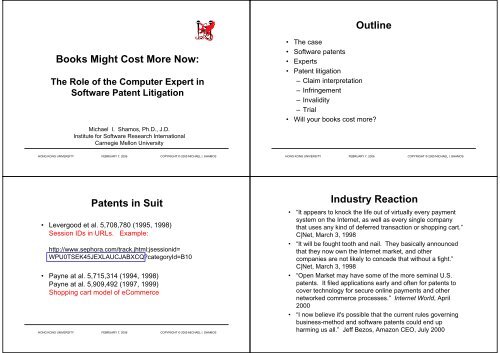

An ecommerce payment system is a digital platform that allows online businesses to conduct financial transactions. It enables secure and convenient processing of payments for goods and services sold on the internet.

This system plays a crucial role in the success of ecommerce operations, providing customers with various payment options and ensuring seamless transactions. A reliable payment system enhances the overall user experience and helps businesses build trust with their customers. With the growing popularity of online shopping, having a robust ecommerce payment system is essential for any business looking to thrive in the digital marketplace.

In today’s fast-paced and competitive ecommerce landscape, the right payment system can make a significant impact on a company’s bottom line.

Credit: www.yumpu.com

The Importance Of An Ecommerce Payment System

Enhancing Customer Experience

An effective ecommerce payment system is vital for enhancing customer experience. When customers have a seamless and secure payment process, they are more likely to trust the website and complete their purchases without any hiccups. This, in turn, leads to greater satisfaction and confidence in the brand, contributing to a positive overall experience.

Increasing Conversion Rates

An ecommerce payment system plays a crucial role in increasing conversion rates. When customers encounter a smooth and convenient checkout process, they are more inclined to follow through with their purchases. A reliable payment system ensures that the entire transaction is completed swiftly and securely, reducing the likelihood of abandoned shopping carts and ultimately boosting conversion rates.

Key Features Of An Effective Ecommerce Payment System

An effective ecommerce payment system is crucial for online businesses to facilitate seamless and secure transactions. A well-designed payment system should offer several key features that not only meet the needs of customers but also provide ease of use for merchants. Let’s explore the essential elements that make an ecommerce payment system effective and efficient.

Secure Payment Processing

Secure payment processing is a fundamental aspect of any ecommerce payment system. Customers expect their financial information to be handled with the utmost care and protection. An effective ecommerce payment system should utilize encryption and tokenization to safeguard sensitive data. Additionally, compliance with PCI DSS and regular security audits are vital to ensure the highest level of security for online transactions. These measures instill confidence in customers, making them more likely to complete their purchases.

Multiple Payment Options

Offering multiple payment options is essential for catering to diverse customer preferences. An effective ecommerce payment system should support a wide range of payment methods including credit cards, debit cards, digital wallets, bank transfers, and even alternative payment solutions popular in specific regions. By providing varied options, merchants can attract a broader customer base, ultimately contributing to increased sales and customer satisfaction.

Seamless Integration

Seamless integration with ecommerce platforms and other business systems is crucial for streamlining operations and enhancing overall efficiency. An effective ecommerce payment system should have easy-to-implement APIs and plugins that allow for smooth integration with popular ecommerce platforms such as Shopify, Magento, and WooCommerce. This ensures that the payment process is seamless for both customers and merchants, resulting in improved user experience and reduced technical complexities.

Choosing The Right Ecommerce Payment System For Your Business

When it comes to running an online business, one of the most important decisions you’ll need to make is choosing the right ecommerce payment system. A good payment system not only ensures seamless transactions but also builds trust with your customers. However, with the multitude of options available, finding the perfect fit for your business can be overwhelming. To help you navigate through this process, we’ve outlined a few key considerations for both small businesses and large enterprises.

Considerations For Small Businesses

Small businesses often have different needs and budget constraints compared to larger enterprises. When selecting an ecommerce payment system for your small business, keep the following factors in mind:

- Cost: Look for an affordable solution that offers transparent pricing with no hidden fees or excessive transaction charges. Consider whether the payment system requires a monthly subscription or if it offers a pay-as-you-go option.

- Integration: Ensure that the payment system is compatible with your ecommerce platform or website builder. It should seamlessly integrate into your existing infrastructure without requiring extensive technical expertise.

- Security: Your customers’ data security should be a top priority. Make sure the payment system you choose is PCI-DSS compliant and offers robust encryption methods to protect sensitive information.

- Customer Service: As a small business, you’ll need reliable support whenever issues arise. Look for a payment system provider that offers responsive customer service, with multiple channels such as phone, email, and live chat.

Considerations For Large Enterprises

Large enterprises have their own unique set of requirements when it comes to ecommerce payment systems. Here are some factors to consider:

- Scalability: Your payment system should be able to handle high transaction volumes and be flexible enough to accommodate future growth. It should also provide features like recurring billing and support for international payments.

- Customization: Large enterprises often require more advanced customization options to meet their specific needs. Look for a payment system that allows you to tailor the user experience, including branding and integration with other business systems.

- Advanced Security Features: With a larger customer base, security becomes even more critical. Choose a payment system that offers advanced fraud detection and prevention mechanisms, such as 3D Secure and tokenization.

- Analytics and Reporting: Data-driven insights are crucial for making informed business decisions. Opt for a payment system that provides detailed analytics and reporting capabilities, allowing you to track transaction patterns, customer behavior, and revenue.

By considering these factors and aligning them with your business’s unique requirements, you’ll be able to make an informed decision when it comes to selecting the right ecommerce payment system. Remember, the right payment system is not just a tool to accept payments but a key component in fostering a seamless and trustworthy shopping experience for your customers.

Popular Ecommerce Payment Systems In The Market

When it comes to running a successful ecommerce business, choosing the right payment system is crucial. Having a reliable and secure payment gateway can improve customer trust, increase sales, and streamline the checkout process. In this article, we will explore three popular ecommerce payment systems in the market namely: PayPal, Stripe, and Amazon Pay.

Paypal

PayPal has become a household name when it comes to online payments. With over 325 million active users worldwide, it is one of the most widely used payment systems in the ecommerce industry. PayPal offers a seamless and secure checkout experience, allowing customers to make purchases using their PayPal account or credit/debit cards.

One of the advantages of using PayPal is its wide accessibility across various devices and platforms. Customers can easily make payments using their smartphones, tablets, or computers, making it convenient for both buyers and sellers. Additionally, PayPal offers robust fraud protection measures, giving sellers peace of mind when processing transactions.

Stripe

Stripe is another popular choice among ecommerce merchants. Known for its developer-friendly tools and flexible integration options, Stripe has gained popularity for its simplicity and user-friendly interface. With Stripe, sellers can easily accept payments in multiple currencies, making it ideal for businesses with an international customer base.

One of the standout features of Stripe is its ability to handle recurring payments and subscription-based billing. This makes it the go-to choice for businesses offering subscription services or products. With a wide range of customization options and powerful analytics, Stripe allows merchants to track and manage their payments efficiently.

Amazon Pay

Amazon Pay is an ecommerce payment system that enables customers to make payments using their Amazon accounts. With millions of users already registered with Amazon, this payment option offers a familiar and convenient checkout experience. Customers can use their stored payment information and shipping addresses to complete their purchases quickly and securely.

In addition to the seamless integration with the Amazon ecosystem, Amazon Pay also provides added benefits such as buyer protection and customer trust. As a trusted brand, customers feel confident using Amazon Pay for online transactions, which in turn increases conversion rates for sellers.

In conclusion, when it comes to choosing an ecommerce payment system, there are several popular options to consider. PayPal, Stripe, and Amazon Pay are all reliable choices that offer unique features and benefits. Whether you prioritize wide accessibility, developer-friendly tools, or seamless integration with a trusted brand, these payment systems can help take your ecommerce business to the next level.

Best Practices For Implementing An Ecommerce Payment System

Implementing an ecommerce payment system is a critical step in ensuring the success of your online store. To make the most of this system and provide a seamless and secure checkout experience for your customers, it is essential to follow best practices. From optimizing the checkout process to ensuring PCI compliance and implementing effective fraud prevention measures, these steps can help you streamline your payment system and increase customer satisfaction. Let’s dive into the best practices for implementing an ecommerce payment system.

Optimizing Checkout Process

Streamlining the checkout process is crucial as it can significantly impact conversion rates. A lengthy or complicated checkout process can frustrate customers and lead to abandoned carts. To optimize your checkout process:

- Minimize the number of steps and forms required to complete the transaction.

- Provide clear and concise instructions throughout the checkout process.

- Offer guest checkout as an option to avoid forcing customers to create an account.

- Enable autofill functionality to save customers’ time and effort.

- Display a progress indicator to keep customers informed about their progress.

Ensuring Pci Compliance

Protecting your customers’ sensitive payment information is of paramount importance. Payment Card Industry Data Security Standard (PCI DSS) compliance is necessary to maintain a secure environment for processing, storing, or transmitting cardholder data. To ensure PCI compliance:

- Use a secure payment gateway that encrypts the data transmission.

- Regularly update and patch your systems to protect against vulnerabilities.

- Restrict access to cardholder data and only allow authorized personnel to handle it.

- Regularly monitor and test your security systems to identify and address any potential weaknesses.

- Maintain a comprehensive data security policy that outlines procedures and responsibilities.

Effective Fraud Prevention

Preventing fraudulent transactions is crucial for protecting your business and customers. Implementing strong fraud prevention measures can help safeguard your store from unauthorized activities. Consider the following practices:

- Require CVV verification to verify the legitimacy of the cardholder.

- Implement address verification system (AVS) to match the billing address provided with the card issuer’s records.

- Monitor and analyze transaction patterns to detect any suspicious activities.

- Utilize fraud prevention tools and services provided by your payment gateway.

- Train your staff to recognize and report potential fraudulent transactions.

Credit: www.mayple.com

Credit: www.digitalsilk.com

Frequently Asked Questions On Ecommerce Payment System

What Are The Benefits Of Using An Ecommerce Payment System?

Using an Ecommerce Payment System offers several benefits such as providing a secure and convenient payment method for customers, increasing sales by accepting a variety of payment options, and easily managing transactions and tracking sales data.

How Does An Ecommerce Payment System Work?

An Ecommerce Payment System allows customers to make online purchases by securely transferring funds from their bank account or credit card to the merchant. It involves encrypting customer information, verifying the transaction, and transferring funds to the merchant’s account.

What Types Of Payment Methods Can Be Integrated Into An Ecommerce Payment System?

An Ecommerce Payment System can integrate various payment methods, including credit cards, debit cards, bank transfers, digital wallets like PayPal or Google Pay, and alternative payment options like cryptocurrencies or mobile payment apps.

How Can An Ecommerce Payment System Help Prevent Fraud?

An Ecommerce Payment System incorporates advanced security measures like encryption, tokenization, and fraud detection tools to help prevent fraudulent transactions. It verifies customer details, detects suspicious activities, and offers chargeback protection to minimize the risk of fraud.

Conclusion

Investing in a reliable and efficient ecommerce payment system is crucial for online businesses to thrive in the digital market. With its secure and seamless transaction process, customers are more inclined to engage in online purchases, resulting in increased sales and revenue.

By optimizing your payment system, you not only enhance customer experience but also build trust and credibility among your target audience. So, make the right choice today and empower your ecommerce business with a robust payment system that guarantees success.

Monica M. Watkins stands as a prominent authority in the realm of investment, recognized for her expertise as a “how-to” invest expert. With a robust background in finance and a keen understanding of market dynamics, Monica M. Watkins has become a trusted source for practical insights on investment strategies. Her career is characterized by a commitment to demystifying the complexities of financial markets and offering actionable guidance to both novice and seasoned investors. Whether unraveling the intricacies of stock market trends, providing tips on portfolio diversification, or offering guidance on risk management, Monica M. Watkins’s expertise spans a wide spectrum of investment-related topics. As a “how-to” invest expert, she empowers individuals with the knowledge and tools needed to navigate the ever-changing landscape of investments, translating complex financial concepts into accessible and actionable advice. Monica M. Watkins continues to be a guiding force for those seeking to make informed and strategic investment decisions, contributing significantly to the broader discourse on wealth-building and financial success.