Creating invoices for small business involves generating detailed and professional billing documents to ensure smooth and timely payment processing. This article provides valuable insights into the essential steps and key elements required for effective invoice creation, helping small businesses streamline their billing process and maintain healthy cash flow.

Learn how to choose the right invoice template, include accurate billing information, itemize products or services, calculate totals, and set up payment terms that encourage prompt payment. By following these guidelines, small business owners can create invoices that are clear, concise, and compliant with accounting regulations, thereby fostering strong client relationships and facilitating efficient financial management.

Importance Of Invoices For Small Businesses

Creating and sending invoices might seem like a mundane task, but it plays a crucial role in the success of small businesses. From ensuring timely payment to maintaining cash flow, invoices are the lifeline of any business. In this blog post, we will explore the importance of invoices for small businesses and how they contribute to their financial stability.

Ensuring Timely Payment

One of the primary reasons why invoices are important for small businesses is that they ensure timely payment. By sending a clear and detailed invoice to your clients, you provide them with all the necessary information regarding the services or products they have received and the amount they owe. This helps in minimizing confusion and delays in payment.

Timely payment is crucial for the financial stability of small businesses. It helps them meet their operational expenses, pay their employees, and invest in growth opportunities. By having a proper invoicing system in place, small businesses can ensure that they receive payment for their products or services promptly.

Maintaining Cash Flow

Invoices also play a vital role in maintaining cash flow for small businesses. Cash flow is the lifeblood of any business, and it determines its ability to pay bills, purchase inventory, and cover other expenses. By sending invoices promptly and tracking their payment status, small businesses can have a clear picture of their incoming revenue and manage their cash flow effectively.

With a consistent cash flow, small businesses can avoid cash shortages and make strategic decisions to invest in their growth. This allows them to take advantage of new opportunities, expand their operations, and stay competitive in the market.

In conclusion, invoices are more than just pieces of paper or digital documents. They are a critical tool for small businesses to ensure timely payment from clients and maintain a healthy cash flow. By having a proper invoicing system in place, small businesses can streamline their financial processes and pave the way for long-term success.

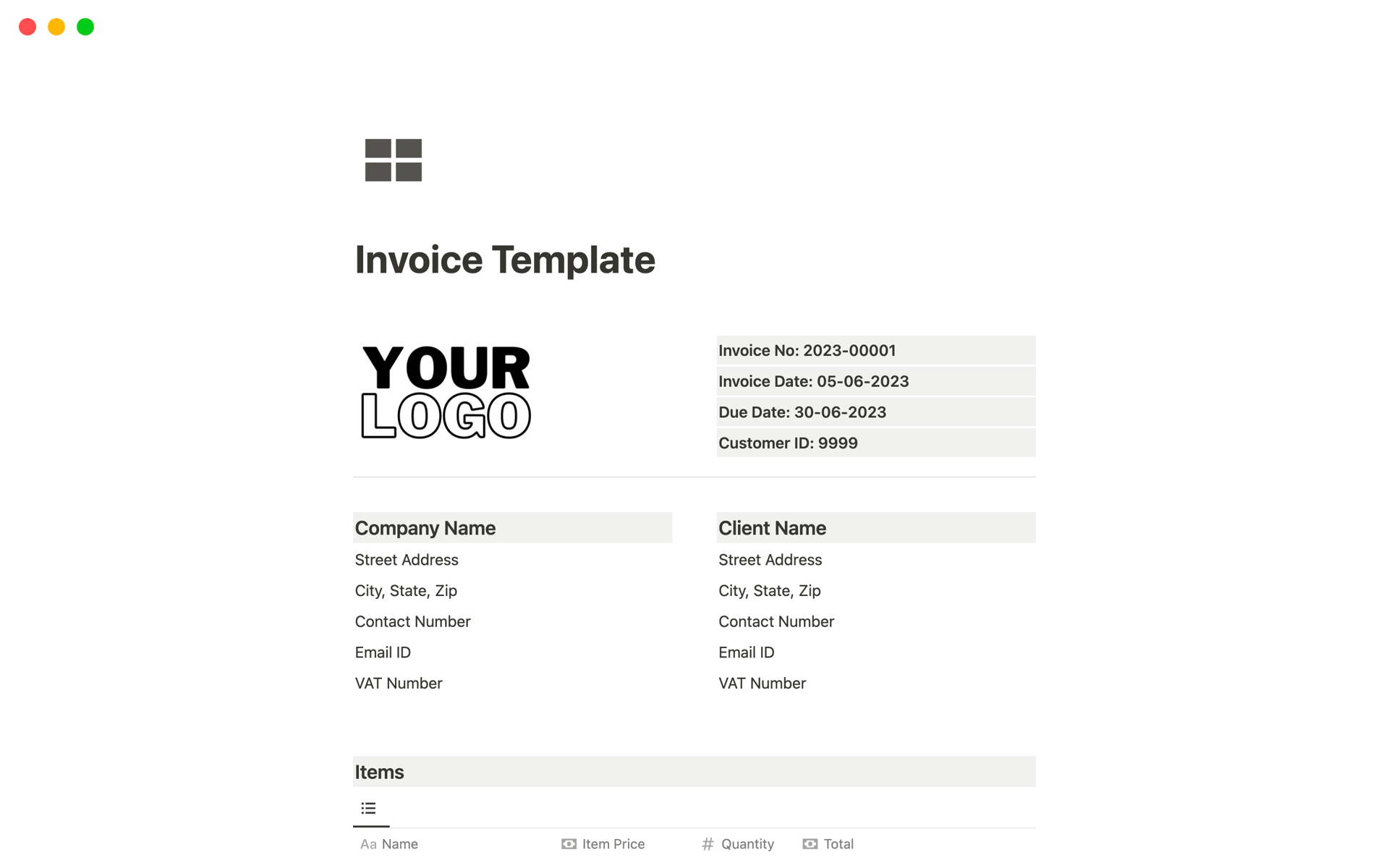

Credit: www.notion.so

Key Elements Of An Effective Invoice

When it comes to creating invoices for your small business, it’s important to remember that the invoice serves as a formal request for payment from your clients. An effective invoice not only ensures prompt payment but also represents your professionalism and attention to detail. To achieve these goals, there are a few key elements that every invoice should include.

Clear And Concise Information

The first key element of an effective invoice is clear and concise information. Your invoice should clearly identify both your business and your client, including full names and contact information. Additionally, include a unique invoice number that will help you keep track of your payments. Make sure to also specify the date of the invoice and the due date for payment, as this prevents any confusion or misunderstanding.

Next, provide a detailed breakdown of the products or services you are billing for. Clearly state the quantity, unit price, and any discounts or taxes applied. Use simple and straightforward language to describe each item to avoid any ambiguity. Bullet points or tables can be used to present this information in a visually clear and organized manner.

Professional Formatting

The second key element of an effective invoice is professional formatting. Ensure that your invoice adheres to HTML syntax by using appropriate HTML tags such as headings, paragraphs, tables, and lists. Use bold formatting to highlight important information, such as the total amount due or any terms and conditions.

Additionally, consider using a professional invoice template that reflects your brand image. A well-designed invoice not only enhances your credibility but also makes it easier for your clients to read and understand the information. Remember, a well-formatted and visually appealing invoice leaves a positive impression and helps build strong client relationships.

In conclusion, including clear and concise information and ensuring professional formatting are two key elements of an effective invoice. By incorporating these elements into your invoicing process, you can streamline payment collection and present a professional image to your clients. Remember, a well-crafted invoice not only helps you get paid on time but also reinforces your reputation as a reliable and trustworthy business.

Choosing The Right Invoicing Software

Selecting the right invoicing software is vital for small businesses looking to streamline the process of creating invoices. With user-friendly interfaces and customizable templates, efficient invoicing software can significantly enhance the invoicing experience and help small businesses keep track of their finances seamlessly.

When it comes to managing your small business, finding the right invoicing software is crucial. Not only does it streamline your invoicing process, but it also helps you track your finances, save time, and improve your cash flow. With numerous options available in the market, choosing the right invoicing software can be overwhelming. However, by considering a few key factors, you can make an informed decision that suits your business needs perfectly.

Cloud-based Solutions

One popular option is cloud-based invoicing software. With this type of software, you can access your invoices and financial data from anywhere, anytime, as long as you have an internet connection. This flexibility is ideal for small businesses that have remote teams, freelancers, or frequently travel for work. Cloud-based software offers advantages like automatic backup of your data, seamless collaboration with team members, and easy scaling as your business grows.

Integration With Accounting Software

Another important aspect to consider is whether the invoicing software integrates smoothly with your accounting software. Integration is crucial because it ensures that your financial data is synced across different platforms, eliminating the need for manual data entry. By integrating your invoicing software with your accounting software, you can automatically transfer crucial information such as invoices, payments, and customer data, saving you valuable time and minimizing errors.

Credit: www.paypal.com

Best Practices For Creating Invoices

When it comes to running a small business, creating invoices is an essential task. Not only does it help you keep track of your finances, but it also ensures that you get paid on time. To make the invoicing process smooth and efficient, it is important to follow best practices. In this section, we will discuss the top practices for creating invoices for your small business.

Including All Necessary Details

One of the most important aspects of creating an invoice is including all the necessary details. By providing clear and comprehensive information, you can avoid any confusion or delays in payment. Here are some key details that you should include in your invoices:

- Business information: Start by including your business name, address, and contact information at the top of the invoice. This ensures that your client knows who the invoice is coming from.

- Client information: Include the client’s name, address, and contact information as well. This makes it clear to whom the invoice is addressed and who is responsible for the payment.

- Invoice number and date: Assign a unique invoice number to each invoice you create, and include the date of issuance. This helps in tracking and organizing your invoices.

- Description of services: Provide a detailed description of the services or products you have provided. Be specific and clear about what was delivered.

- Quantity and rate: Clearly state the quantity of each service or product provided, along with the agreed-upon rate. This allows your client to understand the cost breakdown.

- Total amount: Sum up the total amount due, including any applicable taxes or discounts. Make it easy for your client to know the exact amount to be paid.

Setting Clear Payment Terms

Another best practice is to set clear payment terms in your invoices. This ensures that your clients are aware of the payment schedule and expectations. Here are a few tips to keep in mind when setting payment terms:

- Due date: Clearly mention the due date for payment. Specify the number of days or a specific date by which the payment should be made. This sets a clear deadline for your clients.

- Payment methods: Clearly state the acceptable payment methods, such as bank transfer, credit card, or check. Make it easy for your clients to understand how they can make the payment.

- Late payment fees: If applicable, mention any late payment fees or penalties for overdue payments. This encourages your clients to pay on time and helps you cover any additional costs.

- Terms and conditions: Include a brief section explaining your payment terms and any other relevant conditions, such as refund policies or cancellation fees. This ensures that both parties are on the same page.

By including all necessary details and setting clear payment terms, you can create professional and effective invoices for your small business. These best practices not only help streamline your invoicing process but also contribute to a positive client relationship. Implement them in your invoicing workflow to ensure timely and hassle-free payments.

Addressing Common Invoice Challenges

Dealing With Late Payments

Managing late payments is a common challenge for small businesses. To address this issue, it’s important to establish clear payment terms and communicate them to your clients upfront. This can include specifying payment due dates, late fees, and accepted payment methods in your invoicing process. Additionally, make sure to follow up on overdue payments promptly to avoid prolonged cash flow issues.

Implementing a friendly yet persistent approach in your communication with clients regarding overdue payments can help in maintaining positive relationships while ensuring timely settlements.

Managing Invoice Disputes

Handling invoice disputes with professionalism and efficiency is crucial for maintaining client relationships and ensuring steady cash flow. Firstly, strive to provide detailed and transparent invoices, clearly outlining the products or services rendered, charges, and any terms and conditions. This can help prevent misunderstandings that lead to disputes.

If an invoice dispute does arise, promptly address the issue by providing supporting documentation, engaging in open communication, and seeking an amicable resolution. Remaining calm and respectful during such conversations can often lead to a satisfactory outcome for both parties.

Credit: www.paypal.com

Frequently Asked Questions Of Creating Invoices For Small Business

How Do I Create Professional Invoices For My Small Business?

To create professional invoices for your small business, use software like QuickBooks or FreshBooks. Input your company details, client information, and itemized charges. Then, customize the design and layout to reflect your brand. Finally, save and send the invoice to your client.

What Should I Include In My Small Business Invoices?

Include your company logo, business name and contact information, invoice number, payment terms, due date, itemized list of products/services, total amount due, and accepted payment methods. Also, consider adding a personalized thank-you note for your clients’ satisfaction.

Should I Include Payment Terms On My Small Business Invoices?

Yes, clearly state the payment terms on your invoices. This includes the due date, late payment fees, and any discounts for early payment. Having detailed payment terms helps to manage client expectations and reduces the likelihood of payment delays.

Can I Personalize The Design Of My Small Business Invoices?

Absolutely! You can personalize the design of your invoices to reflect your brand identity. Many invoicing software offer customizable templates, allowing you to add your company logo, colors, fonts, and even personalized messages to enhance your brand’s professionalism.

Conclusion

Invoicing is a vital aspect of running a small business. By following the helpful tips provided in this blog post, you can create professional and accurate invoices that will streamline your business operations and ensure timely payments. From choosing the right invoicing software to including all necessary information, these practices will help you maintain transparency, improve cash flow, and establish a professional image for your business.

Start implementing these tips today and watch your invoicing process become more efficient and effective.

Park Yeh stands as a distinguished expert at the crossroads of finance, investment, and risk management. With a comprehensive background in the share market, loan management, and risk assessment, she has become a trusted advisor in the intricate world of financial strategy. Park Yeh possesses a keen understanding of the share market, where she navigates market trends and provides insights to guide investment decisions. Simultaneously, her proficiency in loan management and risk assessment showcases a unique ability to balance opportunities and potential pitfalls in financial transactions. Park Yeh’s expertise extends further into the realm of gold nugget investments, where she demonstrates a strategic approach to precious metal markets. As a multifaceted professional, Park Yeh continues to contribute to the financial landscape, offering valuable guidance to individuals and organizations seeking informed and diversified investment strategies. Her insights into share markets, loan management, risk assessment, and gold investments make her a well-rounded and respected figure in the world of finance.