most important:

- Identify patterns: By keeping track of your trades in a trading journal, you can identify patterns in your trading. This can help you see what you’re doing right and what you’re doing wrong.

- Improve discipline: A trading journal can help you improve your discipline by keeping you accountable for your trades. By reviewing your journal entries, you can see if you’re sticking to your trading plan or making impulsive decisions.

- Track progress: Keeping a trading journal allows you to track your progress over time. You can see how your trading has improved and what areas still need work.

- Reduce emotions: Writing down your emotions during a trade can help you reduce their impact on your trading decisions. By acknowledging and working through your emotions, you can make more rational trading decisions.

Analyzing Journal Entries For Improvement

Analyzing your journal entries is key to improving your trading skills. Here are some tips for analyzing your journal entries:

- Look for patterns: As mentioned earlier, identifying patterns in your trading is crucial to improving your skills. Look for patterns in your winning trades and losing trades.

- Identify mistakes: Analyzing your journal entries can help you identify mistakes you’re making. Are you entering trades too early or too late? Are you holding onto losing trades for too long?

- Make adjustments: Once you’ve identified patterns and mistakes, make adjustments to your trading plan. This can include adjusting your entry and exit points, setting stop losses, or changing your trading strategy.

- Track progress: Just like with journaling trades, tracking your progress is essential when analyzing journal entries. Make note of any improvements you’ve made and areas that still need work.

By journaling your trades and analyzing your journal entries, you can improve your trading skills and become a more successful forex trader.

Credit: fastercapital.com

Fear Of Missing Out (fomo) In Forex

When it comes to forex trading, the fear of missing out (FOMO) is a powerful psychological force that can significantly impact decision-making and trading outcomes. It is a common phenomenon where traders feel anxious about potentially missing out on profitable opportunities, leading to impulsive actions and irrational decision-making.

Recognizing Fomo Symptoms

Recognizing the symptoms of FOMO is crucial for traders to avoid falling into its trap. Some common symptoms include:

- Constantly checking the market for new opportunities

- Feeling anxious or restless when not actively trading

- Entering trades hastily without proper analysis

- Overtrading in an attempt to capitalize on every perceived opportunity

Preventive Measures Against Fomo

Implementing preventive measures can help traders mitigate the impact of FOMO on their trading decisions. Some effective measures include:

- Setting Clear Trading Goals: Establishing clear trading goals and sticking to a well-defined trading plan can help reduce the influence of FOMO.

- Practicing Patience: Taking a disciplined approach and waiting for high-probability trading setups can mitigate impulsive trading driven by FOMO.

- Utilizing Stop Loss Orders: Implementing stop loss orders can help limit potential losses and prevent emotional decision-making during volatile market conditions.

- Regular Self-Assessment: Engaging in regular self-assessment to evaluate trading decisions and emotions can aid in identifying and addressing FOMO-driven behaviors.

Credit: institutional-trader.com

Frequently Asked Questions

Is Forex Trading Psychological?

Forex trading is indeed psychological. It involves the mental states and emotions that influence trading decisions. Traders’ behavior can be affected by psychological factors, leading to impulsive decisions, biased thinking, and lack of discipline. Mastering trading psychology is crucial for success in the forex market.

How To Master Forex Psychology?

To master forex psychology, practice and backtest your trading strategy. Start by using a demo account to get familiar with trading. Backtesting helps build confidence and make necessary adjustments before investing real money. Understanding and controlling your emotions is also crucial in managing forex trading psychology.

What Is The Psychology Behind Trading?

Trading psychology refers to the mental states and emotions that influence trading decisions. It encompasses factors like greed, fear, impulsive decisions, biased thinking, and indiscipline. Understanding and managing these psychological factors is crucial for successful trading. Traders should practice and backtest their strategies, control their emotions, and develop mental discipline to make rational and informed trading decisions.

Is There Manipulation In Forex Market?

Yes, manipulation can occur in the forex market. Banks or investment houses may manipulate the market to change the value of a currency and make a profit. However, manipulating such a high-volume and liquid market is not easy. Traders should be aware of this possibility and take it into consideration when making trading decisions.

Conclusion

Understanding the psychology of forex trading is essential for success in the market. Traders must manage their emotions, such as greed and fear, to make rational decisions. It is important to have a consistent trading strategy, practice on demo accounts, and backtest strategies to gain confidence.

Additionally, keeping a trading journal and avoiding biases can help improve trading performance. By mastering the psychological aspects of trading, traders can navigate the forex market with greater discipline and profitability.