Artificial intelligence is transforming the insurance industry by streamlining processes and personalizing customer experiences. AI applications in insurance range from chatbots to fraud detection and risk management.

The advent of artificial intelligence (AI) in insurance marks a pivotal shift in how insurance companies operate. By harnessing machine learning and data analytics, insurers are now able to offer more accurate risk assessments, which leads to cost-effective pricing strategies and improved customer satisfaction.

AI-powered chatbots provide 24/7 assistance, handling claims and queries with unprecedented efficiency. Enhanced by AI, fraud detection systems are becoming more adept at identifying false claims, saving companies millions. Predictive analytics, a cornerstone of AI, forecasts potential risks, enabling proactive measures. As AI technology continues to evolve, it promises to unlock new levels of optimization in the insurance sector, benefiting both providers and policyholders alike with its data-driven insights and solutions.

Credit: www.recosenselabs.com

Introduction To Ai In The Insurance Industry

Artificial Intelligence (AI) has swiftly swept through various industries, revolutionizing operations, enhancing efficiency, and providing groundbreaking insights. In the insurance sector, the integration of AI is reshaping the landscape, shifting away from traditional practices towards more innovative, AI-driven models. This technological advent has propelled insurers to leverage big data, automate claims processing, and offer personalized customer experiences.

The specific impacts of AI on insurance are vast and transformative. By harnessing AI, insurers can now predict risks and assess claims with greater precision, craft tailored policies, and pinpoint fraudulent activities with enhanced accuracy. This surge in AI adoption has also fostered a new era of customer engagement, where chatbots and virtual assistants provide real-time assistance to policyholders.

| Traditional Insurance Models | AI-driven Insurance Models |

|---|---|

| Manual data analysis | Automated, AI-powered analytics |

| Standardized products | Customized policy offerings |

| Rigid claim procedures | Flexible, efficient claim processing |

| Generic customer service | Personalized interaction with AI chatbots |

Streamlining Claims Processing With Ai

The insurance industry is revolutionizing with Artificial Intelligence (AI) by enhancing the efficiency and accuracy of claims processing. Insurance providers now utilize chatbots to simplify the claims registration process. These AI-driven chatbots offer an interactive platform for policyholders to report incidents and initiate claims without human intervention, leading to a faster and more streamlined experience.

Fraud detection has been markedly improved through the integration of sophisticated AI algorithms. These systems are capable of analyzing large volumes of data to identify inconsistencies and suspicious patterns that may indicate fraudulent activity, thereby safeguarding against losses.

Further refining the claims process, AI enables quick and accurate assessment. By leveraging machine learning models, AI evaluates the complexity and severity of claims, ensuring rapid and fair settlements. This expedites the decision-making process and enhances customer satisfaction.

| Company | AI Implementation | Outcome |

|---|---|---|

| InsureTech Corp | Deployed AI for claims triage | Reduced processing time by 30% |

| Global InsureGroup | Introduced fraud detection AI | Spotted 25% more fraudulent claims |

| SafetyNet Insurance | Automated assessments with AI | Enhanced accuracy of claim evaluations |

Ai-driven Customer Service And Experience

The incorporation of Artificial Intelligence (AI) in customer service within the insurance sector revolutionizes the way clients interact with their providers. From personalized interactions that cater to individual customer needs to round-the-clock accessibility, AI is at the forefront of enhancing user experiences. Insurers now leverage AI to deliver custom-tailored recommendations and solutions in real-time, forging stronger connections with policyholders.

The advent of intelligent virtual assistants enables uninterrupted 24/7 customer support, ensuring immediate assistance is just a chat away. This level of support means queries and issues are handled swiftly, significantly boosting customer satisfaction. The proactive nature of AI-driven services anticipates potential issues and addresses them proactively, showcasing insurers’ commitment to their customers’ well-being.

Credit: www.linkedin.com

The Future Of Ai In Insurance Claims

The advent of Artificial Intelligence (AI) in the insurance industry has revolutionized claims processing and risk management. Through predictive analytics, insurers are now able to more accurately assess risk by analyzing large volumes of data to identify patterns and anticipate future claims, which leads to a more efficient underwriting process.

IoT (Internet of Things) devices play a pivotal role in claims management, providing real-time data that AI systems can analyze to automate and expedite claims resolution. This powerful combination enhances customer experience by shortening the time taken to settle claims and improving the accuracy of payouts.

Challenges such as data privacy, security, and ethical implications must be navigated carefully. Insurers need to maintain transparency with customers while adhering to regulations to ensure trust and integrity in AI’s application within the sector.

Looking ahead, the evolution of AI in insurance promises to bring about further advancements in customized insurance policies, dynamic pricing models, and fraud detection capabilities, ultimately reshaping the insurance industry.

Credit: www.slideteam.net

Frequently Asked Questions Of Artificial Intelligence In Insurance

Which Insurance Company Is Using Ai?

Many insurance companies utilize AI, including State Farm, Lemonade, and Allianz. These firms leverage artificial intelligence to enhance customer service, underwriting, and claims processing.

What Are The Applications Of Ai In Health Insurance?

AI applications in health insurance include personalized policy pricing, fraud detection, automated claims processing, predictive analytics for risk assessment, and tailored customer service through chatbots.

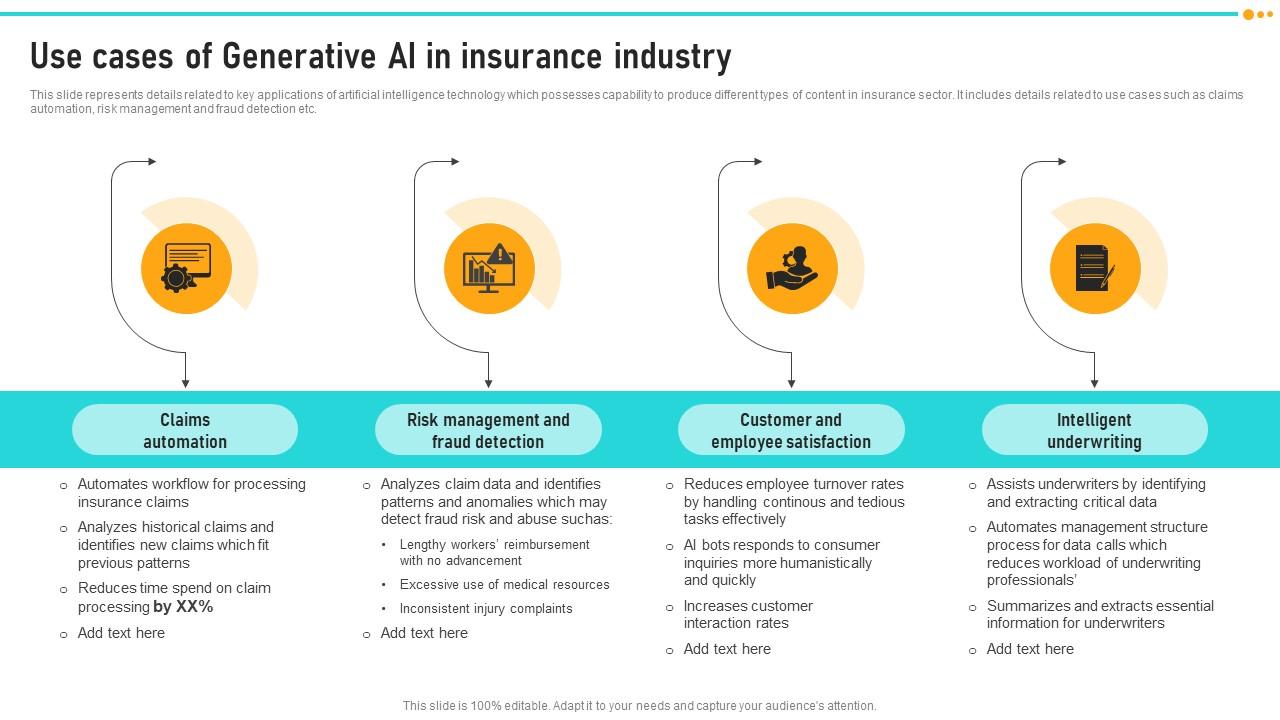

How Generative Ai Can Be Used In Insurance Industry?

Generative AI streamlines the insurance industry by automating claim processing and underwriting tasks. It also assists in fraud detection, generating personalized insurance policy proposals, and enhancing customer service through chatbots.

Are Insurance Companies Using Ai To Deny Claims?

Yes, some insurance companies utilize AI to assess claims, which can sometimes result in denials. These AI systems analyze claims for patterns that may indicate fraud or non-compliance with policy terms.

Conclusion

Embracing artificial intelligence has revolutionized the insurance industry. AI’s impact is clear—streamlined claims, personalized policies, and heightened security. It’s time insurers fully integrate AI to stay ahead. For policyholders, it signifies a future of convenience, accuracy, and peace of mind.

Let’s welcome the AI-driven evolution in insurance.

Monica M. Watkins stands as a prominent authority in the realm of investment, recognized for her expertise as a “how-to” invest expert. With a robust background in finance and a keen understanding of market dynamics, Monica M. Watkins has become a trusted source for practical insights on investment strategies. Her career is characterized by a commitment to demystifying the complexities of financial markets and offering actionable guidance to both novice and seasoned investors. Whether unraveling the intricacies of stock market trends, providing tips on portfolio diversification, or offering guidance on risk management, Monica M. Watkins’s expertise spans a wide spectrum of investment-related topics. As a “how-to” invest expert, she empowers individuals with the knowledge and tools needed to navigate the ever-changing landscape of investments, translating complex financial concepts into accessible and actionable advice. Monica M. Watkins continues to be a guiding force for those seeking to make informed and strategic investment decisions, contributing significantly to the broader discourse on wealth-building and financial success.